As a seasoned crypto investor with a knack for spotting trends and a penchant for long-term gains, I find the meteoric rise of Coinbase’s Ethereum layer-2 network, Base, incredibly intriguing. Having witnessed the evolution of Solana, Ethereum, and Tron, it’s refreshing to see a newcomer like Base making waves in the stablecoin transaction market.

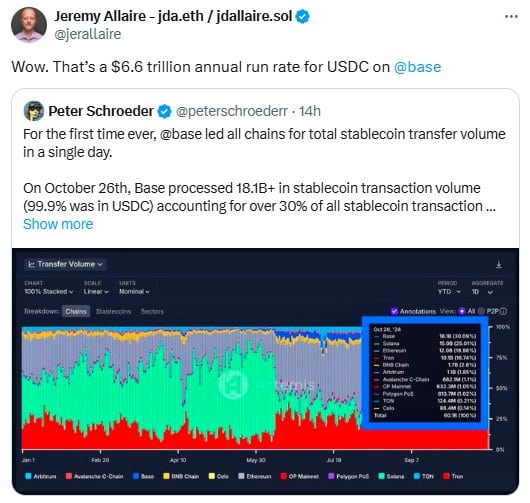

For a moment, Coinbase’s Ethereum layer-2 network called Base surpassed other blockchains as the leading platform for stablecoin transactions. This achievement gave it a 30.06% market share and allowed it to handle over $18.1 billion in transaction volume. Data from Artemis Terminal shows that it outperformed competitors such as Solana, Ethereum, and Tron.

On the heels of Base, Solana captured a quarter of the stablecoin market share, while Ethereum and Tron claimed 20% and 16.7% respectively. Circle’s CEO, Jeremy Allaire, remarked that if this momentum persists, USD Coin (USDC) could potentially achieve an astounding annual pace of $6.6 trillion on Base specifically.

On October 26th, the US Dollar Coin (USDC) accounted for approximately 62% of the overall stablecoin market volume, while Tether’s US Dollar Token (USDT) held around 30%, and the algorithmic stablecoin, DAI, accounted for about 7.4%.

It’s interesting to note that the growth in stablecoin trading occurred at the same time as a significant rise in activity on the Base platform. This surge led to a new record high of 5.6 million daily transactions, marking a 20% increase over the past month, according to Dune Analytics.

Historically, Solana has dominated stablecoin transactions, maintaining approximately 60% of the market share. But, it seems that Base is swiftly gaining ground, and this month, it holds a steady 20.8% of the market – slightly more than Solana’s 20.6%.

Ethereum currently dominates with approximately 25.6%, and Base is gradually gaining traction, establishing itself as a notable contender within the cryptocurrency marketplace.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-28 09:08