As a seasoned crypto investor with a knack for spotting potential gems, I’ve been intrigued by the meteoric rise of Aptos (APT). Having seen my fair share of market fluctuations, I must admit that the 20% surge within a day is indeed eye-catching. The double-bottom formation on its price chart and the sudden increase in open interest point towards a strong bullish momentum, which is music to any investor’s ears.

On the blockchain scene, it’s worth noting that the native token of Aptos, a Layer 1 platform, experienced a significant surge, drawing increased attention from traders with shorter investment horizons.

In the past 24 hours, Aptos (APT) experienced a significant increase of around 20%, currently valued at $10.24 per unit as of the latest check on Sunday. The market capitalization of Aptos now exceeds $5 billion, with a substantial daily trading volume amounting to approximately $530 million.

As an analyst, I’ve observed an intriguing development in the Aptos token market: a double-bottom formation on its price chart spanning from October 2023 to 2024. Historically, such a double-bottom correction is often followed by a robust surge in bullish sentiment for the asset’s value.

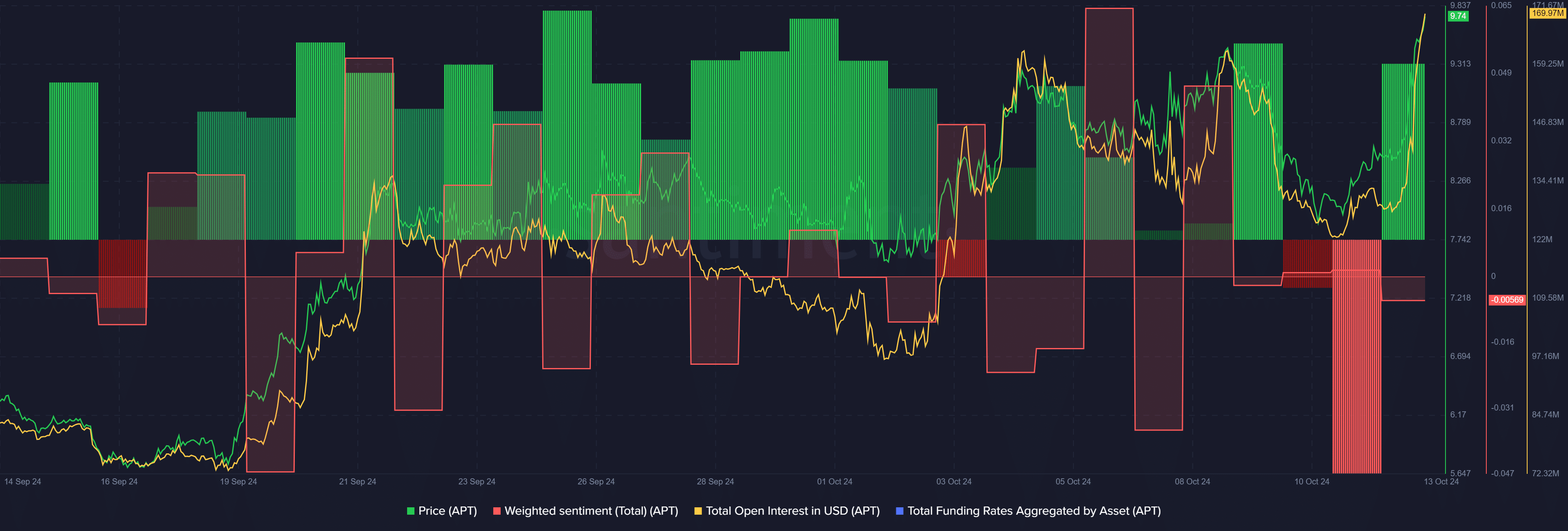

Based on information from Santiment, the total open interest for APT increased from approximately $128 million to $170 million within the last 24 hours, reaching a six-month high. Such a swift rise in open interest typically signifies a growth in the number of short-term traders dealing with this asset.

According to recent data, APT‘s funding rate has dramatically moved out of the negative range. The cumulative funding rate provided by Aptos is currently at 0.009%. This suggests that the overwhelming number of traders are wagering on APT experiencing additional bullish growth, as indicated by this metric from Santiment.

Keep in mind that prolonged liquidation processes might lead to a price adjustment and increased market fluctuations for Aptos.

Currently, despite the significant increase in price, public opinion about Aptos remains generally unfavorable.

According to a report from crypto.news, on October 3rd, the company Aptos took over HashPalette, a Japanese firm specializing in blockchain technology development.

The agreement led to a 7% increase in APT‘s price because the layer-1 network that claims it can handle more than 150,000 transactions per second has now entered the Japanese market.

Aptos was established by ex-engineers who previously worked on the Diem blockchain initiative at Meta Platform (formerly known as Libra). They aim to utilize their expertise in Move, a programming language specifically designed for Diem.

Aptos employs the Move programming language and includes capabilities like simultaneous transaction handling, a Byzantine Fault Tolerant (BFT) agreement system for ensuring security, and self-executing contracts known as smart contracts, all of which contribute to a robust and swift blockchain framework.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-13 14:22