As an experienced crypto analyst, I’ve closely monitored the Bitcoin mining scene for quite some time now. Based on the latest reports from Hashrate Index, it seems that public Bitcoin miners are indeed ramping up their ASIC orders, leading to a significant increase in the network’s hashrate.

According to Hashrate Index, a leading crypto mining analytics company, public Bitcoin miners are following through with their plans to order ASICs (Application-Specific Integrated Circuits) on time.

Bitcoin mining will experience a significant increase in difficulty level within the next eight days, as major mining companies ramp up their operations. Based on data from Hashrate Index, leading public miners have ordered a total of 76.6 exahashes per second (EH/s) worth of equipment for delivery in 2024. Of this, approximately 12.9 EH/s is slated for shipment in Q1, while nearly 36 EH/s is anticipated to arrive in Q2.

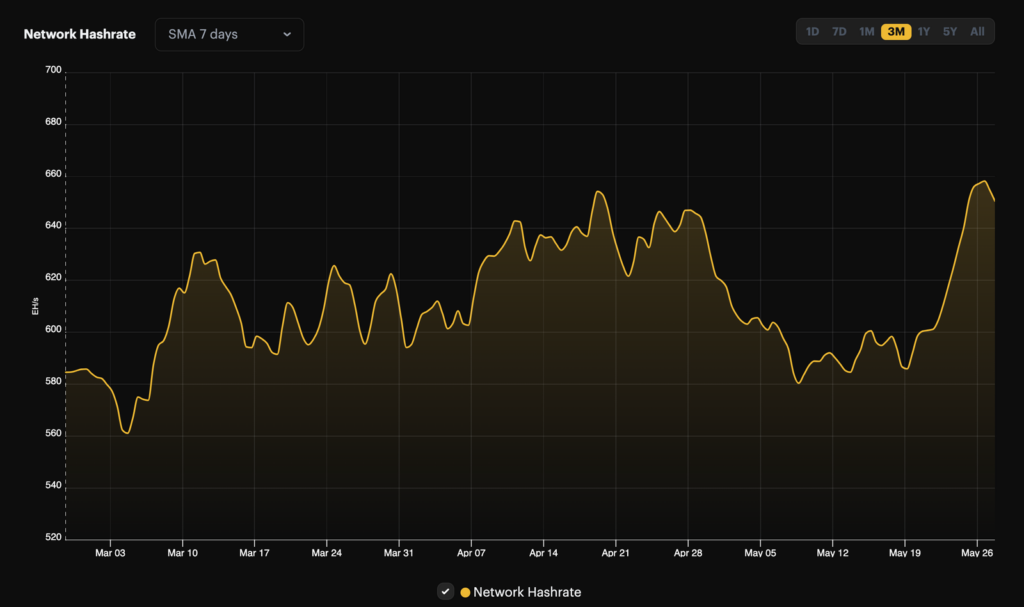

As a researcher studying the mining landscape, I can tell you that within the next eight days, there is an anticipated increase in hashrate. The consequence of this surge could result in a significant hike in mining difficulty. At this point, it’s premature to determine the exact percentage of increase; however, our current projection suggests a rise by approximately 5.97%.

Hashrate Index

At the moment of reporting, Bitcoin’s average hashrate over the past week reached a new record high of 659 exahash per second (EH/s), representing a 13.6% rise from its post-halving minimum of 580 EH/s. Experts note that this level results in an approximate block generation time of 9 minutes and 26 seconds.

In the Bitcoin blockchain’s transaction market, analysts noted that transaction fee volumes have significantly decreased since the halving event. Contrary to expectations raised by the upcoming launch of the Runes fungible token standard, trading activity has dwindled, and transaction fees have returned to typical levels.

In May’s early days, Hashrate Index’s team of analysts projected a hashprice surge within the following half-year. This prediction was founded on three reasons: an anticipated plateau in mining difficulty, escalating transaction fees, and Bitcoin’s price increase. As we move forward, American Bitcoin miners might decrease their operations during summer, which could slow down hashrate growth. Nevertheless, it’s important to consider that global miners could counterbalance this reduction, shedding light on the bigger picture of hashrate development.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-29 12:37