In summary, the altcoin market is experiencing a correction in both USD and BTC valuations, with many analysts predicting further declines in the short term. However, they also see potential for a bullish trend in the medium to long term due to factors such as regulatory clarity and the launch of spot ETH ETFs. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is currently trading around $2,970 and facing bearish sentiment. The trend forecast for ETH remains bearish, with a potential support level at $2800 and resistance at $3050. The price action of Ethereum may impact the broader altcoin market as well. It’s important to stay alert and flexible in this volatile market.

What factors are driving the bearish trend in altcoins, and when can we expect a turnaround?

Over the past month, the crypto market, particularly altcoins, has experienced a significant slump, resulting in substantial losses for many investors.

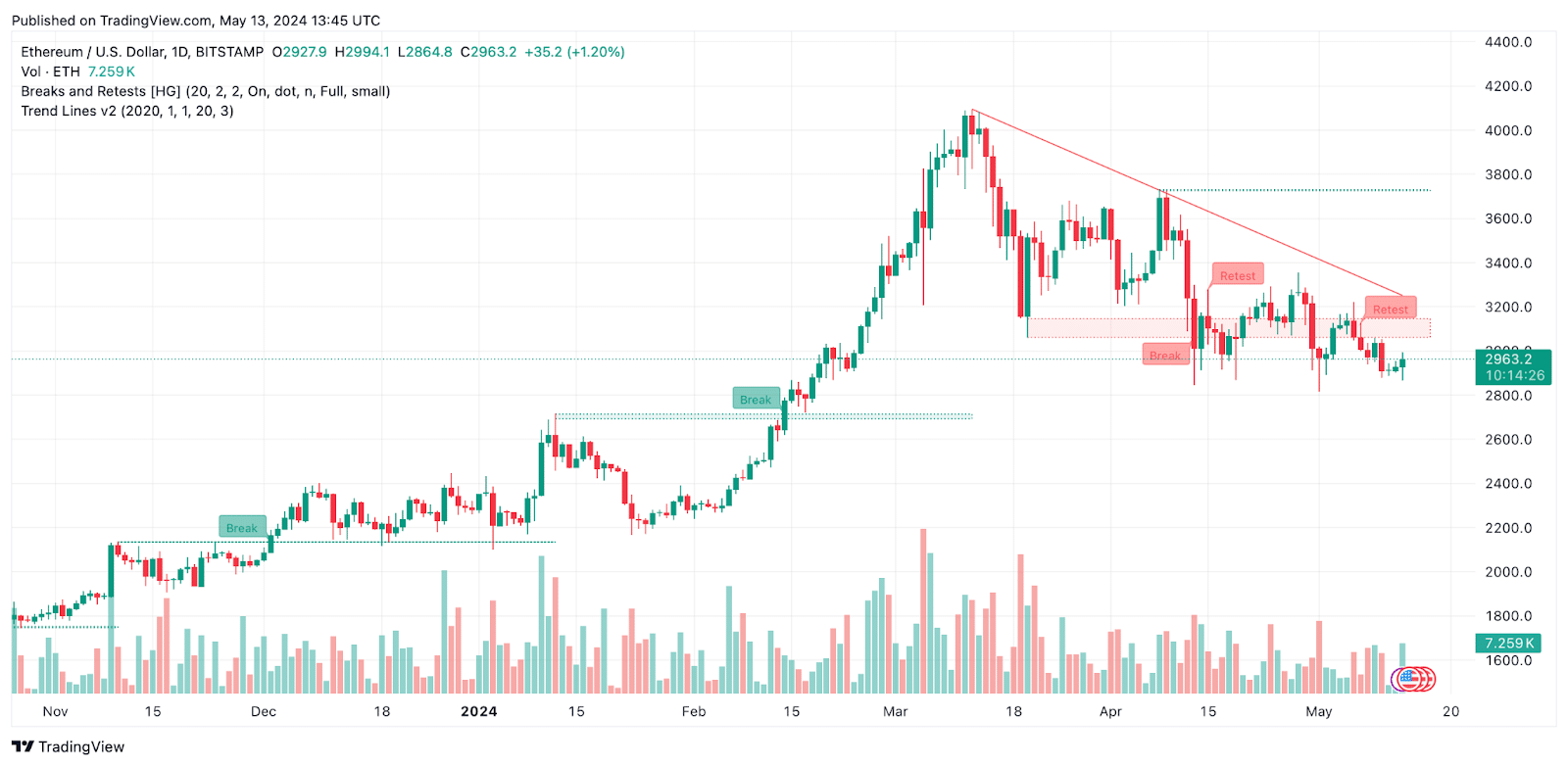

As a market analyst, I’ve observed a significant decline in Ethereum (ETH) over the past month. The cryptocurrency, currently ranked second by market capitalization, has lost nearly 10% of its value and was trading at approximately $2,960 on May 13.

However, Ordinals (ORDI) has been hit the hardest, dropping by 40% and now trading at just $36.80.

The current market slump coincides with broader economic patterns, including the Fed’s ongoing commitment to keep interest rates within the range of 5.25% to 5.50%.

The Federal Reserve’s careful handling of monetary policy, designed to manage inflation and stimulate economic expansion, has left some uncertainty in the crypto market. Consequently, investors have been leaning towards more proven digital assets, such as Bitcoin (BTC), during this period.

During the recent market slump, Bitcoin (BTC) has predominantly been traded above the $60,000 mark. Notably, Bitcoin’s dominance in the cryptocurrency market peaked at approximately 57% in April – a significant jump from the 45-46% share it held during the same period last year. Presently, as of May 13, its dominance remains above 55%.

The Federal Reserve’s plan to decrease its bond purchases at a slower rate may be a sign of economic difficulties on the horizon.

As a researcher studying the cryptocurrency market, I would put it this way: The recent signal could have diminished investors’ trust in altcoins, causing them to shift their focus and resources towards safer investments.

In light of the current cryptocurrency market slump, a pressing query emerges: when can we expect a rebound for altcoins? Let’s delve into it.

What do experts think?

Experts in the field of cryptocurrency have presented diverse viewpoints regarding the present condition of the altcoin market. Let’s explore their insights.

Patric H. | CryptelligenceX

Patric H. maintains his optimistic outlook for the market, predicting that the bull market will persist through mid-Q3 or Q4 in 2024.

🚨 Contrarian opinion: The bottom is not in.

May is going to be emotionally tough for many #Bitcoin and #Altcoins investors.

Sometime in the next 2-6 weeks, we’ll witness the final shake-out before the breakout.

🧵Here’s what to anticipate in this turbulent phase.

— Patric H. | CryptelligenceX (@CryptelligenceX) April 30, 2024

He cautions that the coming weeks may bring volatility, with May being a particularly uncertain period. His projection indicates a potential market correction, which could see Bitcoin dipping back to around $52,000 and the total market capitalization revisiting the $2 trillion mark within the next 2-6 weeks.

As a researcher observing market trends, I’ve noticed that the delayed descent to the bottom is likely due to insufficient discomfort or pain in the market. This suggests that investor sentiment continues to be overly optimistic.

Patric recommends keeping an eye on the Fear and Greed Index for indications of increasing “fear.” Additionally, he suggests observing any disparity between market sentiment and trading volumes as possible signs of an upcoming market reversal.

Benjamin Cowen

As a crypto investor, I’ve been following Benjamin Cowen’s analysis and he’s drawn my attention to an intriguing pattern from the previous market cycle. He points out that altcoin-to-bitcoin pairs often experience significant selloffs right before interest rate cuts. Based on this observation, Cowen predicts that we could see another 40% drop in altcoin values relative to bitcoin over the next few months.

Cowen explains that the persistent challenges faced by altcoins can be linked back to a decreasing level of public engagement, drawing a parallel between the present market dynamics and those observed in 2019.

The struggle of altcoins continues as social interest in them wanes. It seems that people’s indifference towards them is growing. This situation reminds me of late 2019. Social attention dropped around that time, and only after the Federal Reserve made a policy shift did the altcoin-to-Bitcoin pair prices hit their bottoms.

— Benjamin Cowen (@intocryptoverse) April 29, 2024

As a seasoned crypto investor, I’ve observed historical trends that suggest a decline in social interest precedes rate cuts from the Federal Reserve. This pattern could potentially indicate a bottoming point for ALT/BTC pairs and a shift in the Fed’s monetary policy.

Michaël van de Poppe

As a crypto investor, I’ve observed that the corrective phase in altcoins is evident in their USD values. However, when examined against Bitcoin (BTC), the downturn for altcoins becomes more pronounced, approaching cycle lows.

In terms of US dollar value, the total market capitalization of altcoins is experiencing a typical price correction. However, when measured against Bitcoin, many altcoins are currently undervalued and sitting at cycle lows. This disparity between valuation and reality presents an opportunity for those willing to take on higher risks in the crypto markets.

— Michaël van de Poppe (@CryptoMichNL) May 12, 2024

As a crypto investor, I believe that the current undervaluation of the market presents an enticing opportunity for me to up the ante and take on greater risks in my investments, rather than shying away from crypto altogether.

What to make out of it?

Based on the findings from these analyses, it’s advisable to approach the altcoin market with caution in the near future. There is a possibility of further price adjustments or corrections.

Yet, there are indications suggesting a potentially positive development in the mid to longer-term outlook. Therefore, remain vigilant and open to adjusting your position as market conditions change.

Over the coming weeks, the altcoin market is expected to experience significant developments. Various elements, such as investor sentiment, trading activity levels, and external economic news, could significantly influence the market’s direction.

Potential catalysts for market recovery

At the present moment, the cryptocurrency market stands at a pivotal point, holding the possibility of triggers that may bring about a return to stability and rekindle optimistic outlooks among investors.

A significant advancement is the ongoing process of the Financial Innovation and Technology for the 21st Century (FIT21) Act in the US House, which strives to provide clear-cut regulations for digital assets.

If enacted (during May or at any point in the future), the bill would establish federal guidelines for digital assets, provide clarity regarding the oversight of regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC), and create a regulatory infrastructure for digital asset markets.

The crypto market has been yearning for regulatory guidance, and the FIT21 Act may provide the clarification desired by industry players and investors alike, thereby enhancing trust and attracting more capital to the sector.

The bill introduces measures for permitting secondary market transactions of digital commodities and imposes regulations on registered entities. These steps could lead to enhanced market clarity and honesty.

The SEC’s upcoming ruling on VanEck’s proposed spot Ethereum ETF, due May 23, 2024, holds the potential to significantly impact Ethereum markets. An affirmative decision might spark a price increase for Ethereum, reminiscent of Bitcoin’s market surge following favorable ETF approvals earlier in 2024.

Uncertainties remain over the Securities and Exchange Commission (SEC) designating Ethereum as either a commodity or a security. This decision could influence the SEC’s approval process for proposed Ethereum spot exchange-traded funds (ETFs).

The prevailing view regarding the introduction of spot Ethereum Exchange-Traded Funds (ETFs) in the United States is generally negative. Concerns abound over potential regulatory hurdles and the Securities and Exchange Commission (SEC)’s position under Chair Gary Gensler.

Despite the current opposition from industry experts, it is widely anticipated that a spot Ethereum Exchange-Traded Fund (ETF) will eventually be approved. This development may follow the pattern set by spot Bitcoin ETFs, which initially encountered rejections but ultimately triumphed in lawsuits against the Securities and Exchange Commission (SEC).

In the immediate future, if the ETH ETF application is denied, we might witness increased price instability for ETH and a potential decrease in its value as investors process this new information.

As a crypto investor, I believe that the arrival of regulatory clarity and the approval of spot Ethereum Exchange-Traded Funds (ETFs) could significantly boost the altcoin market and set the stage for bullish trends in the coming months.

ETH price analysis

Starting on May 13, Ethereum’s price hovers approximately around $2,970. However, its recent trend shows a downward slope, raising fears that it could potentially dip beneath the $2,500 threshold.

In simpler terms, the price of Ethereum (ETH) has been decreasing recently, as indicated by weekly trade openings that are lower than the previous week’s closing prices. This pattern suggests that there is currently less enthusiasm among buyers to push up the price.

Over the past day, ETH‘s price against the US dollar has been on an uptrend, surpassing the $2900 mark. However, it has encountered strong resistance near the EMA50 at approximately $2990. In order for a bearish trend to take hold once more, ETH must fall below $2900, which could lead to further drops towards the potential levels of $2800 and $2620.

An alternate scenario involves the price continuing to climb beyond $2990, potentially reaching heights of $3130.

As a market analyst, I would assess the Ethereum trading landscape by identifying key support and resistance levels. Based on current market conditions, I anticipate ETH prices may bounce between $2800 and $3050. The overarching trend, however, continues to exhibit bearish tendencies.

As a researcher studying the Ethereum market, I’ve noticed some trends that indicate potential downward price pressure for Ethereum. This could have ripple effects on other altcoins in the market as well.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-14 17:01