As a seasoned researcher with over two decades of experience in the financial markets, I must admit that the current forecast for Ethereum (ETH) is quite intriguing. The convergence of political events, market trends, and technological advancements seems to be setting the stage for a potentially significant rally.

After Donald Trump’s victory in the U.S. presidential election, analysts predict that Ethereum (ETH) will experience a significant surge over $3,200 due to an enhanced risk tolerance within the cryptocurrency market.

Analysts from Bitfinex anticipate that Ethereum will surpass its established price range where substantial buying has occurred, with an estimated price of $3,200 in the upcoming months. This prediction is based on the assumption that Ethereum will rise once Bitcoin‘s market influence reaches 60%. As of November 8th, Bitcoin’s dominance had already reached 60.4%, potentially signaling a forthcoming Ethereum surge.

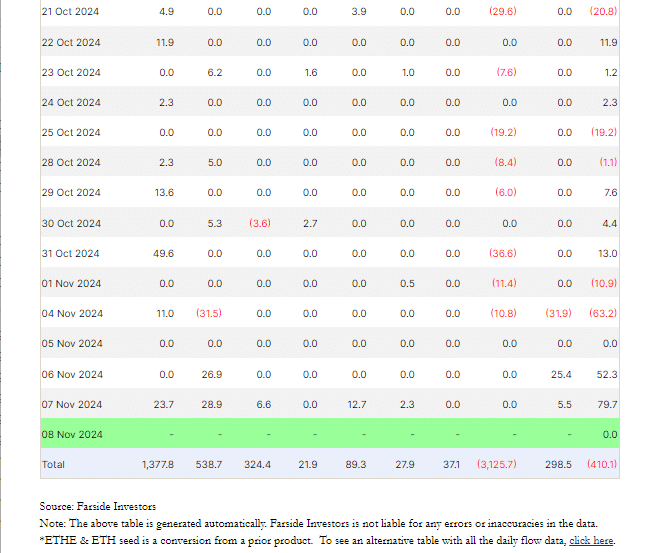

After the election, there have been increasing investments into spot Ethereum Exchange Traded Funds (ETFs). Specifically, on November 6th, $52.3 million in net inflows were reported and an additional $79.7 million on November 7th, as per data from Farside Investors. This surge in investments may be attributed to the increased investor confidence following Trump’s victory, hinting at sustained bullish sentiment for Ethereum.

The level of trading related to Ether has significantly increased, causing the open interest to jump to $1.3 million compared to $800,000 in August. Bitfinex experts have observed an increase in short positions, which might lead to a rise in pricing pressures.

Optimism continues to grow for Ethereum-based Exchange Traded Funds (ETFs), as analyst Edward Wilson from Nansen predicts that a Trump administration could endorse the first staked Ether ETF. This approval might increase Ether’s attractiveness and potentially push its price above its previous high of $4,800 from November 2021.

As more Ether-focused Exchange Traded Funds (ETFs) could be introduced in the future, analysts anticipate that President Trump’s administration may create a favorable climate for cryptocurrencies, which could boost Ether’s development.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-08 16:04