Ah, the crypto-verse, a digital gulag of sorts. 🤔 Cowen, a name whispered in fearful reverence, predicts the altcoins, those shimmering promises of digital freedom, shall continue to “bleed” in value relative to Bitcoin, that monolithic monument to cryptographic orthodoxy. This “bleeding,” mind you, is not unlike the slow, agonizing drip of hope from a prisoner’s heart. Especially as BTC‘s dominance swells like the belly of a corrupt bureaucrat. Cowen, bless his analytical soul, sees parallels to last year when the U.S. Federal Reserve (the Fed), that shadowy cabal of economic puppeteers, announced it would slow its Quantitative Tightening (QT) efforts. As if they know what they are doing! 🤣

Understanding Bitcoin’s Dominance Over Altcoins

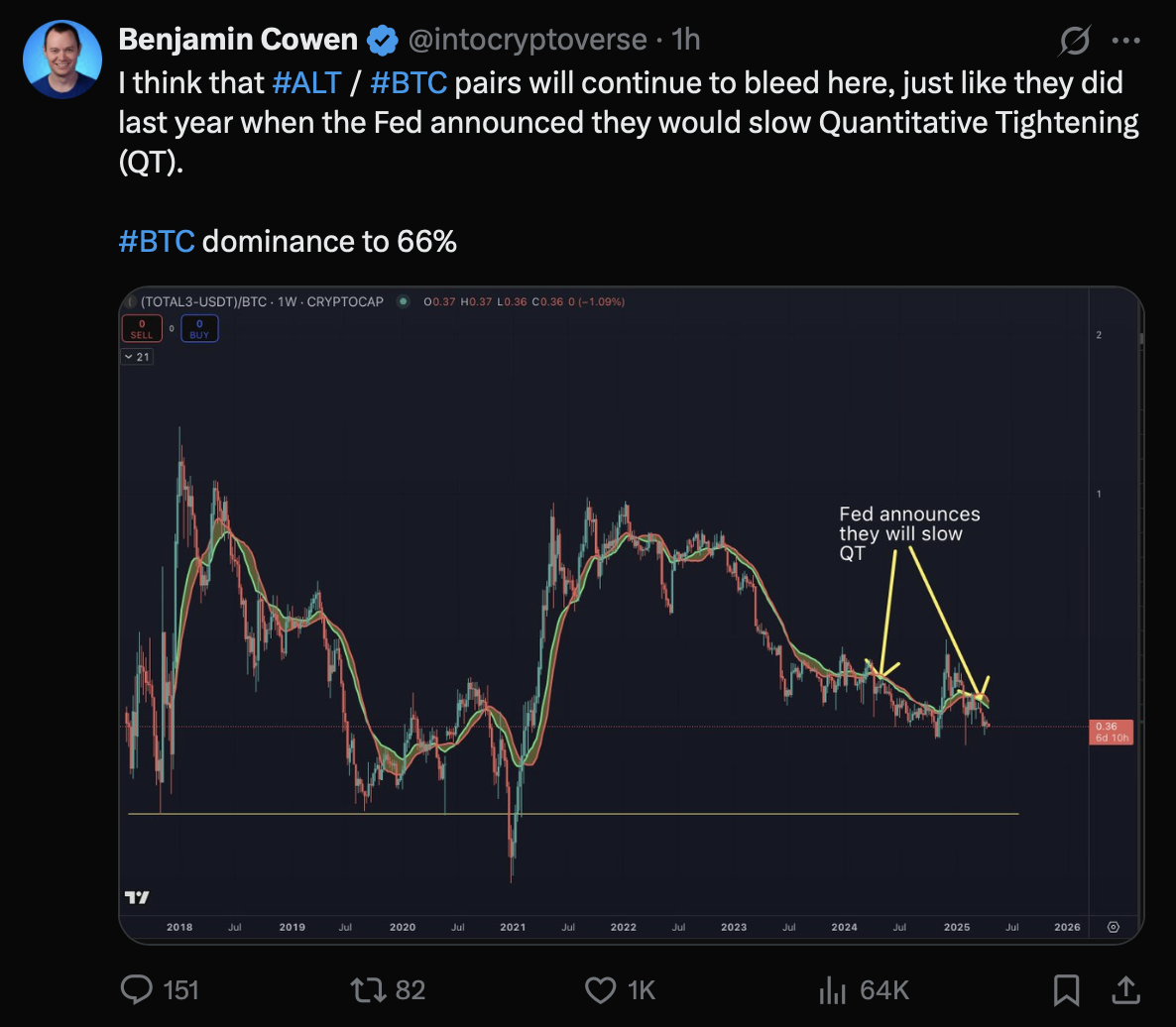

Bitcoin’s dominance, that iron grip on the digital ruble, the proportion of the total cryptocurrency market capitalization that Bitcoin accounts for, has been a key indicator in market trends. Cowen points out, with the grim satisfaction of a seasoned warden, that when the Fed slowed its QT policies, it was followed by a drop in altcoins’ performance relative to Bitcoin. A veritable cascade of despair! This trend of altcoins underperforming while Bitcoin rises in dominance is something Cowen anticipates will continue. Because, of course, the powerful always get more powerful. Isn’t that how it goes? 🤷♂️

as the Fed adjusted its policies, altcoins saw a significant bleed in value against Bitcoin. As clear as a muddy puddle after a rainstorm. 🙄

The Pattern of BTC Dominance

Looking at the historical data shown in the chart, Bitcoin dominance fluctuates with changes in monetary policies like QT. Cowen believes that the slowing of QT in 2025 will continue to cause altcoins to underperform compared to Bitcoin. This could also lead to an increase in Bitcoin’s dominance to 66%, as more capital flows into BTC as the Fed’s actions impact market liquidity. 66%? Soon it will be absolute! Like the power of the Party. 😈

The visual representation of BTC dominance on the chart shows how Bitcoin has gained a larger market share during periods when QT has been slowed or paused. This dominance trend could potentially continue into 2025, further reinforcing Bitcoin’s leadership in the crypto space. A leader… or a tyrant? The line blurs. 🤔

What is Quantitative Tightening (QT)?

Quantitative Tightening (QT) is the opposite of Quantitative Easing (QE). In simple terms, it’s the process by which a central bank reduces the amount of money circulating in the economy by selling off its assets, such as government bonds. The effect of QT is often a tightening of liquidity in the financial markets. For the cryptocurrency market, this liquidity reduction tends to affect altcoins more than Bitcoin, causing a shift in capital towards Bitcoin, which is perceived as a safer and more stable asset. A “safer” asset, they say. Like a well-guarded prison cell. 🔒

Conclusion

Benjamin Cowen’s insights suggest that Bitcoin’s dominance will continue to rise, particularly as altcoins struggle in a tighter liquidity environment caused by the Federal Reserve’s slowing of Quantitative Tightening. For those invested in altcoins, the road ahead might be challenging unless broader market conditions shift. As always, market participants should stay informed and prepared for shifts in both the crypto market and traditional financial policies. Prepare for the worst, hope for the best, and buy Bitcoin? 🤷♂️

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-21 20:10