As a researcher with a background in financial markets and experience in analyzing the correlation between Bitcoin (BTC) and macroeconomic factors, I find Lucy Gazmararian’s perspective on the topic intriguing. Her insights from her role as the founder and managing partner at Token Bay Capital add credibility to her analysis.

As a researcher studying the relationship between Bitcoin and macroeconomic factors, I’ve found that this is a significant area of interest given recent developments. Over the past month, both global monetary policies and Bitcoin’s price have experienced noticeable downturns.

As a researcher studying the cryptocurrency market, I’ve come across some intriguing insights from Lucy Gazmarian, the founder and managing partner at Token Bay Capital. In a recent interview on CNBC, she shared her perspective that Bitcoin (BTC) might follow the trend of the stock market.

The connection between digital assets and conventional finance is becoming clearer, according to Gazmararian’s observation. Analysts have identified a relationship between Bitcoin (BTC) and macroeconomic factors due to geopolitical instability and monetary policies such as interest rate adjustments by the U.S. Federal Reserve.

As a crypto investor, I’ve noticed that in certain situations, the conventional wisdom of treating Bitcoin as a “risk-on” asset and a hedge against inflation might not always hold true. Gary Marzararian made this point clear when he explained that the correlations between Bitcoin and other asset classes like bonds or equities can sometimes diverge. Bitcoin’s unique characteristics set it apart, making it an intriguing alternative investment option.

Bitcoin top expected by late 2025

Despite a 9% decrease in Bitcoin’s value over the last month and rising inflation worries in the US, the founder of Token Bay Capital maintains that we are at most halfway through the current Bitcoin bull market. He referenced past “four-year boom-bust patterns” observed in crypto markets, implying that the recent market correction, which often follows the Bitcoin halving event, is a normal occurrence.

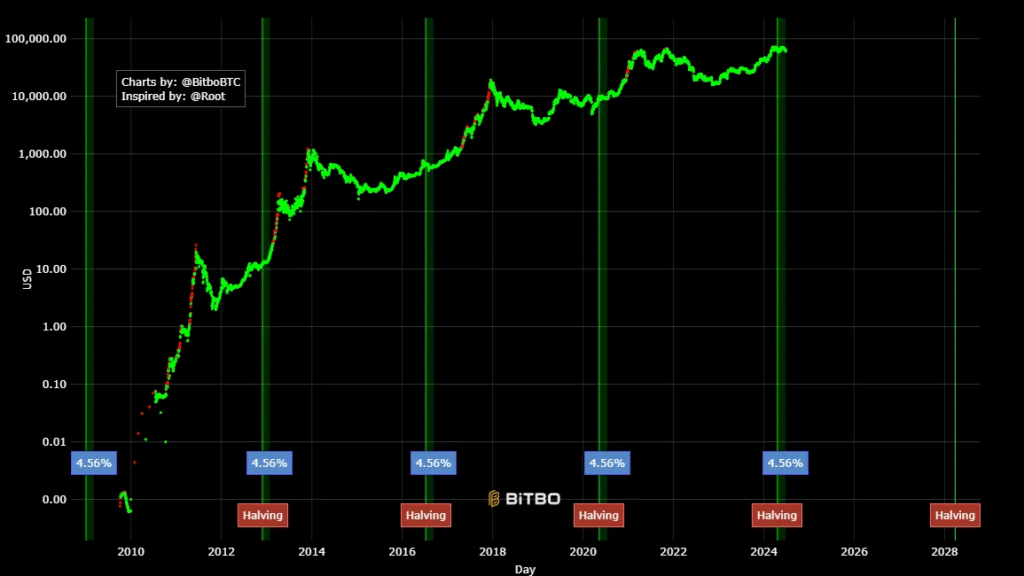

As an analyst, I’ve observed that drops between 10% and 30%, which have been common in past Bitcoin cycles, are still occurring. According to data from BiTBO and TradingView, there have been instances of significant slumps, reaching up to 40%, following Bitcoin’s quadrennial code changes. However, these downturns have typically been followed by parabolic runs leading to new record highs for the cryptocurrency.

Based on the data from the graphs, Bitcoin has failed to revisit its previous prices following each halving event. The managing partner at Token Bay Capital hypothesized that historical trends might recur, leading to a potential Bitcoin peak toward the end of 2025.

In contrast, Gazmarian hypothesized that Bitcoin’s ongoing bull market could be challenged if its value dropped by over 50% within the upcoming months. At present prices, such a decline would push Bitcoin below the $32,000 mark.

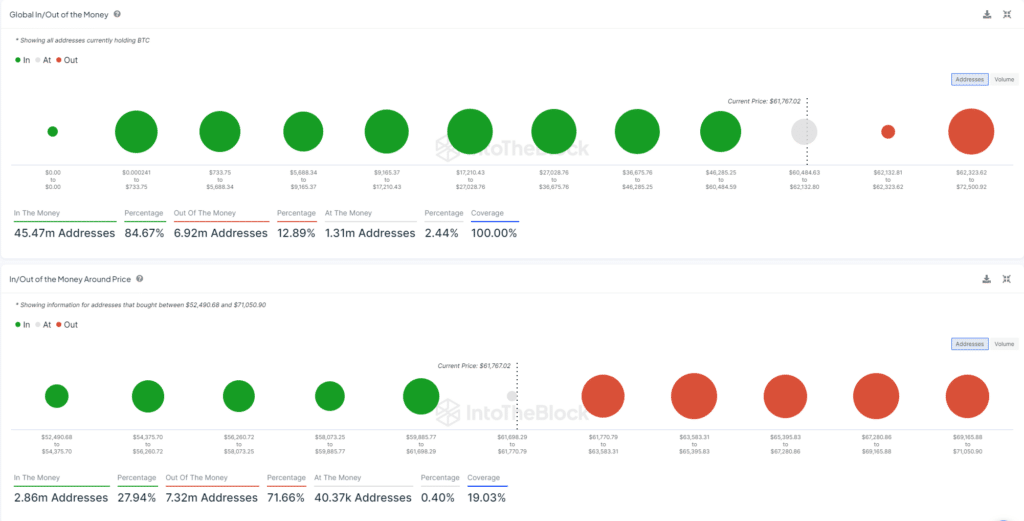

According to IntoTheBlock’s analysis, approximately 84% of Bitcoin investors who have held their coins for the long term are currently making a profit. In contrast, around 71% of recent purchasers, who bought Bitcoin between $52,490.68 and $71,050, are currently experiencing losses or are “underwater.” This indicates that significant price drops could result in substantial financial setbacks for these investors.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-06-26 19:08