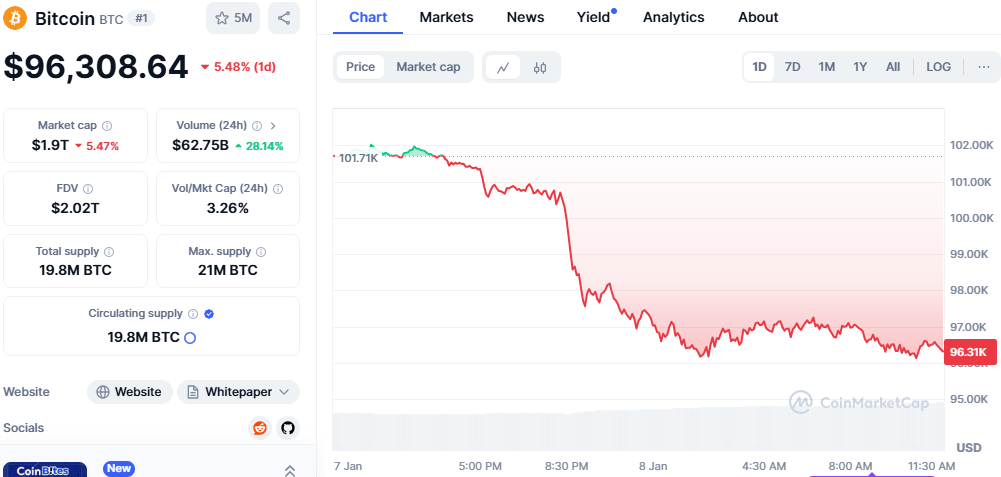

Over the last day, there’s been a significant drop in the cryptocurrency market, with Bitcoin (BTC) experiencing a decrease of approximately 5.48%, reaching a new price point of $96,308.64. The total value of all Bitcoins in circulation is now estimated at around $1.91 trillion, while trading activity has increased dramatically, reaching a volume of approximately $62.75 billion – an uptick of 25.8%.

As a researcher studying the cryptocurrency market, I’ve observed that altcoins have taken the brunt of the recent sell-off, experiencing losses across the board. Notably, Hyperliquid (HYPE) has led this downturn, diving 15.29% to reach $21.62. Previously a rising star with a 60% gain in the past month, HYPE has been on a steady decline, shedding 10.24% over just one week.

1. In addition, Celestia (TIA) saw a decrease of 14.71%, currently valued at $4.66, with a market capitalization of $2.24 billion. Similarly, Ethena (ENA) experienced a drop of 13.65% to reach $0.9913. The decentralized exchange token dYdX (DYDX) also declined by 13.49%, trading at $1.40. Lastly, the meme coin Bonk (BONK) suffered a loss of 13.29% and is now priced at $0.00002976.

24-hour market sell-offs underscored the intensity of the market chaos. Over 204,000 traders saw their positions closed, leading to a massive loss of $626.85 million. The biggest single liquidation involved the sale of approximately $17.74 million worth of ETHUSDT on Binance.

In a total of approximately $110.89 million worth of account closures (liquidations), Bitcoin was responsible for about $98.6 million from positions where people were betting on an increase (long positions), and around $12.19 million from those who were betting on a decrease (short positions). On the other hand, Altcoins played a substantial role in the $565.68 million worth of long liquidations, while only accounting for about $61.22 million in short liquidations.

Specialists link the market drop to excessive borrowing and investors cashing out following the recent gains, particularly in digital currencies such as Hyperliquid that witnessed a significant rise. The increased trade activity suggests that traders are acting impulsively.

As a crypto investor, I’m mindful that even though this correction seems promising for potential purchases, the market continues to be extremely volatile. This recent downturn underscores the significance of carefully managing my risks and diversifying my investments. Analysts recommend staying alert and cautious, emphasizing vigilance as a crucial strategy in these unpredictable times.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-08 11:01