As a seasoned researcher with a knack for deciphering the intricacies of the crypto market, I find myself intrigued by the recent surge in Beam (BEAM). The sudden spike in whale transactions and the subsequent price rally have piqued my interest, not just because of the financial implications, but also due to the underlying dynamics at play.

Following a drop to its lowest point in December 2023, there was a noticeable surge in the attention given to this asset by large investors, who then began amassing it.

On August 5th, BEAM’s value dropped to $0.0106, marking the lowest point since December 2023. However, after a general market rebound, BEAM stood out as the top performer, experiencing a 12.2% increase over the past day.

At this moment, Beam’s value stands at $0.014 per unit, giving it a total market capitalization of approximately $700 million. Notably, the asset’s trading volume experienced a significant increase of around 130%, reaching over $23 million within the daily trade.

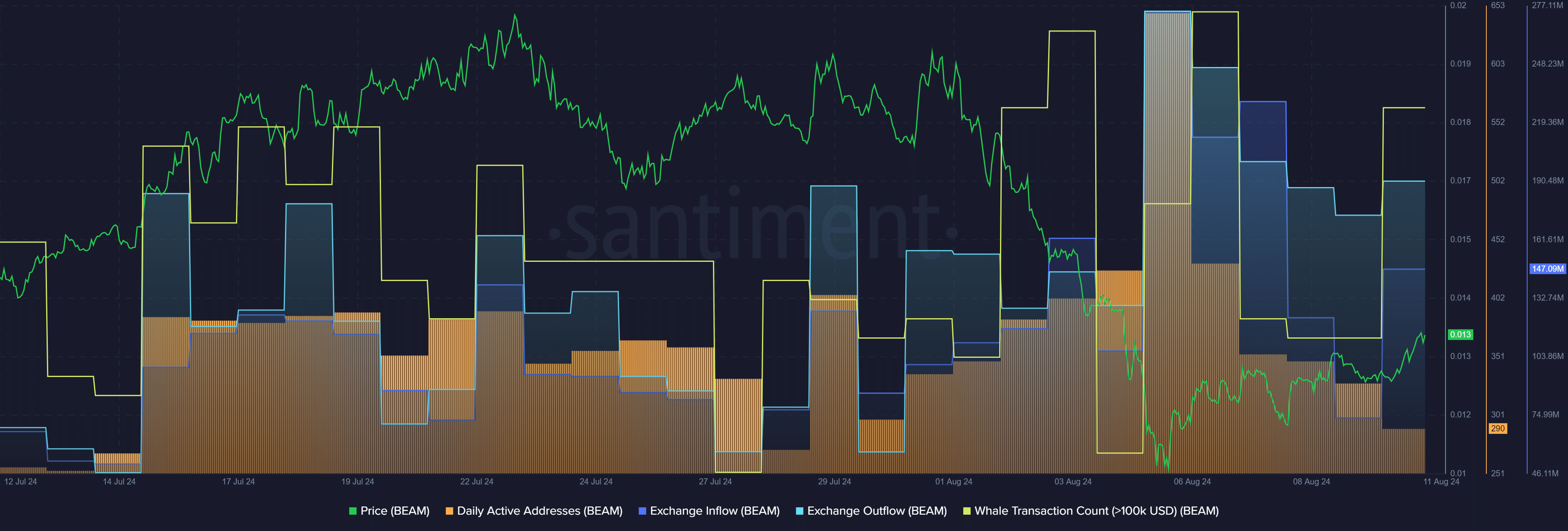

Over the last day, the number of distinct whale transactions involving at least $100,000 in BEAM tokens, as reported by Santiment, has risen from 15 to 27.

Whale interactions with the Beam token significantly increased on August 5, coinciding with the point where its price had hit a local minimum.

According to data from a market analysis tool, it appears that the number of BEAM tokens being moved off exchanges has increased significantly after the asset’s price rebound. As reported by Santiment, more than 162.6 million BEAM tokens have been withdrawn from exchanges within the last 24 hours.

The number of BEAM tokens entering crypto exchanges is currently sitting at 147 million.

Based on data from Santiment, there’s been a steady decrease in the number of daily active Beam wallets over the past week. On August 5, this number stood at 647, but as of the latest report, it has dropped to 290.

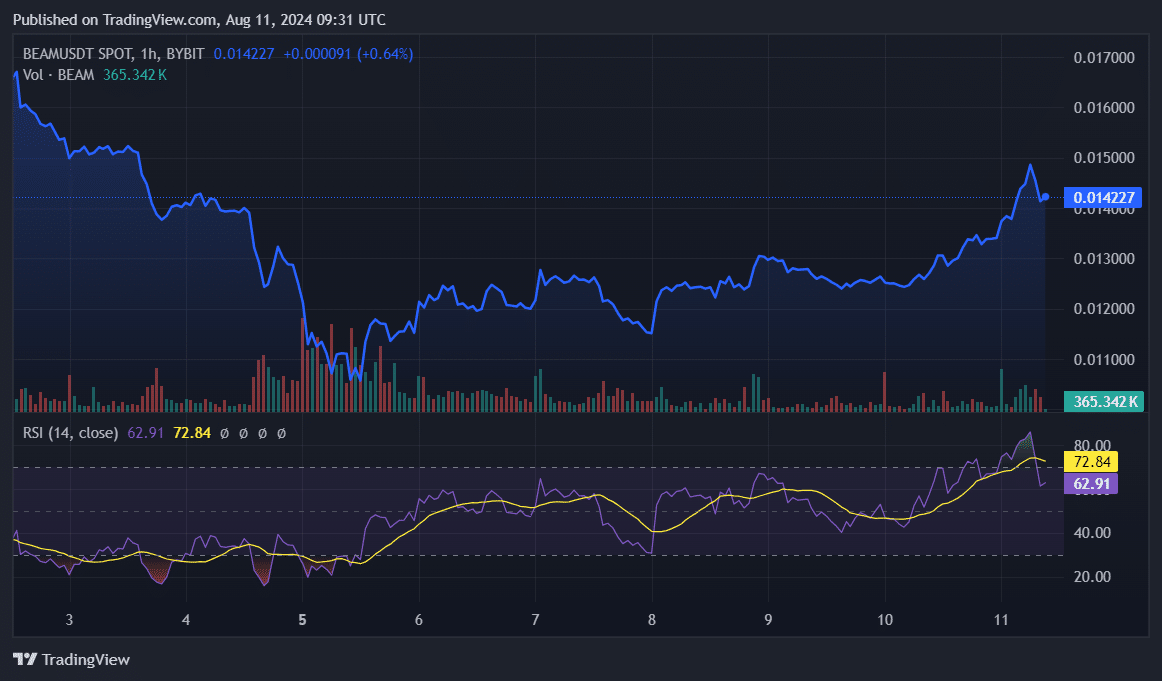

Because of the heightened whale involvement, the Beam’s Relative Strength Index has spiked up to 72 as well. This signifies that BEAM is currently overbought, implying a possible price adjustment or correction might occur.

When the number of whale interactions with a particular asset abruptly rises, the on-chain data often indicates heightened activity due to the possibility that large token holders might be artificially influencing the price.

Additionally, it’s crucial for investors to stay alert about broader economic occurrences as these can swiftly alter the circumstances in both the cryptocurrency and stock markets.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-11 22:04