As a seasoned analyst with over two decades of experience navigating various financial markets, I must say that the recent trend of institutional investment in U.S. spot Bitcoin ETFs is a testament to the growing maturity and acceptance of cryptocurrencies within traditional finance. The resilience of these investments despite challenging market conditions speaks volumes about the confidence institutions have in this asset class.

Regardless of the drop in Bitcoin‘s price and a tough market situation, holdings of U.S. Bitcoin ETFs by institutions grew during the last quarter.

By the close of the second quarter in 2024, institutional ownership in U.S.-traded Bitcoin ETFs climbed to 24%, as reported by analysts from H.C. Wainwright. This represents an increase from the previous quarter’s 21.4%, based on recently disclosed 13-F filings and data compiled by Coinbase.

In a tough market setting where the combined value of the managed assets in these ETFs decreased by 13% every three months to approximately $51.8 billion, this expansion still took place, primarily due to a decrease in Bitcoin (BTC) values.

Among significant fresh institutional investors, we find Goldman Sachs investing $412 million in ETF shares, followed by Morgan Stanley at $188 million. However, it’s possible that part of this investment is being held on behalf of their clients.

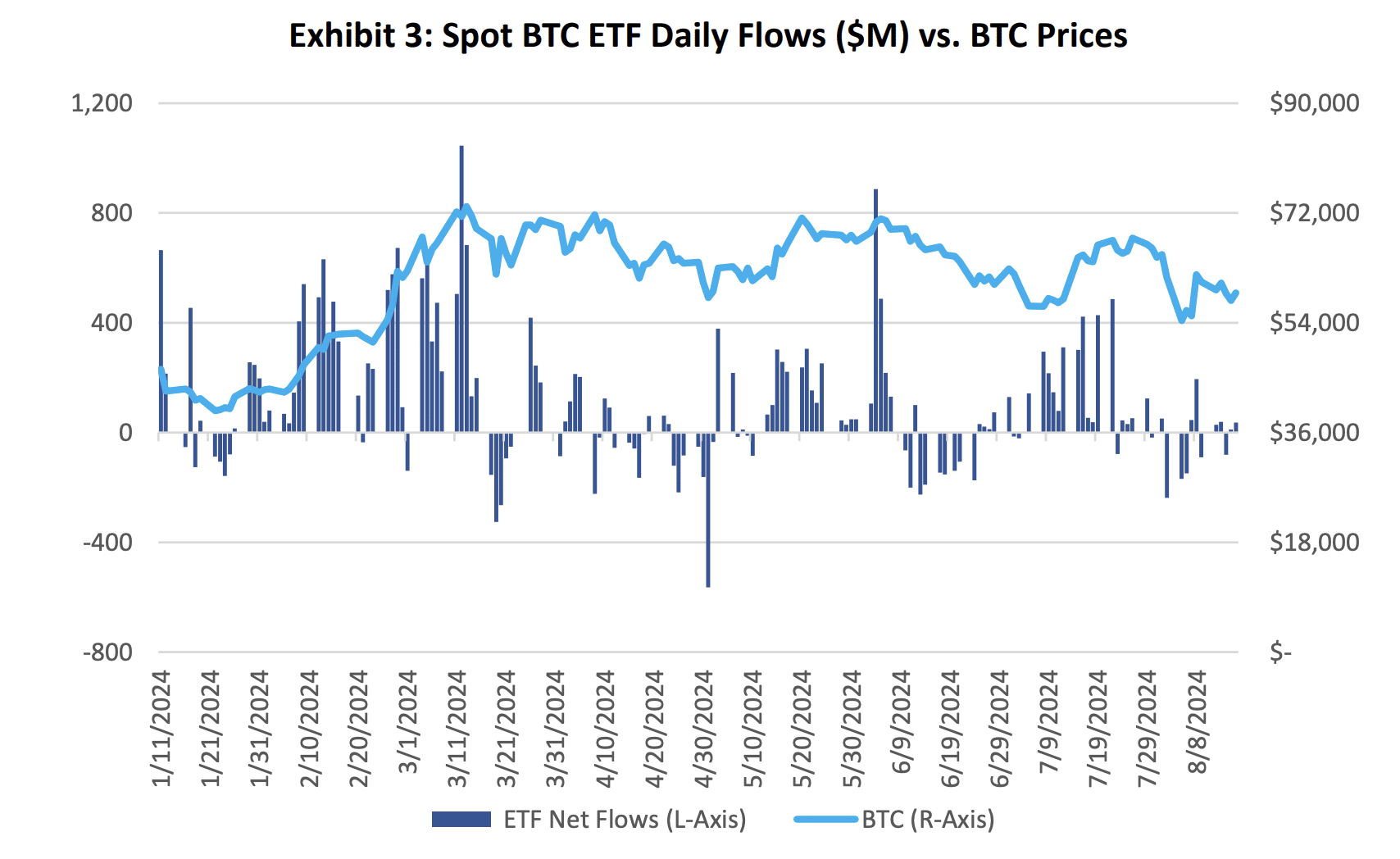

Bitcoin ETF inflows

On August 19th, there was a substantial investment of approximately $61.98 million into Bitcoin Exchange-Traded Funds (ETFs), primarily driven by BlackRock’s IBIT with an inflow of $92.7 million. Interestingly, certain ETFs such as Bitwise’s BITB and Invesco Galaxy’s BTCO saw outflows during this period. Despite this, the collective investment into Bitcoin ETFs has now surpassed a monumental total of $17.4 billion.

Currently, investment advisors make up approximately 36.6% of the overall ownership in Bitcoin Spot ETFs, which is an increase from 29.8% during the first quarter. Meanwhile, hedge fund ownership has decreased to 30.5%, down from 37.7%.

Regardless of the ups and downs in the market, Bitcoin ETFs saw a total of $2.4 billion flowing in during the quarter, indicating that institutions continue to show strong interest in the cryptocurrency sector.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-20 17:57