As a seasoned crypto investor with a knack for spotting promising projects, I find myself intrigued by the meteoric rise of Aptos (APT). Having been around since the early days of DeFi and witnessing countless market fluctuations, I’ve learned to read between the lines of price movements and partnership announcements.

APT secured the top gainer spot on Oct. 22 amidst a surge in total value locked in the protocol.

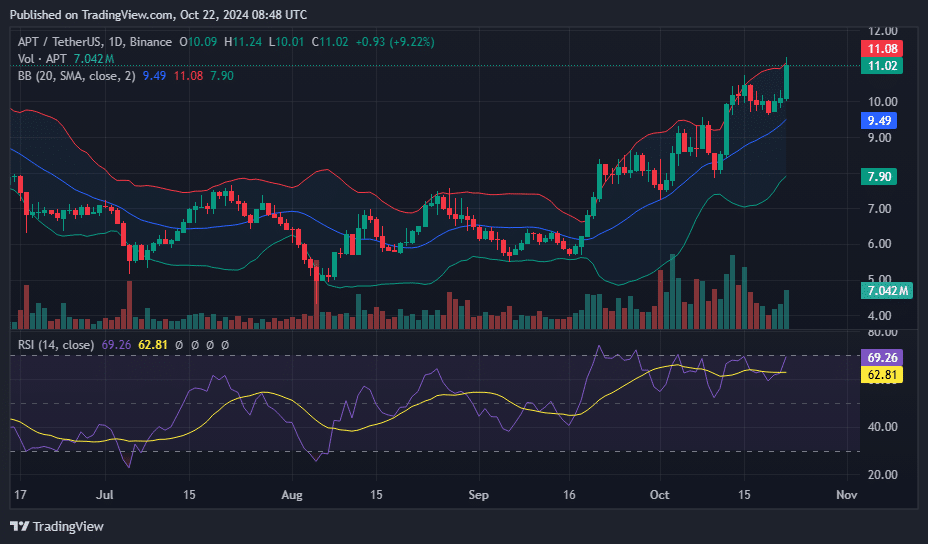

In the last 24 hours, Aptos (APT) rose by 9%, reaching a peak of $11.13. This significant increase in value pushed its market capitalization beyond $5.7 billion. Moreover, the daily trading volume exceeded half a billion dollars, standing at over $597 million.

The Price’s surge follows its breakout from a narrow trading band of $9.7 to $10.1 over the past five days. In the early hours of October 22nd, a significant candle appeared on the APT chart, propelling its value from $10.10 to $11.12.

A couple of recent partnerships and developments helped fuel this rally.

Initially, Aptos linked with Echo Protocol, a decentralized finance system on October 21st, boosting the total value locked within Aptos to $150 million. This connection enables users of Echo Protocol to potentially earn returns as high as 10% in APT, thereby expanding the practical applications of this alternative coin.

According to DeFi Llama’s data, Aptos has reached an all-time high TVL (Total Value Locked) of $2.15 billion, positioning it as the 7th largest blockchain in the decentralized finance (DeFi) sector. Notably, this surpasses its rival Sui, with a TVL of $1.64 billion.

Additionally, Aptos gained attention following its announcement of a strategic alliance with cryptocurrency exchange MEXC. This partnership is set to include collaborative efforts geared towards boosting the visibility of APT token through various events.

These advancements have rekindled enthusiasm among traders. According to CoinGlass’s data, the open interest in the futures market increased significantly, climbing from $213.9 million to $274 million within a single day, hitting a six-month peak. This substantial jump implies that traders are anticipating the upward trend to persist in the near future.

On CoinMarketCap, the general attitude among the trading community, as indicated by the sentiment metric, was largely optimistic, with most traders expressing a positive, or ‘bullish’, outlook.

Technical indicators signal more upside

As a researcher delving into the fascinating world of cryptocurrencies, I’ve noticed some intriguing patterns on the Aptos network. Anonymous analyst AMCrypto has pointed out that Aptos is exhibiting a bullish flag formation. This pattern is reinforced by an upward trend in Total Value Locked (TVL), a spike in daily active users, and a quiet yet significant accumulation of the token by smart money.

Reviewing the chart provided, it appears that if APT manages to break above the $10.50 resistance level, it would signal the confirmation of a bull flag pattern. Notably, at this moment, APT is trading at $10.96, suggesting that it has already surpassed the mentioned resistance level. Consequently, based on my analysis with AMCrypto’s projections, we might anticipate a potential short-term price surge toward approximately $12.50 for APT.

In the 1D APT/USDT price chart, the 50-day moving average line intersected with the 200-day moving average line, creating what’s known as a “golden cross.” This occurrence often signals a significant change in direction for the trend, moving from downward to upward, according to technical analysis.

Additionally, the Relative Strength Index has been above its neutral point since September 18th, indicating ongoing investor enthusiasm, which lends credence to the broader optimistic outlook.

With bulls holding strong and a recent golden cross suggesting a prolonged upward trend, it’s possible that the price of APT may head towards increased resistance levels. The next potential peak might be found near $11.08, which is indicated by the upper boundary of the Bollinger Band.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-22 12:21