As a seasoned researcher with years of experience in the turbulent world of finance and technology, I find Cathie Wood’s recent moves with ARK Invest particularly intriguing. After a brief hiatus, ARK has once again shown faith in Coinbase and Robinhood during a market downturn, characterized by Bitcoin plummeting below $50,000.

Ark Invest, led by Cathie Wood, has resumed buying shares for companies like Coinbase and Robinhood, as the market experiences a substantial dip, with Bitcoin temporarily dipping beneath $50,000.

On August 5th, ARK Invest purchased approximately 93,797 shares of Coinbase Global Inc., worth about $17.77 million. This is their initial investment in Coinbase’s stock, following a phase of selling these shares in the year 2024.

Cathie Wood and Ark Invest’s trade activity from today 8/5

— Ark Invest Daily (@ArkkDaily) August 6, 2024

Furthermore, it was disclosed that ARK acquired a total of 681,885 shares in the cryptocurrency-focused brokerage, Robinhood (HOOD), worth approximately $11.19 million. This represents their initial investment since February 13th.

1. Most of the buying actions took place in the ARK Innovation ETF (ARKK), where they acquired 65,165 shares of Coinbase. Additionally, both the ARK Fintech Innovation ETF (ARKF) and the ARK Next Generation Internet ETF (ARKW) were involved, buying 15,629 and 13,003 shares of Coinbase respectively.

In a similar manner, the ARKK investment fund purchased approximately 461,100 shares of Robinhood, while both the ARKF and ARKW funds increased their holdings in Robinhood by around 110,402 and 110,383 shares respectively.

As a researcher, I found myself noting some striking changes in the financial landscape on Monday, August 5th. Both Coinbase Global (COIN) and Robinhood Markets (HOOD) saw substantial declines in their stock prices. COIN dropped by approximately 7.3%, closing at $189.47, while HOOD dipped by around 8.17% to settle at $16.42. These decreases came amid a broader market correction, which seems to have impacted not only the crypto market but also global stock markets significantly. This downturn appears to be one of the more severe occurrences in recent memory.

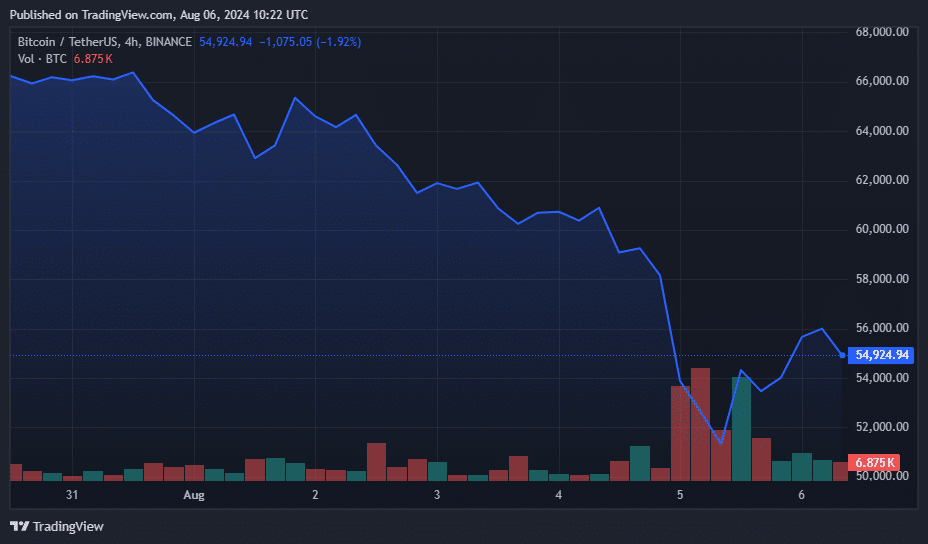

On the very same day, the worth of Bitcoin (BTC) dropped beneath $50,000 for the first time since February 2024, reaching a minimum of $49,800 based on data from crypto.news. This significant fall resulted in Bitcoin shedding more than 20% of its value, sliding down from approximately $63,000 on August 1 to a low before regaining slightly and settling around $55,000.

At present, Bitcoin is being transacted for approximately $55,092, marking a 6.4% rise in value over the past day. However, compared to a week ago, its price has dropped by about 17%.

ARK Invest often buys more stocks when their prices drop, with plans to sell them once their market values increase. The company carefully maintains its portfolio so that no individual investment represents over 10% of the total worth of its ETFs. This strategy has resulted in recent sales of COIN shares.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-06 13:45