As a seasoned crypto investor with years of experience under my belt, I’ve witnessed numerous market trends and cycles. And based on my observations and learnings from past events, I believe we might be on the cusp of an altcoin season.

As a researcher studying the cryptocurrency market, I’m intrigued by recent developments such as the introduction of spot Ethereum Exchange-Traded Funds (ETFs) and the volatility of Bitcoin. While it’s essential to note that no crystal ball exists to predict market trends with absolute certainty, these occurrences could potentially indicate an upcoming altcoin season.

Table of Contents

As a crypto investor, I’ve noticed some significant changes in the market lately, leaving us all on tenterhooks. The turbulence started when the defunct Mt. Gox exchange began repaying its creditors, resulting in a steep decline in Bitcoin (BTC) prices and causing widespread panic. This has led to intense speculation among us that the bull run could be coming to an end.

Enhancing the existing confusion, the German government instigated a massive sale of their crypto assets, resulting in a significant drop in Bitcoin’s price to approximately $53,700 by July 5th.

In spite of the challenges posed by the Mt. Gox repayments and the German sell-off, Bitcoin managed to bounce back and reach a price of $58,000 as the market adjusted to these events.

As an analyst, I’d rephrase it as follows: Surprisingly, the pivotal moment arrived unexpectedly during a political rally when former U.S. President Donald Trump, known for his pro-crypto stance, was suddenly shot in the right ear.

After the attack, there were rumors that Trump might make a political return, fueling optimism in some circles about the crypto market’s prospects.

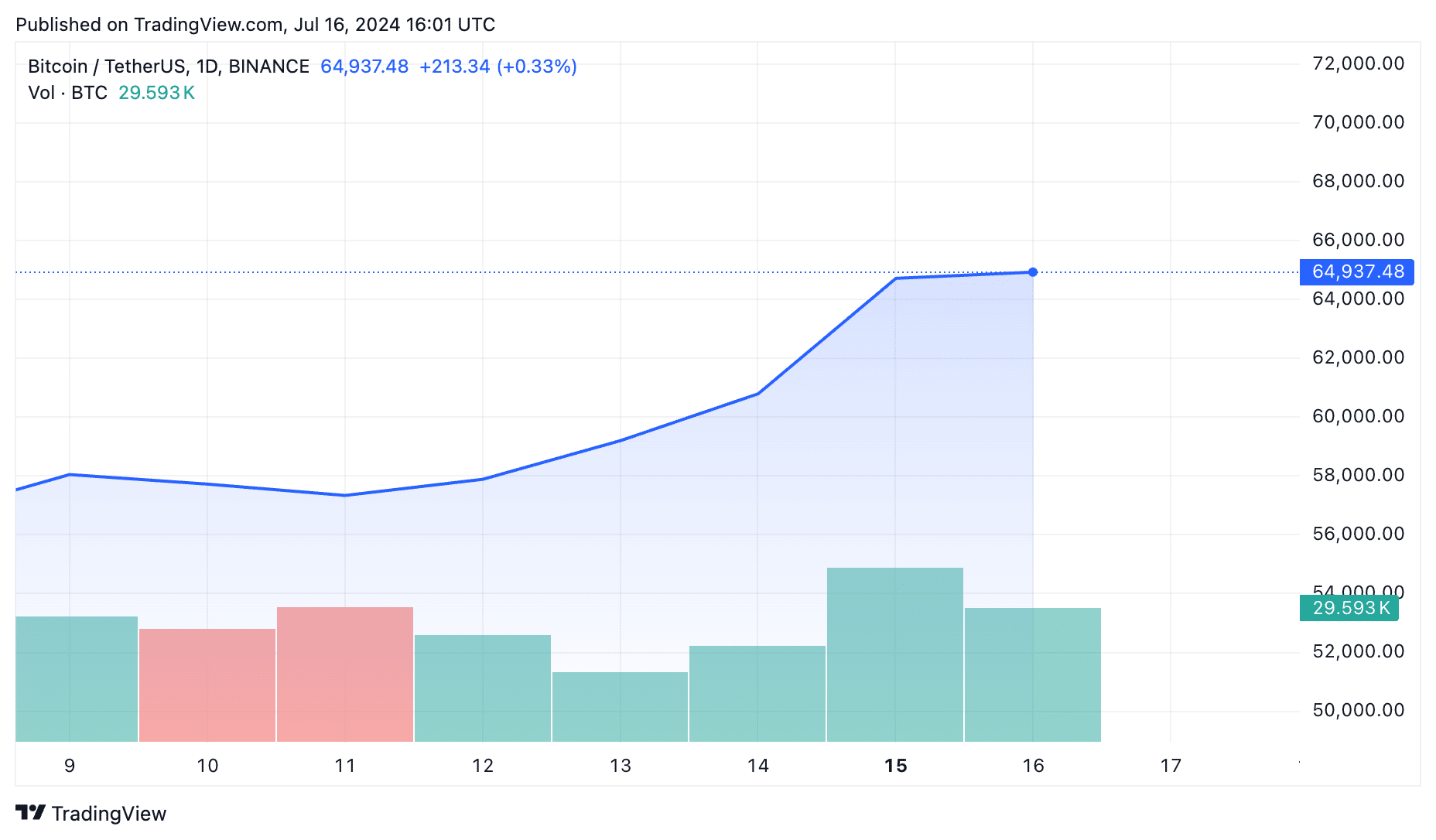

Bitcoin’s price experienced a significant surge, rising from $58,000 to over $63,000 by July 14, reaching as high as $65,000 on July 16 before ending up at $64,937 at the moment this text was penned.

From a researcher’s perspective, the unpredictability of the market seems to be intensifying with an imminent game-changer: the anticipated approval of spot Ethereum (ETH) Exchange-Traded Funds (ETFs).

The SEC has given its initial blessing to at least three out of the eight prospective asset managers aiming to introduce spot Ethereum (ETH) exchange-traded funds (ETFs). However, their final approval depends on their submission of S-1 documents to regulators by this week’s end.

Heavyweight asset managers such as BlackRock, VanEck, and Franklin Templeton, who have been given approval by the SEC, are anticipated to receive final confirmation on July 22. Trading in these new products is scheduled to commence immediately, beginning on July 23.

Revised: Nate’s intuition proved correct; the SEC contacted issuers today, requesting they submit their final S-1 forms, including fees, by Wednesday. If all goes smoothly, the SEC will then grant effectiveness on Monday following the market close, aiming for a Tuesday, July 23rd launch. However, this is contingent upon any unexpected last-minute complications not arising.

— Eric Balchunas (@EricBalchunas) July 15, 2024

Given the recent impact of these occurrences on the cryptocurrency market, a crucial inquiry arises: what could be the implications for altcoins? Is it possible that we are at the threshold of an altcoin boom, or will Bitcoin (BTC) and Ethereum (ETH) keep leading the pack?

“Let’s explore the available data and current market opinions to determine if we’re on the verge of an altcoin resurgence.”

Altcoin dominance taking a hit

As a researcher studying the current state of the altcoin market, I recognize that recent price fluctuations have made it essential to examine key data points in order to gain a clear understanding of the situation.

Let’s discuss Bitcoin’s market supremacy first. Starting from November 2022, Bitcoin’s dominance has shown significant improvement. Initially, its share in the entire crypto market was approximately 40%. Over the subsequent months, this percentage increased consistently and peaked at more than 56% in April 2024. Currently, Bitcoin’s dominance hovers around 54-56%, with a value of nearly 55% as of July 16.

As an analyst, I’ve observed that the trend for altcoin dominance, excluding the top ten coins by market capitalization, has taken a distinct course. It peaked at approximately 19.3% in January 2022, but subsequently plummeted to a low of 8.22% by June 2023. There was a subsequent recovery to around 13.4% in March 2024. However, following Bitcoin’s achievement of its all-time high, altcoin dominance once again declined, reaching approximately 10.27% as of July 16.

Ethereum has been the main driver behind any increases in altcoin dominance. When ETH prices went up, altcoin dominance followed, but other altcoins didn’t see the same level of interest or investment.

The Altcoin Season Index provides insight into the relationship between altcoins and Bitcoin by quantifying their performance. Generally, an altcoin season is identified when over 75% of the top 50 non-stablecoin altcoins exhibit better returns than Bitcoin.

In October 2023, the cryptocurrency market shifted gears and became bullish. During this period, altcoins gained significant strength. By January 2024, the crypto index had surged from a base of 16 to reach an impressive peak of 84. This notable increase in value implies that an “altcoin rally” or “altseason” was underway.

Despite the surge of Bitcoin-linked ETFs causing a setback for altcoins, pushing the index down to 16 by June 2024, recent developments saw Bitcoin losing some momentum. Consequently, the altcoin market regained strength, leading to an impressive rise in the index, reaching a high of 46 – its fastest increase since January.

The market took a downturn once more due to Mt. Gox’s repayment issues and German selling concerns, causing the index to plummet to a level of 33 by July 16th.

Ethereum significantly contributes to the surge of the altcoin market. The data reveals that when Ethereum’s price goes up, so does the Altcoin Season Index, demonstrating Ethereum’s influential role in boosting the entire altcoin sector.

As a researcher studying the cryptocurrency market, I have observed that for a genuine altcoin season to commence, it is essential that the Altcoin Market Cap Ratio (the ratio of the total market capitalization of all altcoins to that of Bitcoin) remains persistently above 75 for an extended period, be it several weeks or months. Until then, Bitcoin is expected to maintain its dominant position, with Ethereum playing a pivotal role in supporting the overall ecosystem.

Is the altcoin season around the corner?

As a market analyst, I frequently observe that the discourse surrounding altcoins is heavily influenced by anticipated events and trends derived from the cryptocurrency market’s history.

Based on the insights of cryptocurrency analyst Wise Advice, the arrival of altcoin seasons is frequently linked to Bitcoin halving occurrences. Traditionally, following a Bitcoin halving event that decreases the reward for mining new Bitcoins, Bitcoin’s price has reached unprecedented peaks (ATH) approximately 1 to 1.5 years after the event.

The price increase of Bitcoin has been accompanied by a significant upward trend for Ethereum and other alternative cryptocurrencies. For instance, during the third bull run following the halving event in November 2021, Bitcoin reached its all-time high at around $69,000, while Ethereum peaked at approximately $4,800.

In the past, similar price surge patterns have been noted during Bitcoin’s rallies. For instance, cryptocurrencies such as Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) reached all-time highs following Bitcoin’s price increase.

The reason for this trend’s foundation lies within the monetary currents in the market. To begin with, a large number of investors rush towards Bitcoin, leading to an uptick in its value. Once Bitcoin investors reap their profits, they frequently choose to invest those gains into Ethereum and other lesser-known cryptocurrencies. Due to their smaller market caps, even modest infusions of capital can result in significant price surges for these altcoins.

As an analyst, I’ve observed a recurring pattern in the crypto market where investors shift their funds from Bitcoin to Ethereum and then to smaller altcoins. This cycle results in a brief dip in Bitcoin’s market dominance, creating opportunities for altcoin rallies and eventually leading to what is commonly referred to as “altcoin season.”

Currently, Yann Allemann, Glassnode’s co-founder, noted an ongoing trend in financial markets where riskier equities have surpassed the performance of more stable assets. This observation may hint towards a potential parallel occurrence in the cryptocurrency sector.

Yesterday’s market behavior displayed contrasting trends with the Nasdaq experiencing a decline of over 2%, while the iShares Russell 2000 ETF (IWM) rallied by more than 3%. This situation is referred to as rotation. Essentially, investors are moving their funds from less risky assets like large-cap stocks in the Nasdaq to more risky ones such as small-cap stocks in IWM.

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) July 12, 2024

As a researcher observing market trends, I’ve noticed that the recent rotation could potentially lead to a significant surge in altcoins, similar to what we witnessed in November 2020. In that instance, a shift of this magnitude resulted in an impressive 400% increase in altcoin values over the subsequent four months.

Although these forecasts present an optimistic outlook, it’s crucial to exercise caution when interpreting them. The market can be unpredictable, offering potential profits but also harboring risks that deserve careful consideration.

Always do your research, stay informed, and avoid making decisions based purely on hype.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-16 19:22