As an experienced analyst, I’m closely monitoring the Ethereum (ETH) market amid its recent price decline below the $3,500 threshold. The current bearish trend has pushed multiple altcoins to their lowest levels in weeks, and Ethereum is no exception.

With Ethereum (ETH) dipping back towards the $3,500 mark during the broader market slump, CryptoQuant analyst ShayanBTC proposes that a potential worsening of current trends in the futures market could lead to additional losses for the asset.

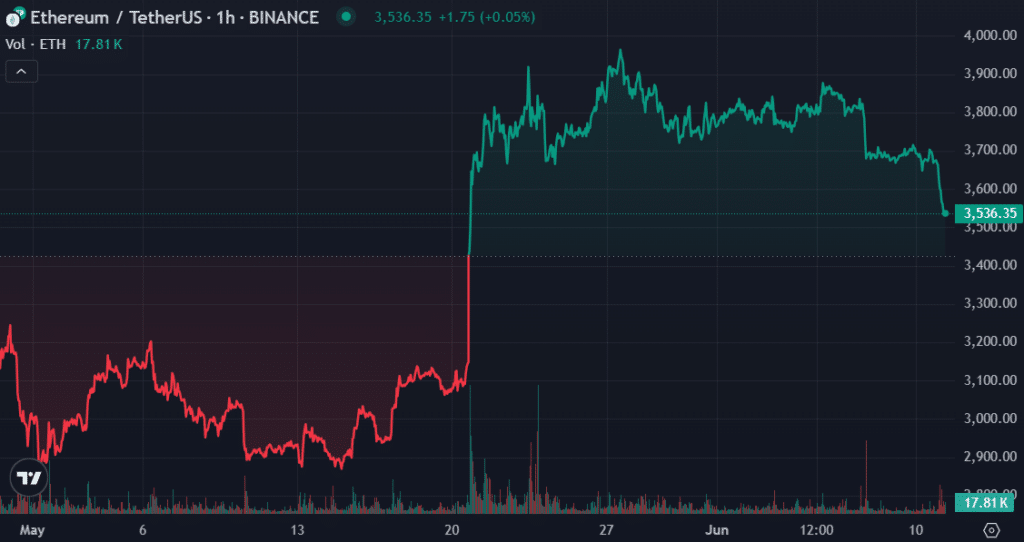

In recent times, market instability has caused numerous altcoins to hit their lowest points in weeks. Among them, Ethereum experienced a significant drop, reaching the lower boundary of $3,500 for the first time in over three weeks. Today, it revisited its previous low of $3,503.

In the face of pessimistic market trends, apprehension among investors has resurfaced. Evidence from the futures market reveals that traders are adopting a bearish stance, anticipating larger drops and an enduring volatility.

In a recent examination, ShayanBTC highlighted the significance of the Taker Buy Sell Ratio, which reflects the degree of buyer versus seller activity in the futures market. A figure greater than one signifies that buyers are in the driver’s seat, while a value less than one implies that sellers are taking a more assertive role.

As a researcher studying market trends, I’ve observed that the seven-day moving average of Ethereum’s trading ratio has been decreasing and has yet to surpass the one mark. This persistent decline suggests that a significant number of futures traders have been actively selling Ethereum in the market.

The cause behind such actions might be speculation or the pursuit of profits under the present market circumstances. ShayanBTC asserts that the noticeable decrease in this ratio functions as a warning sign, implying that Ethereum’s price drop may extend if selling pressure remains intense.

Concurrently, there was a significant surge in derivatives trading volume by 131% to reach an all-time high of $24.8 billion. However, Ethereum’s long/short ratio, indicative of the balance between bullish and bearish positions, has undergone a substantial decrease. This ratio now stands at 0.8921, implying a predominance of short positions based on Coinglass statistics.

As an analyst, I would describe the situation with Ethereum as follows: Currently, Ethereum is priced at $3,537, marking a slight rebound from its earlier low of $3,503 established this morning. Although there has been a 3.58% decrease in value today, it’s important to note that Ethereum still hovers above significant moving averages. Specifically, it trades above the 200-day Exponential Moving Average (EMA), which stands at $2,945, and the 50-day Simple Moving Average (SMA), currently sitting at $3,381.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-06-11 12:20