As a seasoned researcher who has witnessed the evolution of the financial landscape over the past few decades, I find myself intrigued by Australia’s rapid expansion in the crypto ATM market. The 17-fold increase in just two years is nothing short of remarkable and underscores the country’s appetite for innovative technology.

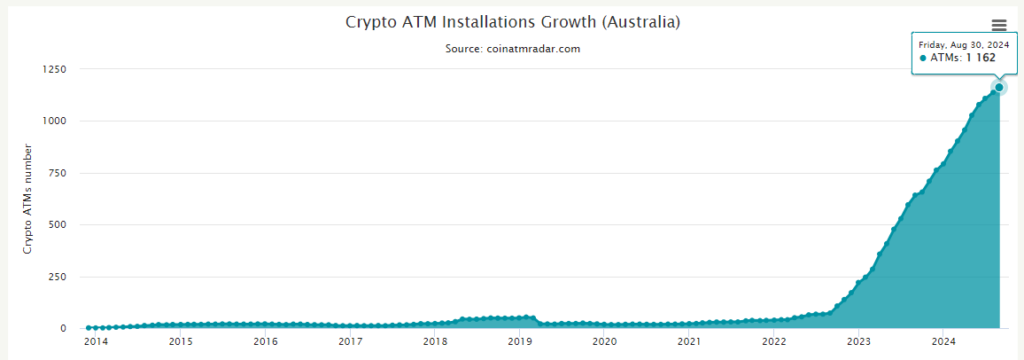

In a span of merely two years, Australia’s market for cryptocurrency Automated Teller Machines (ATMs) has witnessed an impressive growth. The number of these machines has multiplied seventeen times, as per Coin ATM Radar. With just 67 machines operational in August 2022, the country now boasts a total of 1,162 units. This positions Australia as the third largest market globally for cryptocurrency ATMs, following the United States and Canada.

Since just April 2024, there has been a surge of 160 additional Automated Teller Machines (ATMs), indicating Australia’s swift embrace of cryptocurrency technology. TRM Labs, a firm specializing in blockchain intelligence, described this expansion as the most substantial growth in the cash-to-crypto sector observed over the recent years.

Although there’s been a significant increase, Australia’s portion in the global crypto ATM market is quite minimal at only 3%. This figure pales in comparison to the U.S., which holds more than 82% of the world’s total of 31,877 crypto ATMs, clearly leading the pack.

Meanwhile, it’s come to notice that these booms have sparked interest from law enforcement agencies. TRM Labs highlighted that Australian authorities are growing wary of the possibility that such kiosks might be exploited for money laundering activities.

Last year in March, the Australian Federal Police established a joint task force involving multiple agencies, aiming to combat money laundering activities. This move was prompted by the perceived dangers associated with cryptocurrency Automated Teller Machines (ATMs).

Since 2019, cryptocurrency Automated Teller Machines (ATMs) have handled at least $160 million worth of transactions that are suspected to be illegal, with schemes and fraudulent activities being significant factors. In 2023 alone, more than $30 million was channeled into wallets associated with scams using these devices, nearly doubling the illicit activity observed across the entire crypto industry.

In certain nations, there’s been an increase in efforts to control these devices. For instance, Germany confiscated 13 unauthorized cryptocurrency automated teller machines not long ago, while the UK’s Financial Conduct Authority took down 26 such machines last year, thereby reducing the number of operational kiosks by approximately 90%. In simpler terms, some countries have been taking steps to limit or regulate these devices due to their involvement with cryptocurrency transactions.

The speedy expansion of cryptocurrency Automated Teller Machines (ATMs) in Australia is noteworthy, yet it carries substantial risks that regulatory bodies are growing more concerned about addressing.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-30 08:36