As a seasoned crypto investor with battle-tested nerves and an eye for promising opportunities, I find myself increasingly intrigued by Aave (AAVE). The recent surge of over 10% amid heightened whale activity is not just a blip on my radar but a beacon that catches my attention.

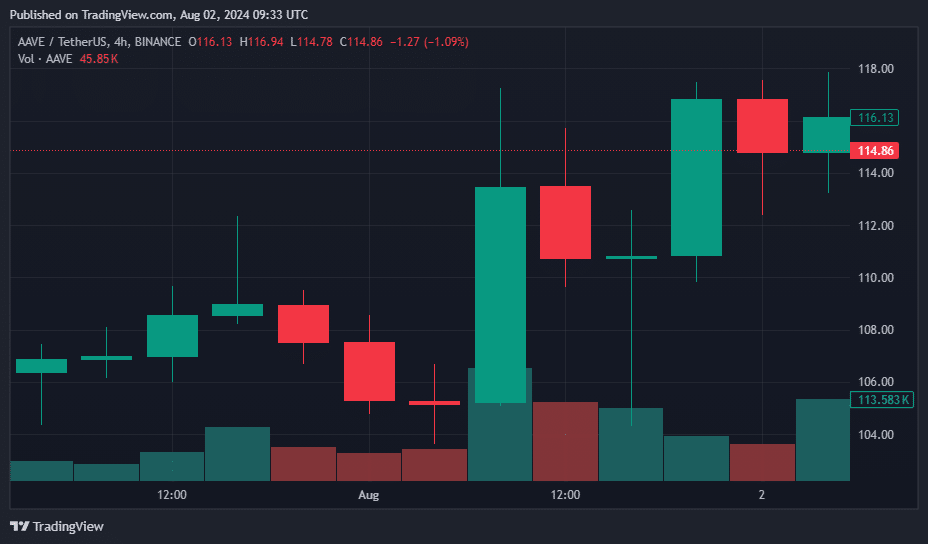

The cost of Aave increased by more than 10%, largely due to increased buying from large investors, during a period when the market was rebounding following a previous decline.

On August 2, Aave (AAVE) climbed to become the 55th largest digital currency, as its market capitalization surpassed $1.725 trillion and its price increased by 8%. The coin was trading at around $116.22, based on data from crypto.news. Although Aave experienced a significant surge, it still remains 82.5% below its peak value of $661.6. Its daily trading volume is currently at approximately $432 million.

On August 1st, Aave’s value experienced an increase, coinciding with a Lookonchain report published on July 31st. This report emphasized substantial purchases made by whales over the previous days. The investigation uncovered that approximately 58,848 AAVE tokens, equivalent to around $6.47 million, were transferred off exchanges.

In the last two days, whales have amassed approximately 6.47 million dollars worth of AAVE tokens!— Lookonchain (@lookonchain) July 31, 2024

It was revealed through comprehensive transaction records that the wallet identified as “0x9af4” withdrew an equivalent of 11,185 AAVE, which equates to around $1.23 million, from Binance. Subsequent transactions showed that a sum of approximately 21,619 AAVE, or roughly $2.38 million, was moved from Binance to Aave. Moreover, it’s worth noting that the wallet “0xd7c5” had earlier transferred over 26,044 AAVE, equivalent to more than $2.83 million, off Binance.

On August 1, Lookonchain provided additional information suggesting increased trading activity by a significant investor (referred to as a ‘whale’). This whale moved approximately 45,718 AAVE, valued around $5.21 million, from Aave to Binance in only two hours. Over the period from February to June, this whale had amassed 74,656 AAVE at an average price of $95.38 per token, equating to a total cost of about $7.12 million.

Presently, the value of the 28,938 AAVE that the whale still owns amounts to approximately $3.28 million. It’s anticipated that this investment could potentially yield a profit of around $1.37 million.

Aave Labs teases new products as TVL surpasses $12b

Currently, the combined value locked within the Aave protocol is roughly $12.63 billion. As per DefiLlama’s data, around $11.19 billion is allocated to Aave V3, while the older versions, V2 and V1, hold approximately $1.42 billion and $14.17 million respectively.

As a seasoned DeFi enthusiast who has closely followed the evolution of Aave since its early days, I am thrilled to see the launch of Aave V3.1 across all active networks. Having witnessed the growth and maturation of this innovative platform, it’s impressive to see continuous improvements like these that address security, operational efficiency, and usability concerns – aspects that are paramount in my personal investment decisions and overall DeFi experience. The collaboration between @bgdlabs and the Aave DAO is a testament to the power of community-driven development, which I believe will further solidify Aave’s position as a leading decentralized lending and borrowing platform. I eagerly await the positive impact that V3.1 will bring to the DeFi landscape.

— Aave Labs (@aave) July 31, 2024

In terms of progress, Aave Labs declared the rollout of Aave V3.1 on all networks that host active Aave V3 instances, which was set for July 31. This upgrade, supported by the Aave DAO governance, focuses on improvements to strengthen the protocol’s security, optimize its performance, and enhance user interaction.

As we move forward, Aave Labs has outlined an extensive plan for the project with challenging goals, such as the creation of Aave V4 by the year 2030.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-03 01:39