As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and bear markets. The upcoming token unlock event for Celestia (TIA) has me concerned, to say the least. With a significant portion of its total supply set to enter circulation, coupled with the potential profit-taking from early investors, there’s a strong possibility that we could see a bearish momentum in the TIA price.

By the end of October, there may be increased selling activity for Celestia as a significant token release event is approaching, according to Illia Otychenko, Lead Analyst at CEX.IO, who shared this information with crypto.news.

On October 30th, a significant amount of Celestia (TIA) tokens – approximately 175 million, which is equivalent to about 16.4% of the total supply – will be added to the circulating supply. This event occurs as the modular blockchain celebrates its first anniversary. Currently, these coins are worth around $1 billion at their current market value.

Otychenko pointed out three key points that could trigger bearish momentum for the TIA price in the upcoming token unlock event:

-

Early unlock: The network launched just a year ago, and this is its first major unlock since the initial launch. Additionally, the Oct. 30 release marks the beginning of subsequent monthly unlocks. Historically, tokens that have distributed less than 70% of their total supply tend to have larger volatility during their unlocking events, according to the 6MV report.

Large unlock: TIA is set to nearly double its circulating supply in a single event as its circulating supply will increase by 82% — far beyond the 1% threshold where negative price impact typically begins to emerge.

Profit-taking opportunity: Approximately 67% of tokens within the upcoming unlock will go to seed and series A and B investors, who are currently sitting on 59,400% and 1,800% profits, respectively.

As a lead analyst at CEX.IO, I’m observing a challenging situation with TIA, which has seen a significant decline of approximately 70% from its peak of $20.9 in February 2024. Given this downturn, early investors might be contemplating selling their holdings due to the current market conditions.

Based on Otychenko’s examination, there’s been a substantial rise in activity on the Celestia network this year, alongside a decrease in fees. This trend indicates potential decreased revenue and short-term stress on the TIA token. However, for the long haul, “this pattern could be a favorable sign.

Additionally, it’s noted by the analyst that Token Incentive Asset (TIA) might encounter a situation known as a “short squeeze” because of the large token release event and possible selling by early investors seeking profits.

As an analyst, I foresee that if Celestia doesn’t experience a significant increase in positive engagement post token unlock, or if a robust uptrend across altcoins fails to manifest, thereby failing to bolster the asset, there’s a high likelihood that the TIA token could plummet by more than 20% following its release.

Otychenko told crypto.news.

On Sept. 23, the Celestia Foundation announced a $100 million funding round, led by Bain Capital Crypto. This helped the TIA price surge 14% in less than 24 hours as the positive sentiment surrounding the asset significantly increased.

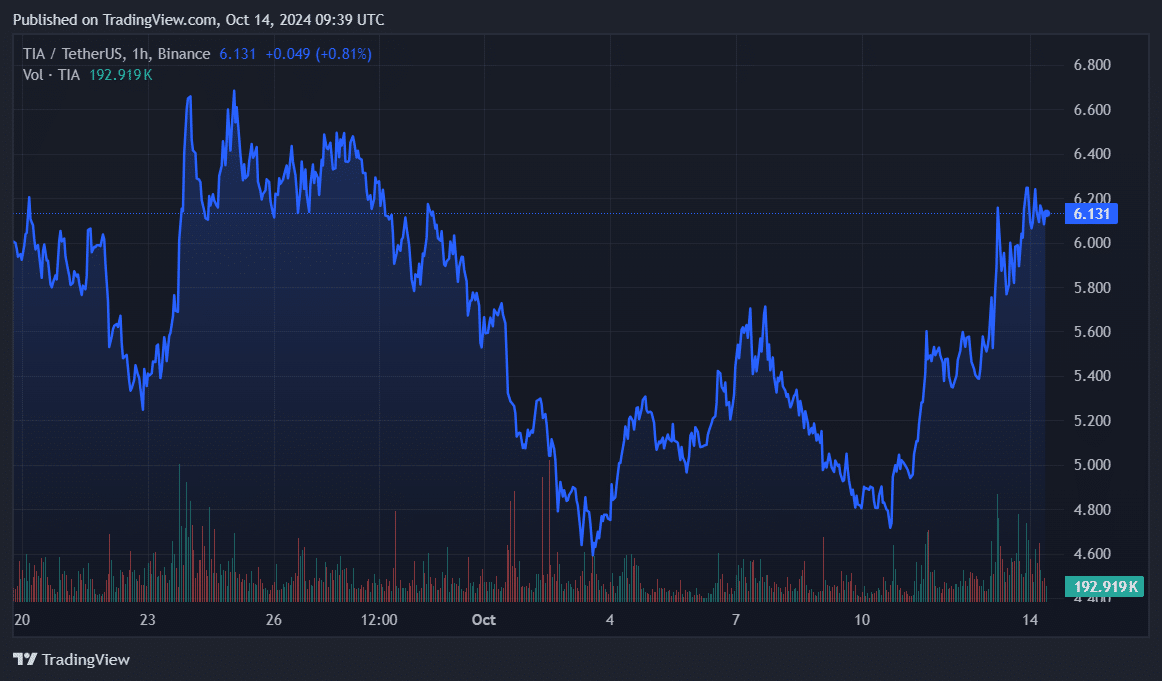

In the last 24 hours, TIA has experienced a 3.4% increase and is presently valued at $6.12 per share. At this moment, its market capitalization stands around $1.33 billion, while its daily trading volume amounts to approximately $227 million.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-14 13:16