As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find myself intrigued by the current state of AAVE. Having witnessed numerous bull and bear markets, I can confidently say that the token’s recent accumulation phase is reminiscent of past scenarios where patient investors have been handsomely rewarded.

The price of AAVE‘s token has stayed within a limited bandwidth since 2022, yet certain experts predict that it might be due for a significant jump given the ongoing accumulation trend.

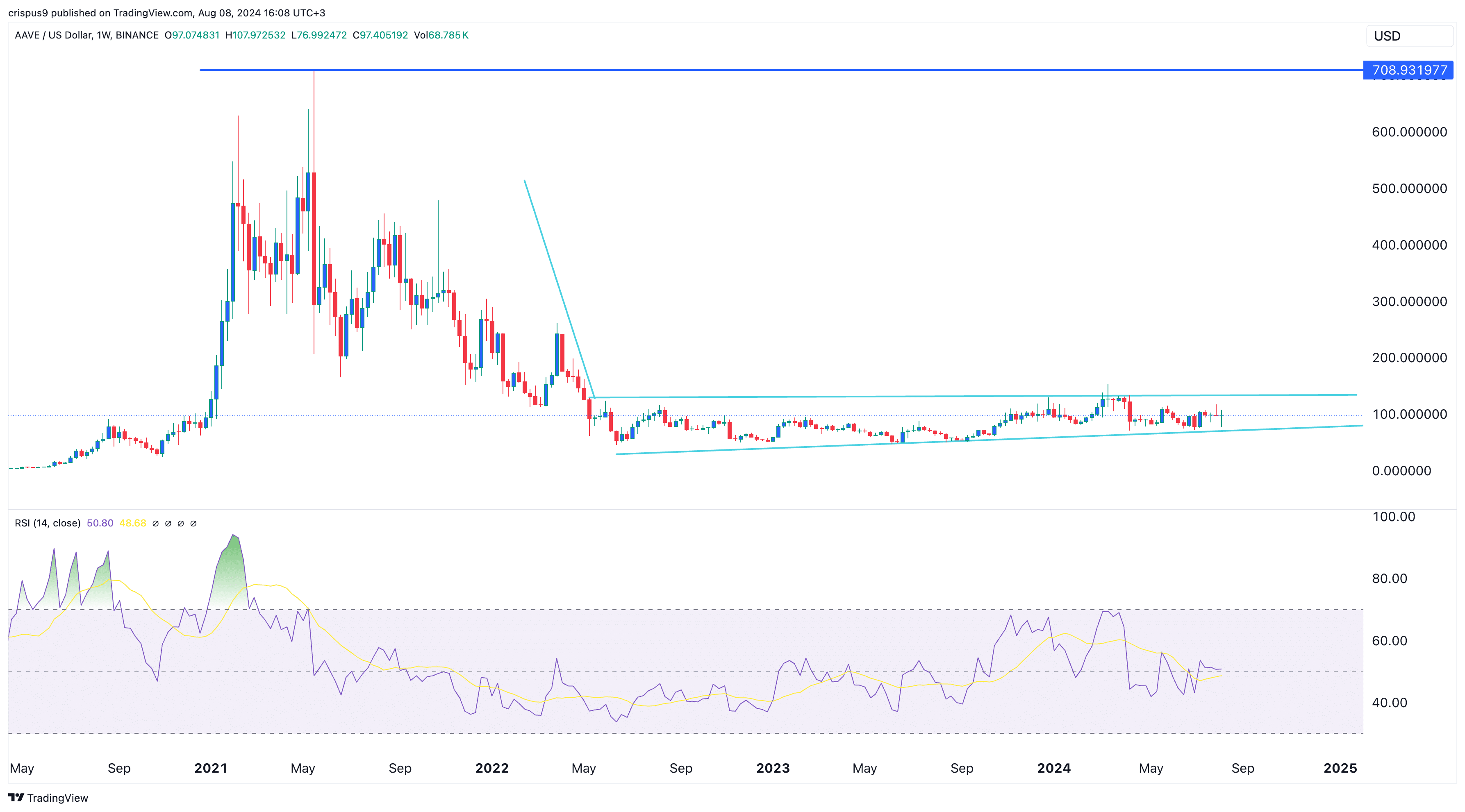

AAVE (AAVE) was trading at $97.75 on Thursday, Aug. 8, up by 100% from its lowest point in 2022 but much lower from its all-time high of $708.

AAVE token is in an accumulation phase

It’s plausible that AAVE‘s recent surge in value is attributable to a growing awareness among investors of the network’s widespread appeal and monetary potential. According to DeFi Llama, AAVE currently ranks as the third-largest entity within the decentralized finance sector, boasting more than $10.7 billion in assets under management.

Additionally, AAVE significantly earns high revenues, ranking as the third most profitable Decentralized Finance (DeFi) platform this year, accumulating over $222 million in fees. AAVE primarily gains income from the difference in interest rates between what it offers to lenders and what it charges borrowers, which is known as the interest rate spread. Furthermore, it generates revenue through flash loans and liquidation costs.

Certain experts predict that Asset A (AAVE) could offer even greater gains due to its increasing hoarding, with Michael van de Poppe, a well-known analyst in the X community, pointing out AAVE’s weekly chart as one of the most enticing in the cryptocurrency market on his recent X post.

One of the most promising charts in crypto is $AAVE. DeFi is looking awesome for a big run. — Michaël van de Poppe (@CryptoMichNL) August 7, 2024

Many other experts, such as Otsukimi, also echoed this perspective, highlighting the continuous buildup and the observation that the Relative Strength Index (RSI) surpassed the non-biased threshold of 50.

As a seasoned analyst who has closely observed and analyzed the cryptocurrency market for years, I share the bullish outlook expressed by other experts regarding AAVE. Based on my understanding of the Elliot Wave pattern, which I have applied in various market scenarios, I am inclined to believe that the token is forming an impulse wave. This pattern, with its five distinct phases, has proven to be a reliable indicator of bullish trends in the past. However, it’s important to note that the third phase, known for its robust momentum and potential for significant growth, is where I see the most promise for AAVE. My experience tells me that this could be a promising opportunity for investors who are willing to ride the wave.

It’s plausible that increased interest in AAVE could stem from the observation that whales have been buying up the token for several months now. Just last week, one of these whales amassed AAVE tokens valued at over $6.47 million within a span of two days.

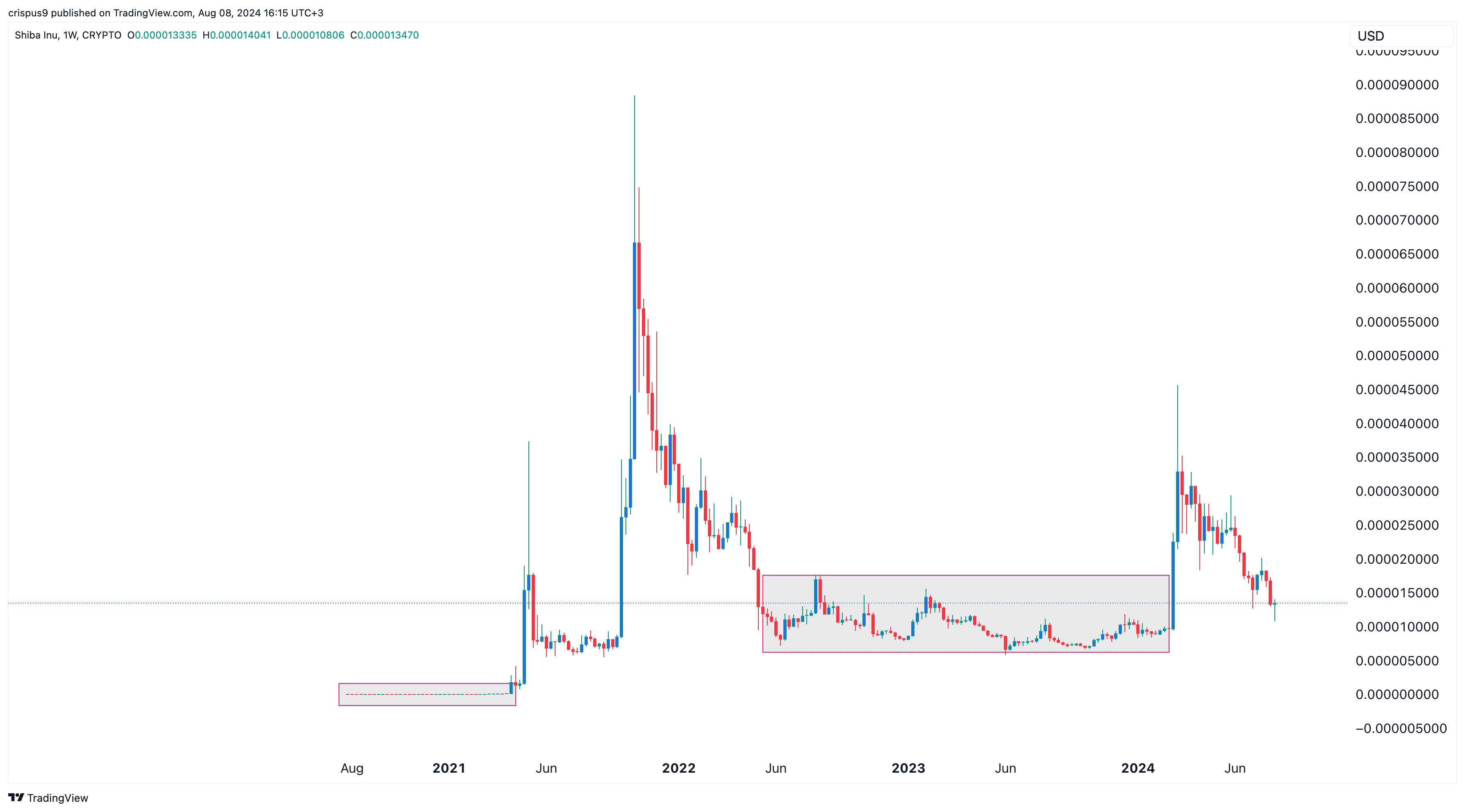

It’s been observed that the concept of gradual buildup, or accumulation, has proven successful for other digital currencies historically. Specifically, Shiba Inu (SHIB) experienced two prolonged periods of consolidation last year and this year. Each of these phases ended with a significant surge in price, indicating a bullish trend.

Risks to AAVE bullish thesis

One potential prolongation of the bullish argument’s major concern is the possibility of an extended period of sideways movement, potentially lasting several months or even years, in the two-year market phase.

As an analyst, I’ve noticed some technical indications suggesting a potential bearish outlook for the token. Specifically, it appears to be forming a rising wedge and a bearish pennant chart pattern. Historically, these patterns often lead to a bearish breakout, especially when the trendlines are close to converging, as they are currently approaching.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-08-08 17:33