High above the echoing plains of speculation, Bitcoin steadies itself, leaning—almost dreamily—against the lofty balustrade of $100,000. There is about it the air of a poet hauled before his muse: every time the price dips, the crowd rushes in, snatching hope with creased palms and unbuttoned wallets. So it bounces—a little stubborn, a bit theatrical—inviting the voyeurs of finance and soothsayers of charts to predict, prophesy, and roll their bones. Will the next act be tragedy or farce? 📈🤷♂️

Over 97% Holders Turned Profitable

Bitcoin, in a fit of ambition and cheered by a brief respite from the offstage drama of U.S.-China acrimony, pranced giddily past the $100,000 threshold. The mood turned feverish. The bears—once so numerous, snuffling out disaster—were liquidated to the tune of $243.3 million, while buyers suffered minor indignities, losing just $35.7 million (wallets still smarting, but pride intact). Someone at Coinglass probably poured themselves a drink.

Open interest slackened by 3.2%—perhaps taking a long nap after all that excitement—yet the casino of volumes whirled on. In short: activity lingers, like a late train nobody wants but everybody boards.

Up in the grandstands, the institutional titans have cleared their throats and filled their ETFs—$142.3 million swept into the great digital maw like so much spare change. ARK bellowed the loudest ($54 million), Fidelity whistled a supporting tune ($39 million), and BlackRock? Well, BlackRock always arrives fashionably late with a single, mysterious $8.4 million transaction. A round of applause for the suits. 🎩👏

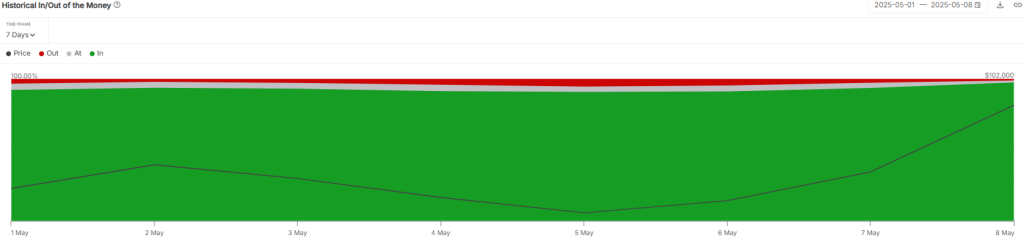

Have you seen such a spectacle? IntoTheBlock tells us that more than 97% of holders now stand on the sun-lit side of fortune, smiles glinting like polished rubles. A parade of dollar signs! Well, not so fast. Such prosperity tingles with peril. What is happiness, but the prelude to impulsive selling, snacks, and regret?

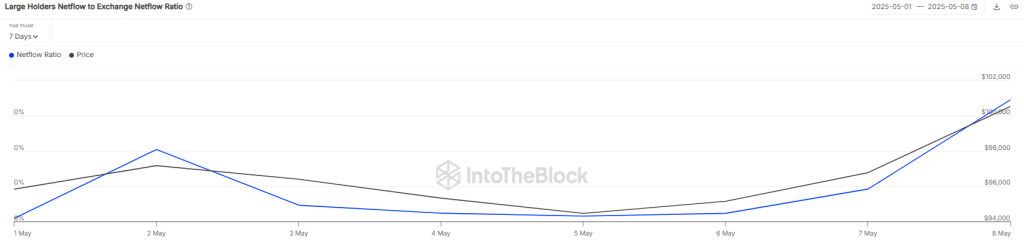

All the while, the whales—those cynical grandees—roil the market’s smooth surface. The volume of their ponderous, blubbery transactions has swelled from $68.45 to $72.67 billion. The sea is choppy, and the dinghies tremble.

Now, as if on cue, netflow of these leviathans toward exchanges jumps to 0.17%. A mere number, yes, but like the clink of a pistol at a poetry reading, this signals intent: are the whales about to dump, or merely showing off for the smaller fish? If a selldown comes, it’ll be as subtle as a Moscow blizzard in April.

What’s Next for BTC Price?

Ever stubborn, Bitcoin lounges above the EMA20, like a dashing revolutionary taking refuge behind a velvet sofa. Buyers stand by, purses jingling, ready to defend any modest dip. Not to be outdone, sellers gather at $104,360, wagging their fingers and muttering about resistance levels. As I scribble these lines, Bitcoin parades itself at $102,483—a 1.13% rise and the sort of drama that keeps traders awake at night dreaming about lamborghinis they’ll never buy.

A whisper of resistance persists around $104K. Should Bitcoin breach this, the next outpost glimmers at $109,500, a psychological Maginot Line where sellers make one last heroic stand. Above that? The fabled $110K—a new all-time high, a reason for banner headlines, shoe ads, and articles just like this one.

Yet, all is not luchshy svet (sunshine and roses). Our bearish friends, those cold-eyed skeptics, have a mere handful of days to wrest back the narrative. Unless they drag the price below its 20-day moving average and keep it there, their hopes may evaporate like vodka in July. Should they succeed? $93,500 beckons, near the 50-day, where dreams go on sale—half price.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-09 21:03