The value of companies specializing in artificial intelligence for cryptocurrencies decreased to approximately $11.3 billion, as many alternative coins experienced a significant decline during a widespread adjustment within the crypto market.

Artificial Intelligence-driven agents, which are platforms and initiatives utilizing AI technology, experienced the sharpest drop among cryptocurrencies, as the altcoin sector saw a decrease of 16% over the last 24 hours.

On January 13th, significant drops were observed in the sector, with prominent initiatives like Virtuals Protocol, AI16z (AI16Z), and AIXBT by Virtuals (AIXBT) reporting decreases of ten percent or more. This downturn followed a broader slide in digital asset prices on the same day.

16% drop was experienced by the virtual entity, resulting in a market value of approximately $2.3 billion. This venture enables software developers to design and engage with artificial intelligence systems within decentralized networks such as Base, a scalability solution on the Ethereum blockchain that is being nurtured by Coinbase.

As an analyst, I’m observing a significant dip in the market value of another crypto AI infrastructure provider. The company has seen a drop of 16%, which has brought its market capitalization down to a staggering $1.07 billion. Interestingly, among all AI agents, it was AIXBT, a popular platform utilized by traders for token analysis, that experienced the sharpest decline. Its market cap plummeted by an alarming 21%, leaving it approximately valued at $338 million.

AI Agents reel as crypto market sheds 6%

Artificial Intelligence agents made their debut in the cryptocurrency world towards the end of last year, yet they quickly gained substantial attention on social media platforms and accumulated billions in worth within just a few short months.

Conversely, the swift upward trend experienced by the sector has been replaced with its initial decline, as the overall value of all cryptocurrencies dropped to approximately $3.2 trillion – a decrease of 6%.

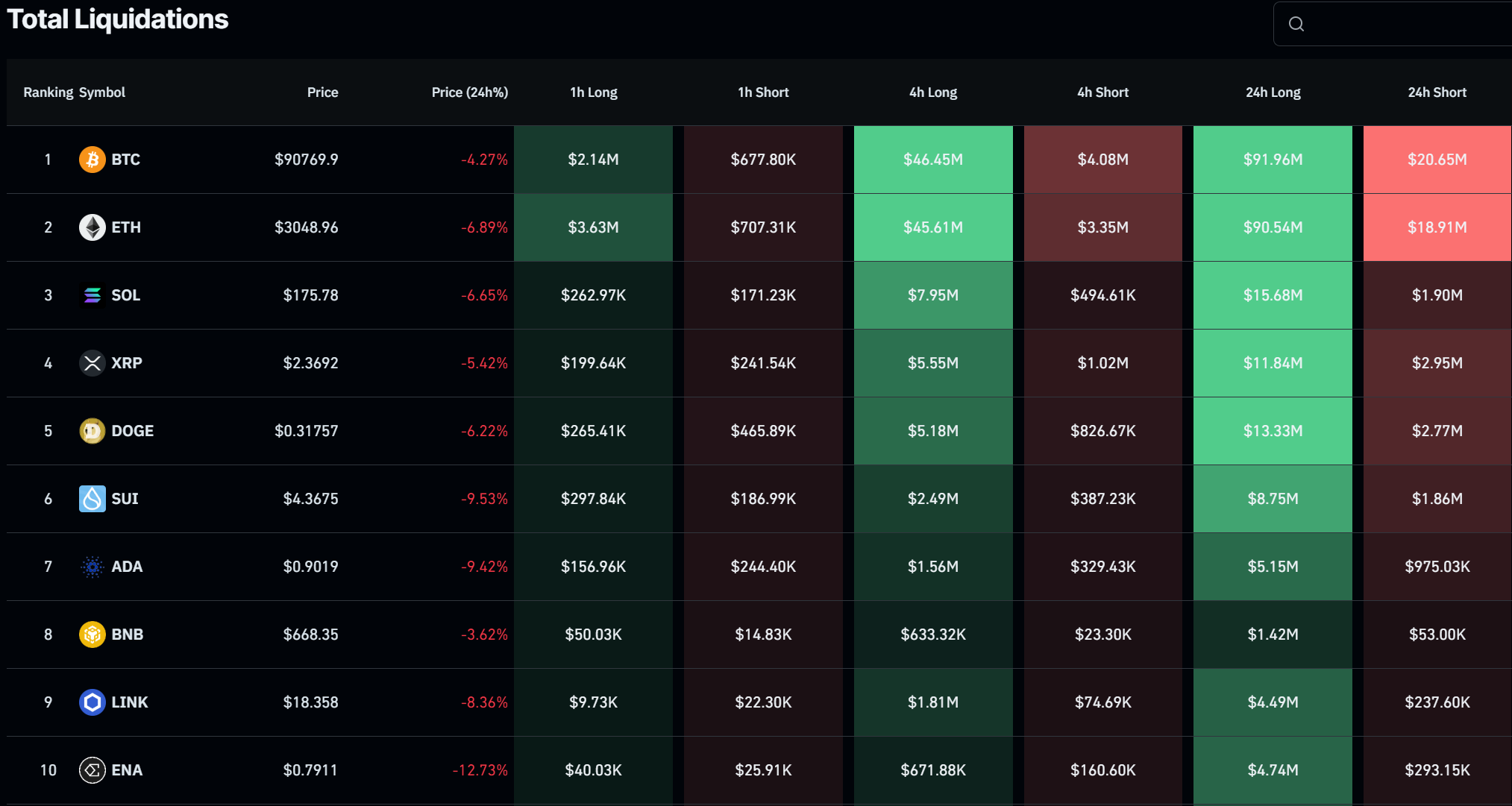

Based on information from CoinGlass, a market slump led to liquidations in multiple cryptocurrency pairs. A staggering 222,751 traders had their positions closed, resulting in total liquidations amounting to approximately $544.82 million. Notably, the single largest liquidation order occurred on Binance for the BTCUSDT pair, with a value of $8.21 million, as reported by CoinGlass.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-13 17:55