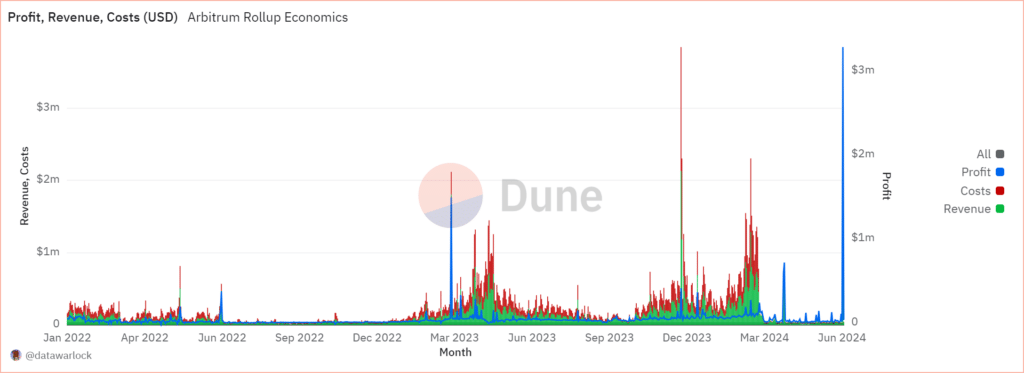

As a researcher with extensive experience in blockchain analytics and network economics, I find the surge in transactions on Arbitrum amid the LayerZero (ZRO) token claim to be a fascinating development. The data from Dune and Arbitrum’s aggregator, datawarlock, clearly illustrates the significant increase in daily revenue and transaction volume on June 20th compared to the previous day.

On Thursdays, Arbitrum experienced a significant increase in daily income due to a massive uptick in transactions. This activity was fueled by the LayerZero (ZRO) token distribution event.

As an analyst, I’ve examined the recent financial performance of Arbitrum, specifically focusing on the data provided by Datawarlock’s Dune dashboard. On Wednesday, June 19, the Ethereum layer-2 network recorded a daily revenue intake of approximately $20,000.

On June 20th, the day LayerZero’s airdrop claim became available, I observed a remarkable surge in the aggregator’s total revenue. This spike can be attributed to the Arbitrum network experiencing an astounding increase of approximately 3.7 million transactions, marking a significant jump of over 1.2 million transactions compared to the previous day.

Austin Marrazza, in his role as product manager at Offchain Labs, brought to light the significant influx of traffic from ZRO claimers, resulting in over $3 million being amassed by Arbitrum DAO.

As an analyst, I’d rephrase it as follows: “I observed significant gains for Arbitrum from the LayerZero airdrop. Their DAO amassed approximately $3 million through collecting congestion fees during the token distribution process.”

Arbitrum transactions surged amid ZRO token claim

LayerZero distributed 8.5 million ZRO tokens through its airdrop, representing 8.5% of the total minted amount of 1 billion tokens. This event turned out to be a significant success for Arbitrum as a large number of people claimed their share of ZRO tokens, resulting in increased activity on the platform.

Arbitrum’s unique advantage as a coordination chain comes from its ability to handle ZRO token transactions atomically, without the need for intermediary cross-chain communication through LayerZero.

The surge in network traffic caused the average gas price to rise from a mere 0.011 gwei to an impressive 2.189 gwei, while transaction fees experienced significant escalation.

As a crypto investor, I closely monitor data from platforms like Dune. On the 20th of June, network costs amounted to an astounding $140,200. However, this was more than offset by impressive revenue of $3.43 million, resulting in a substantial profit of approximately $3.29 million.

In terms of Ether (ETH), the expenses amounted to 40 units and the earnings reached a total of 956 units. The profit generated was equal to 916 Ether units.

As an analyst, I’d rephrase it as follows: On Arbitrum, I’ve observed that revenue is derived from transaction fees in Arbitrum One, whereas costs are associated with posting data to Ethereum. According to the data presented on the dashboard at Datawarlock, Arbitrum has accumulated a total profit of over $57 million.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-06-21 18:02