As an analyst with a background in cryptocurrency market analysis, I’ve seen my fair share of market fluctuations. The recent decline in several altcoins, including BRETT, PEPE, WIF, and JUP, is concerning, especially given their significant drops over the past day and week.

July 8 saw most alternate coins, such as BRETT, PEPE, WIF, and JUP, experience a decline of more than 10%, following Bitcoin‘s dip of approximately 4% in the previous 24 hours.

As I pen this response, BRETT, the cryptocurrency based on a “Boy’s Club” comic character, was experiencing a 8% decrease in value over the previous 24 hours and a substantial 30% loss over the last week. The asset’s trading volume remained stable at approximately $49.1 million during this period. Additionally, its market capitalization had dropped to $1.12 billion, positioning it as the 62nd largest cryptocurrency according to CoinMarketCap (CMC).

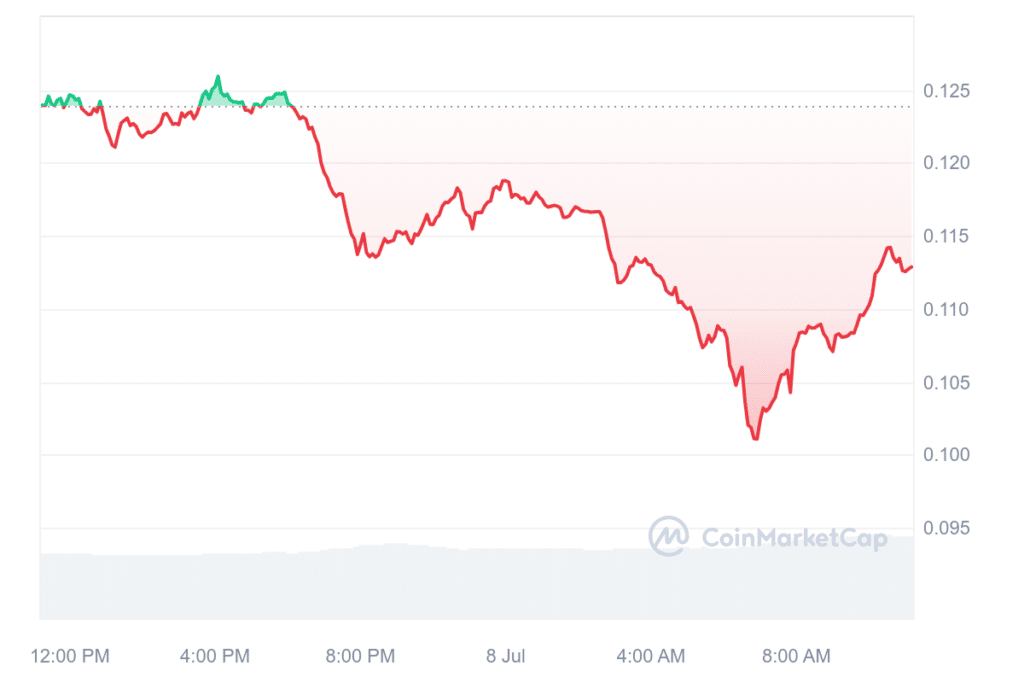

PEPE, the Ethereum-backed meme coin inspired by the green frog meme, experienced a significant loss on Monday morning, shedding approximately 12% of its value within the last day. Over the past week, this meme coin has recorded a substantial decrease of around 30%. At present, PEPE boasts a daily trading volume of over $768 million and a market cap that has dropped to $3.47 billion, currently placing it as the 24th largest cryptocurrency among the top 100 by market capitalization.

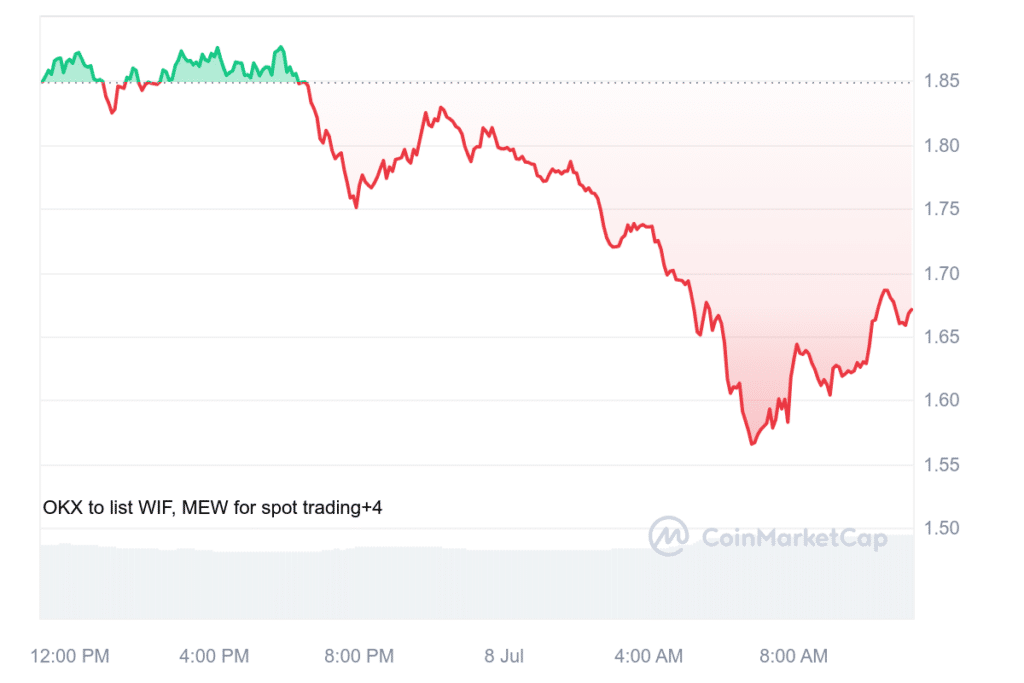

At present, the Solana-backed meme token WIF was seeing a decline of 11% within the last 24 hours, with a price point of $1.66. Over the past week, this token had dropped by approximately 27%. Concurrently, the dog-themed meme coin adorned with a pink hat experienced an increase of 14% in its daily trading volume, reaching nearly $468 million. Its market capitalization currently stood at around $1.6 billion.

Jupiter (JUP), a decentralized exchange aggregator built on the Solana blockchain, experienced a 10% decrease in value over the last 24 hours and a more significant loss of 16% over the past week. The daily trading volume for its crypto assets remained stable at approximately $109 million, while its market capitalization dipped below the $1 billion mark.

The significant drop in the value of these alternate cryptocurrencies can be attributed to Bitcoin’s price decrease. On Monday morning, Bitcoin hit a low of $54,424 and a high of $57,863 within the past day, representing a 4% decline that brought its value down to $55,676. Over the last week, Bitcoin had experienced a more substantial drop of 12%.

The price decrease in Bitcoin occurred concurrently with the German government shifting 700 BTC, equivalent to around $40.47 million, to cryptocurrency exchanges. This action represents a continuation of their previous practices, as the German authorities have persistently disposed of their Bitcoin stocks since June.

As a researcher studying cryptocurrency trends, I’ve come across an intriguing piece of information from Lookonchain, a reputable blockchain analytics platform. They reported that the German government recently moved 700 Bitcoins (approximately $31 million) to cryptocurrency exchanges. This revelation has ignited a lively debate on crypto Twitter, with some speculating that this transaction could lead to a potential price drop to the $40,000 region.

The unidentified transfer of 47,229 Bitcoins valued at approximately $2.7 billion from Mt. Gox to an unknown wallet is adding fuel to the market’s instability, contributing to Bitcoin’s ongoing price decrease.

As a financial analyst, I’d rephrase it this way: After facing bankruptcy in 2014, Mt. Gox – previously the front-runner in cryptocurrency exchanges – is planning to repay its creditors. This news has sparked concerns that an influx of Bitcoin into the market as a result could potentially push prices down even further. Creditors might choose to sell their recovered funds immediately, adding more supply to the market and increasing pressure on the Bitcoin price.

I’ve analyzed the current Bitcoin holdings as of July 5. The German government owns 41,226 Bitcoins valued at approximately $2.28 billion. In comparison, the U.S. government holds a substantial amount with 213,297 Bitcoins, equivalent to around $11.72 billion. Furthermore, Mt. Gox manages 141,687 Bitcoins, which translates to roughly $7.78 billion in value.

The relationship between Bitcoin’s performance and the altcoin market is such that when Bitcoin’s value significantly decreases, it can trigger a domino effect, causing many alternative cryptocurrencies to follow suit with declining values. This occurs as investor confidence weakens and the overall sentiment in the market shifts towards pessimism.

In spite of the present slump affecting altcoins and the cryptocurrency market as a whole, certain analysts continue to harbor hope that an altcoin rally may occur imminently.

Here’s a suggestion for paraphrasing the given statement in a natural and easy-to-read way:

— STEPH IS CRYPTO (@Steph_iscrypto) July 7, 2024

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-07-08 10:26