As an experienced analyst, I’ve seen my fair share of meme coins coming and going in the cryptocurrency market. The current surge in the price of dogwifhat (WIF) is indeed impressive, but it also comes with a degree of caution as the market sentiment remains bullish.

The five-month-old meme coin based on dogs, called Dogwifhat (WIF), has experienced a significant price increase in the current market upturn. Some investors, however, anticipate a potential decline.

At present, WIF has experienced a 14% increase within the past 24 hours and is currently priced at $3.85. Earlier in the day, this meme coin reached a peak price of $4.05 – a level not attained since early April. The market capitalization of WIF stands at a substantial $3.85 billion, positioning it as the 28th largest cryptocurrency as we speak.

As an analyst, I’ve observed a significant increase in the daily trading volume of the meme coin, reaching over $1.5 billion following a robust 33% price growth within the last 24 hours.

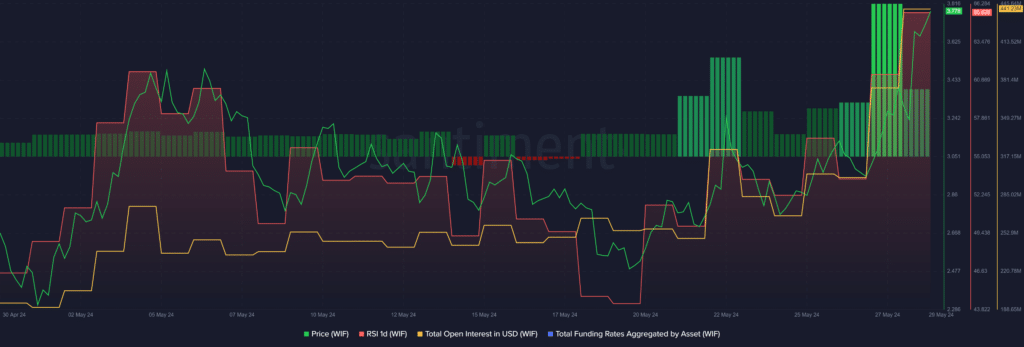

Based on Santiment’s data, WIF‘s open interest experienced a significant growth of 17.7% over the last 24 hours, which raised it from $374.9 million to $441.2 million. When open interest swells unexpectedly for an asset, it often indicates impending price instability due to possible liquidations.

Based on data from our market intelligence platform, the combined funding rate for WIF dropped from 0.043% to 0.019% within the last 24 hours. This indicates a noticeable surge in the number of traders placing bets on the meme coin’s price decreasing.

Furthermore, based on Santiment’s information, the WIF‘s Relative Strength Index (RSI) increased from 61 to 65 within the last 24 hours. This implies that the meme coin with a theme of dogs is now considered overbought in the market. Even potential price manipulation by large investors, or whales, could be influencing its current trend.

Currently, the cost of Dogewhats could experience abrupt fluctuations as traders cash in on temporary gains or face compulsory sales (liquidations).

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-29 13:04