As a seasoned crypto investor with a decade of experience under my belt, I’ve seen my fair share of DeFi platforms come and go. Beta Finance (BETA) has certainly piqued my interest lately due to its unique offerings and recent price surge.

As a financial analyst, I can explain that Beta Finance (BETA) functions as a Decentralized Finance (DeFi) solution, enabling users to participate in both borrowing and lending activities related to cryptocurrencies. Furthermore, it offers an additional feature: the ability to short-sell crypto assets, allowing users to profit from the price decline of specific digital currencies.

As a researcher exploring decentralized finance (DeFi) platforms, I’ve come across one that distinguishes itself through its money market feature. Unlike other renowned DeFi solutions, this platform offers access to a more extensive array of assets. Additionally, it prioritizes user experience, making it easier for participants to engage with the platform and execute transactions.

Table of Contents

What is the Beta Finance coin price right now?

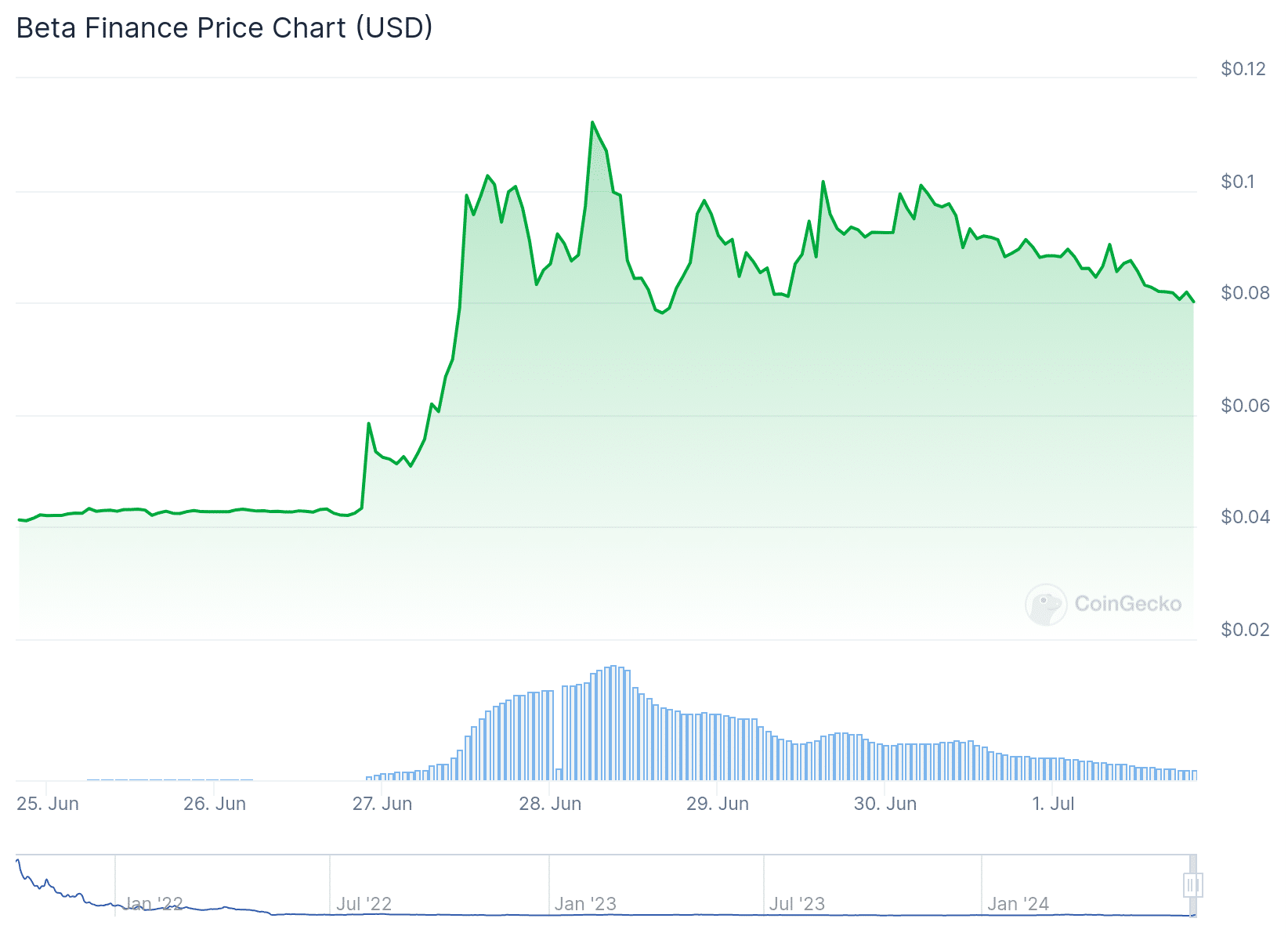

The value of Beta Finance has increased to $0.08017, representing a surge of over 94% in just the past seven days. This notable growth can be attributed to heightened trading activity during this timeframe. Additionally, a significant price rise occurred after a technical breakout from a descending triangle pattern was confirmed on June 26.

On Binance exchange, there was significant trading activity for BETA, with many investors jumping in to capitalize on its price uptrend. Despite a recent 10% decline in value, BETA is still hovering close to its highest point this month.

It’s important to mention that Beta’s price has experienced a significant decrease since its launch in January 2022, when it was valued over $3. Additionally, the highest value the coin reached annually surpassed its current level, which was at approximately $0.11.

BETA has fallen steadily in value since 2022 and is down almost 98% overall.

Why is causing the Beta Finance (BETA) coin to rise?

The price surge of Beta Finance could primarily be attributed to the optimistic outlook towards Decentralized Finance (DeFi) tokens in the market at large, coupled with noteworthy advancements within the project itself. Having entered its second version, dubbed Omni, Beta Finance has garnered some traction on Ethereum and Binance Smart Chain as a lending market.

A few days prior to the price surge, Beta Finance introduced a new market on Arbitrum. This move enhanced the value of BETA coins, as they are utilized for platform discounts and incentives like liquidity mining rewards.

Despite the recent developments at Beta Finance, there’s been relatively scant media attention on the crypto scene. Nevertheless, traders have managed to stay informed about the platform’s latest launch.

Beta Finance provides “customized lending and borrowing with a focus on efficiency” in the Omni market, according to their statement. The availability of short-selling could potentially make it an attractive choice over larger platforms that lack this functionality.

BETA price prediction 2024 – 2025

As a researcher studying Beta Finance’s price predictions, I would advise taking into consideration the historical price trends and the current surge in interest and demand for this platform.

Over the last seven days, the project has experienced significant growth. However, the value of the Beta crypto has plummeted significantly compared to its all-time high. From an external standpoint, based on chart analysis alone, the Beta Finance token might have been deemed a failed or dead coin.

“Despite what was previously stated, it’s plausible that the project is experiencing underestimation in its current price. The 10% decrease in price over the last day suggests that the market has hit a ceiling for growth, causing some traders to sell and realize their gains.”

As a researcher studying the cryptocurrency market, I’ve noticed that Beta, with a market capitalization of $66 million, falls under the category of small-cap coins. Given its size, Beta is more susceptible to dramatic price swings, which some traders find appealing. However, these extreme volatility patterns make it a high-risk asset. Consequently, predicting an accurate price for BETA becomes challenging due to its unstable market conditions.

The increase in price for Beta Finance is dependent on two factors: first, the successful rollout of Omni on Arbitrum; second, expanding Beta Finance’s presence on social media platforms.

In summary, Beta Finance’s future looks promising, but its cryptocurrency coin is presently unstable and has the potential to experience significant price fluctuations in the near term.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-02 12:06