As a seasoned researcher with years of experience in the cryptocurrency market, I find myself deeply concerned about the current state of Avalanche (AVAX). Having closely followed its progress since its inception, it’s disheartening to see such a promising project falter amidst a bear market.

The 14th largest digital currency, known as Avalanche, finds itself trapped within a prolonged downturn in the crypto market due to lackluster on-chain performance and decreasing returns from staking.

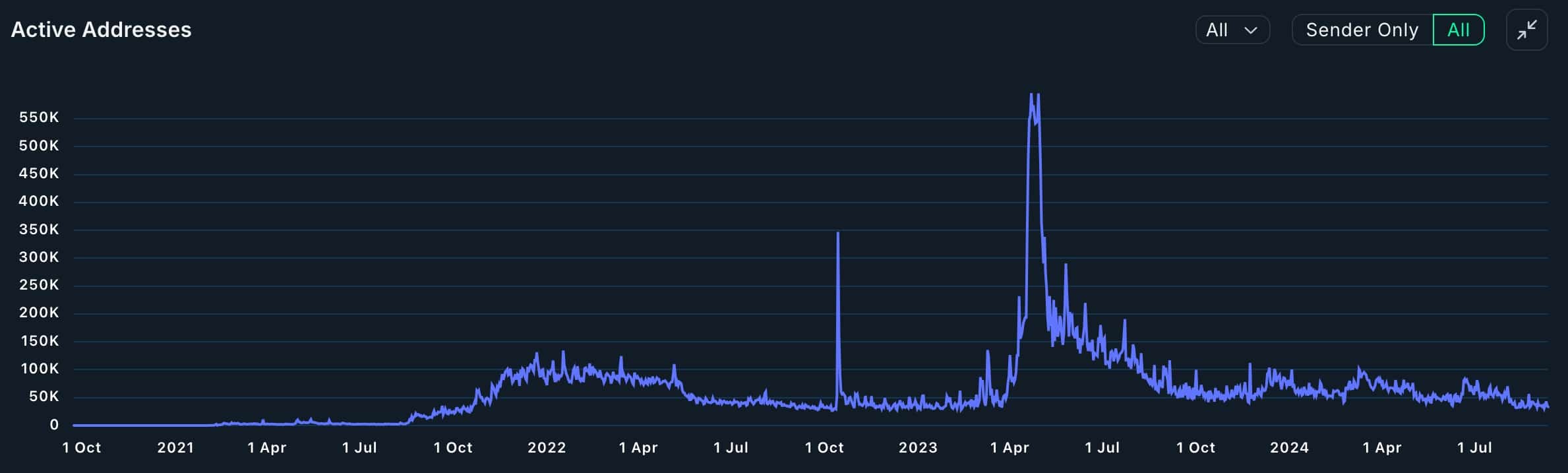

Avalanche active addresses are falling

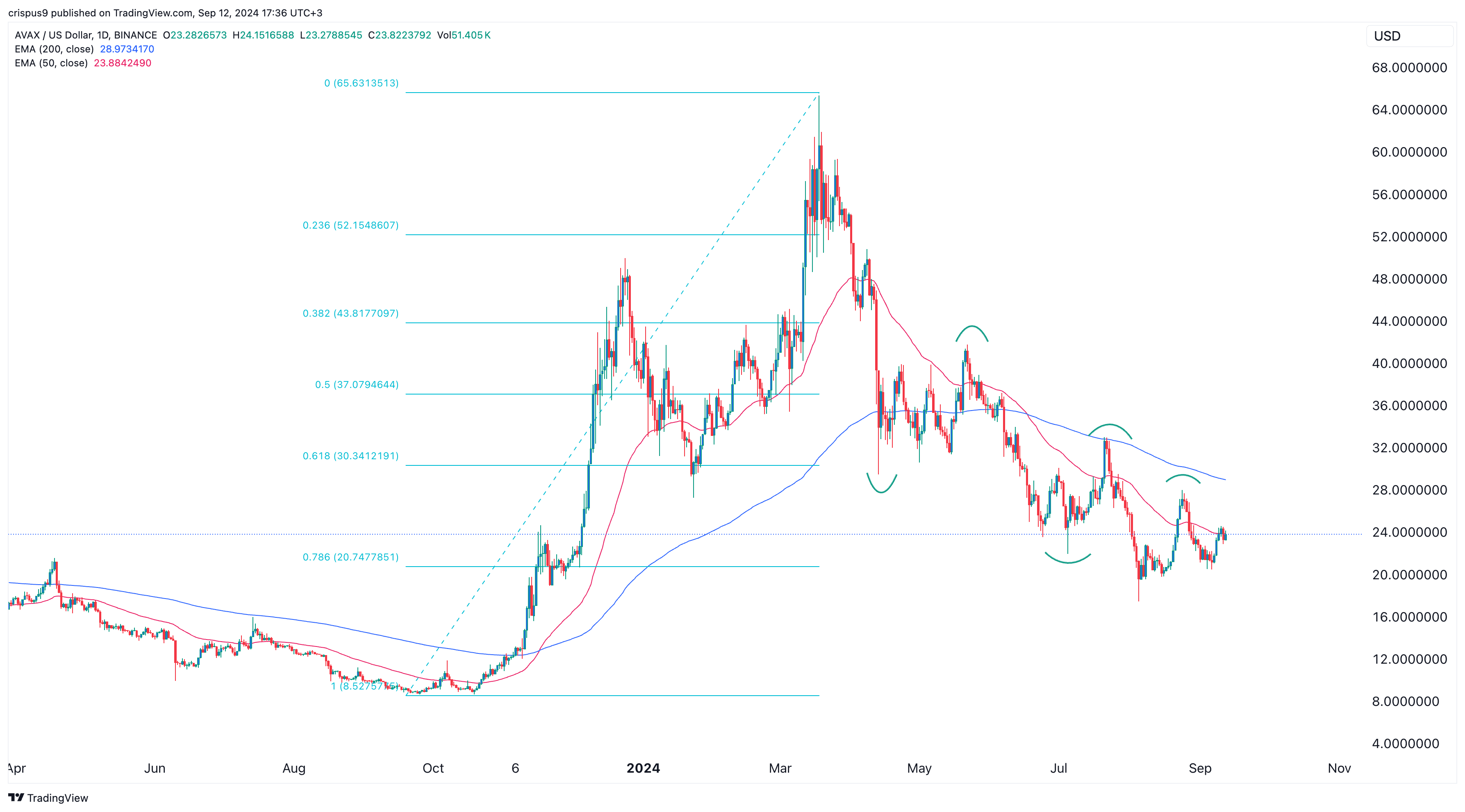

As a researcher, I find myself observing the current trading price of Avalanche (AVAX), which stands at approximately $23.8 – a significant drop from its peak in March, where it reached above $64. This represents a decline of more than 63%. Additionally, its market capitalization has seen a substantial reduction, falling from over $22 billion in March to the current $9.57 billion.

The decrease in activity within this network is linked to a decline in on-chain performance indicators, as suggested by data from Nansen. This drop in active addresses can be seen in the ecosystem, which has dwindled to approximately 43,208, marking a significant fall from over 91,000 in March and surpassing its previous peak of over 555,000 recorded in April 2023.

The number of Avalanche transactions and gas fees has been decreasing. On September 10, the network processed about 155,000 transactions, which is significantly lower than the 600,000+ transactions in March. Currently, the gas fee is under $20,000, contrasting the year-to-date peak of over $300,000.

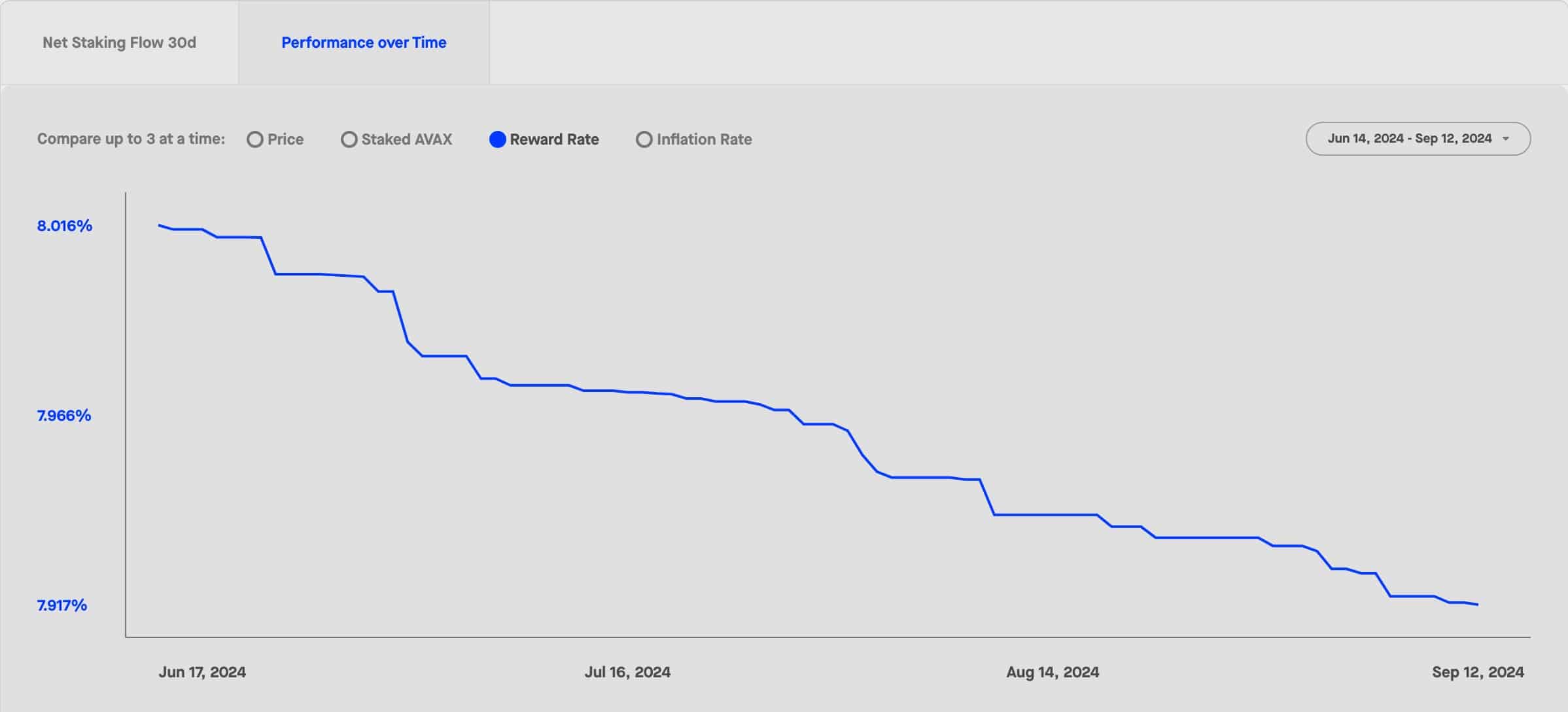

Currently, statistics from StakingRewards indicate that the return on staking AVAX has been steadily decreasing, hitting an all-time low of 7.9% since last November. This decrease correlates with a downward trend in the amount of AVAX being staked within the network.

In the past month, more than $494 million worth of transactions involving over 21 million units have been processed and withdrawn from the network, with a significant portion of these transactions taking place on September 11th.

For some time now, the proportion of the market held by Avalanche in the cryptocurrency sector has been decreasing, as users have been choosing alternative Layer 1 networks such as Solana (SOL) and Tron (TRX), along with Layer-2 platforms like Arbitrum and Base.

In 2023, the platform known as Base experienced significant growth, accumulating more than 1.6 million active user addresses. Furthermore, the volume of transactions within the network reached an all-time peak.

In the past week, transactions on Decentralized Exchanges (DEXes) based on Base amounted to approximately $3.4 billion, whereas Avalanche recorded around $554 million in volume. The total value locked in DeFi for Base currently exceeds $1.4 billion, compared to Avalanche’s $923 million.

Avalanche has formed lower highs

The danger of an avalanche worsening seems high, given its formation of a ‘death cross’ pattern in June. This pattern occurred when the 200-day moving average crossed below the 50-day moving average, signaling a potentially negative trend.

Ever since then, the coin’s trend has been marked by progressively lower troughs and peaks. Furthermore, it persists below both the 50-day moving average line and the 61.8% Fibonacci retracement level.

Consequently, it’s probable that the downward trend will continue as far as the price stays under the 200-day moving average.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-12 18:00