As a seasoned researcher who has weathered countless market fluctuations over the years, I can confidently say that the recent crypto market downturn is nothing new to me. However, it’s always a bit disconcerting to see familiar names like Fantom, Sui, FET, Lido DAO, and Bitcoin dropping significantly in value.

On August 28th, a significant number of alternative cryptocurrencies like Fantom, Sui, FET, and Lido DAO experienced double-digit decreases, whereas Bitcoin, the leading crypto asset, fell by approximately 6% in the previous 24 hours.

Currently, when this is being written, Fantom (FTM), a blockchain platform designed for decentralized finance with scalability in mind, has seen a 14% decrease over the past 24 hours. In that same period, the trading volume of cryptocurrencies remained roughly at $294 million, whereas its market capitalization dropped by 14%, now totaling approximately $1.219 billion.

On crypto.news, it’s reported that SUI, the token of the Sui blockchain, decreased by 11.8%, currently trading at approximately $0.8302. In this timeframe, the daily trading volume reached $343 million. As a result, the market capitalization of SUI dropped to $2.16 billion, positioning it as the 44th largest cryptocurrency on CoinGecko’s rankings.

The Artificial Superintelligence Federation (FET), a collaboration between blockchain platforms Fetch.ai, SingularityNET, and Ocean Protocol, which aims to develop decentralized AI, is experiencing an impact due to the latest fluctuations in Bitcoin’s price. Currently, it’s trading at $1.22, having dropped by 13.7% within the last 24 hours. The daily trading volume amounts to $525.6 million, and its market cap has decreased to approximately $3 billion.

At the time of this writing, the price of Lido DAO (LDO) decreased by 13%, and it was trading at around $1.04. The daily trading volume for this token reached approximately $109.3 million. Additionally, its market capitalization dropped to about $938 million. As a result, LDO now ranks 80th among the top 100 cryptocurrencies currently in circulation.

Bitcoin drops below $59K

Because Bitcoin holds a large influence and dominates the crypto market, it’s common for altcoins’ prices to fall when Bitcoin experiences a downturn. Steep drops in Bitcoin’s price can create a domino effect throughout the cryptocurrency market, causing altcoin values to drop dramatically as investor confidence weakens and the overall market sentiment becomes more negative.

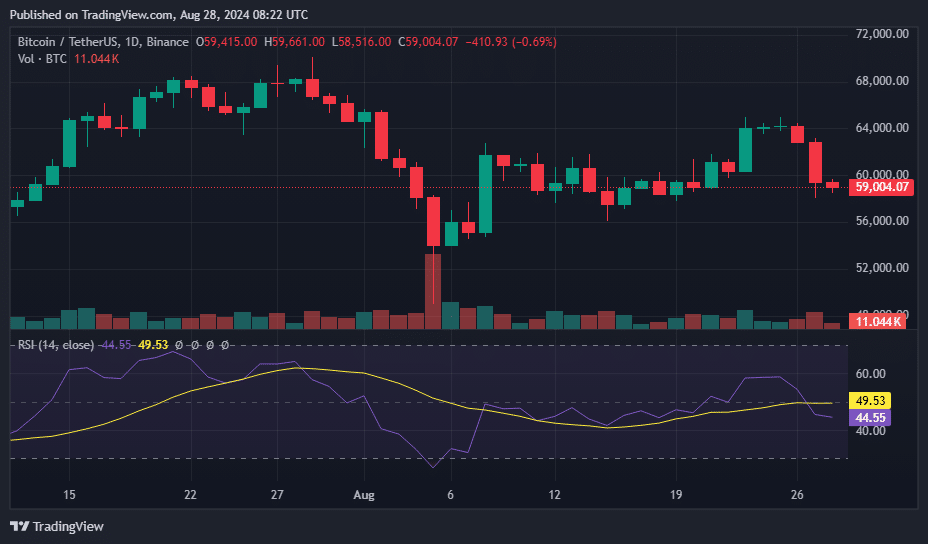

On August 28th morning, Bitcoin (BTC) experienced a decrease of about 6% to reach $58,609. Over the past day, its lowest and highest points were at $58,059 and $62,963 respectively. Additionally, the Fear and Greed Index, as reported by Alternative, currently reads 30, indicating that the crypto market is currently exhibiting fear based on current data.

According to Glassnode’s latest findings, Bitcoin’s recent price decline could be due to the market reaching a stable equilibrium that might not persist. The report highlights the MVRV ratio, a metric used to determine whether Bitcoin holders are currently in profit or loss, by comparing the current market value with the price at which coins were previously moved.

Lately, the MVRV ratio has been hovering near its historical average of 1.72, which usually marks a transition between bullish and bearish markets. This implies that following the initial enthusiasm about Bitcoin spot ETFs, investor profits have stabilized, causing a market cool-down and potentially contributing to the recent drop in prices.

Analysts have suggested that the decline in Bitcoin’s price might be related to the intensifying Russia-Ukraine conflict, as during such tense periods, securities considered ‘risky’, including Bitcoin, are frequently the ones investors choose to liquidate first.

Meanwhile, crypto expert Ash Crypto hypothesized that large investors are buying Bitcoin when its price ranges from $50,000 to $65,000. They expect a surge in value after the accumulation period ends, which might occur as early as late September.

At the present moment, the Relative Strength Index (RSI) of Bitcoin is 44.56, implying that Bitcoin’s price isn’t overly cheap (undervalued) or excessively expensive (overbought) at its current market value.

The funding rate for Bitcoin has plummeted to -0.004%, suggesting an increase in traders wagering that Bitcoin’s value will decrease. This shift came after approximately $96.5 million worth of positions were terminated over the previous day.

Historically speaking, a swift alteration in an asset’s funding rate usually triggers a price shift going in the reverse direction. Translated to Bitcoin terms, this might signify a temporary surge in its price.

In summary, over the last 24 hours, the cryptocurrency market saw a total of approximately $320 million worth of liquidations. This included about $285 million from traders holding long positions and around $35 million from those with short positions getting closed out.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-28 12:52