As a researcher who has closely followed the cryptocurrency market for the past decade, I have witnessed the rise and fall of numerous players, but none quite like Binance. The exchange’s journey is not only remarkable but also instructive about the challenges and opportunities that lie ahead in this rapidly evolving industry.

Binance’s recent achievement of reaching 250 million users is truly impressive, particularly when considering the regulatory hurdles it has faced. From the SEC’s allegations of securities violations to the money laundering charges against its co-founder, Binance has weathered a storm that would have sunk less resilient companies. Yet, it continues to thrive, demonstrating an adaptability and agility that is truly admirable.

The appointment of Richard Teng as CEO was a strategic move that reflects the company’s commitment to navigating complex regulatory landscapes. His leadership will be crucial in building trust, strengthening compliance, and ensuring Binance’s long-term success.

It’s interesting to note the contrast between centralized exchanges like Binance and decentralized ones such as Uniswap and PancakeSwap. While DEXs champion decentralization and privacy, they often struggle with user complexity and lower liquidity. This dichotomy highlights the ongoing debate about the optimal balance between centralization and decentralization in the crypto ecosystem.

In my opinion, Binance’s success underscores the continued reliance on centralized platforms to drive mainstream adoption. However, as the CEO of Binance said, “It’s really about building a sustainable enterprise that will not only succeed over the next few years but continue to prosper for the next 50 to 100 years.” With such a long-term vision, who knows? Perhaps in a century, we’ll be reminiscing about Binance as the pioneer that paved the way for a fully decentralized world.

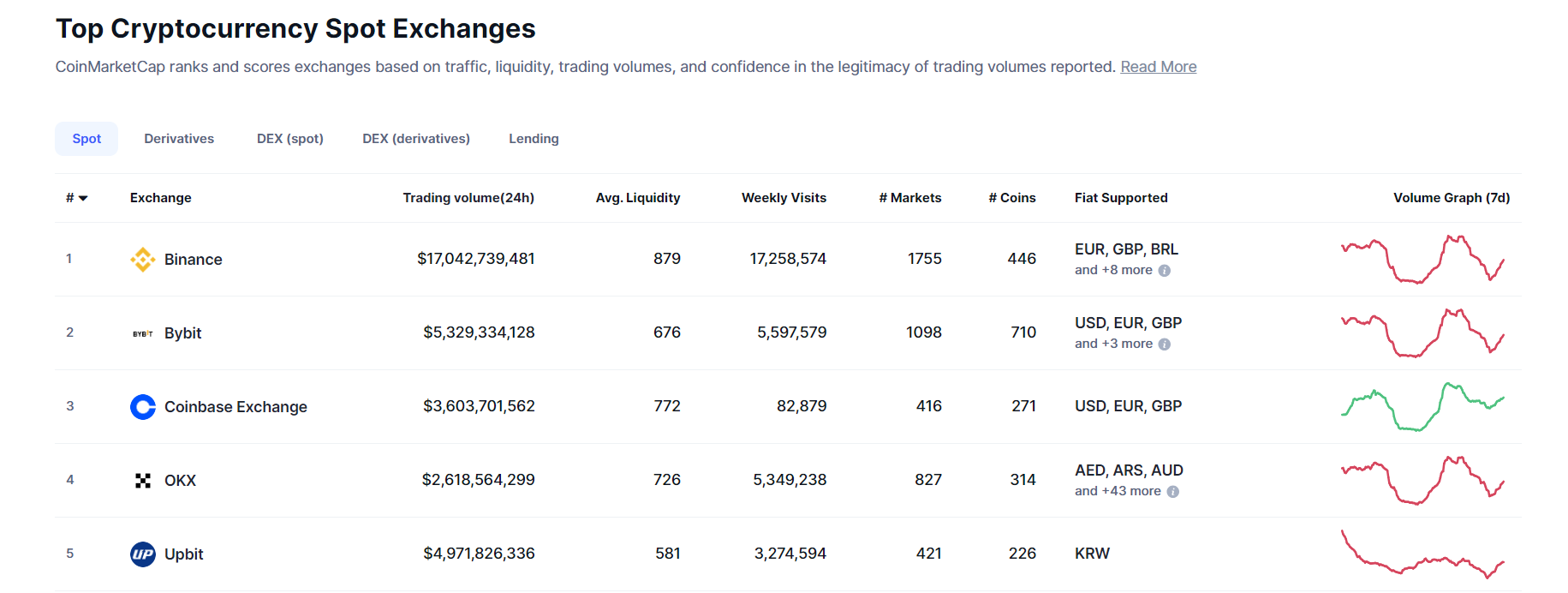

And now, a little humor to lighten the mood: I can only imagine the conversation between Binance and its competitors – “Hey Bybit, Coinbase, how’s it going? Still trying to catch up?

On the trading front, Binance continues to lead the pack with a high volume of transactions, surpassing rival platforms even amidst challenging legal environments.

It’s worth noting that the leading global cryptocurrency trading platform, Binance, has surpassed a significant figure – 250 million registered users.

This success solidifies Binance’s dominance in the cryptocurrency market, boasting a 24-hour trading volume of around $17 billion. Notably, Binance far surpasses rivals like Bybit, which recorded $5.3 billion, and Coinbase, with $3.6 billion.

In 2024, although Binance was a leader in trading volume, it encountered numerous regulatory hurdles. Specifically, in the U.S., it was accused by the SEC of violating securities laws. As a result of this lawsuit, Binance.US, its American affiliate, faced operational difficulties, leading to a 75% decrease in revenue and the dismissal of around two-thirds of its staff (over 200 employees). These actions were part of the company’s efforts to adapt to the regulatory pressures and their effects on its business operations.

In 2024, Binance’s co-founder CZ found himself under increased regulatory scrutiny, with accusations of money laundering surfacing in the U.S. He eventually admitted guilt to these charges, resulting in a six-month prison sentence. This significant court case underscored Binance’s persistent regulatory hurdles and served as a notable milestone in their legal struggles.

Worldwide, Binance faced increased examination. In Australia, the Australian Securities and Investments Commission (ASIC) alleged insufficient consumer protections, while in Nigeria, legal proceedings were started over allegedly illegal activities. These occurrences highlight the challenges of adhering to various global regulatory standards while maintaining a competitive market position.

In 2024, Binance tapped Richard Teng to take on the role of CEO in an effort to restore trust and tackle existing issues. This decision signifies a focus on enhancing compliance measures and bolstering leadership for better navigation through intricate regulatory environments.

Instead of platforms like Binance that function as centralized intermediaries, networks such as Uniswap and PancakeSwap are decentralized exchanges. These DEXs allow users to trade directly using blockchain protocols without any intermediaries. While they prioritize decentralization and privacy, their complexity for users and lower liquidity levels can sometimes make them less appealing to inexperienced traders due to the associated challenges.

The fact that Binance has reached over 250 million users highlights the ongoing preference for centralized platforms as they foster mainstream acceptance within the cryptocurrency world. As the digital asset landscape undergoes transformation, the interplay between centralized and decentralized structures will dictate the direction of future financial technology.

Currently, Binance stands as a leader, managing growth while dealing with the intricacies of a progressively demanding regulatory environment. Looking to the future, Changpeng Zhao, CEO of Binance, expressed in an interview: “Our goal is to establish a resilient business that not only thrives in the near future but continues to grow for the next half century or more. That’s definitely our aim.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-01-02 16:50