As a researcher with a background in cryptocurrency and market analysis, I find the current trend of tokens with extremely low initial circulating supply to fully diluted value ratios quite concerning. According to Binance’s latest report, this ratio has reached historical lows in 2024, indicating potential high selling pressure that could negatively impact the crypto market.

Cryptocurrencies having a small initial circulation with high potential for increased supply may pose a risk to the overall crypto market by potentially devaluing other tokens.

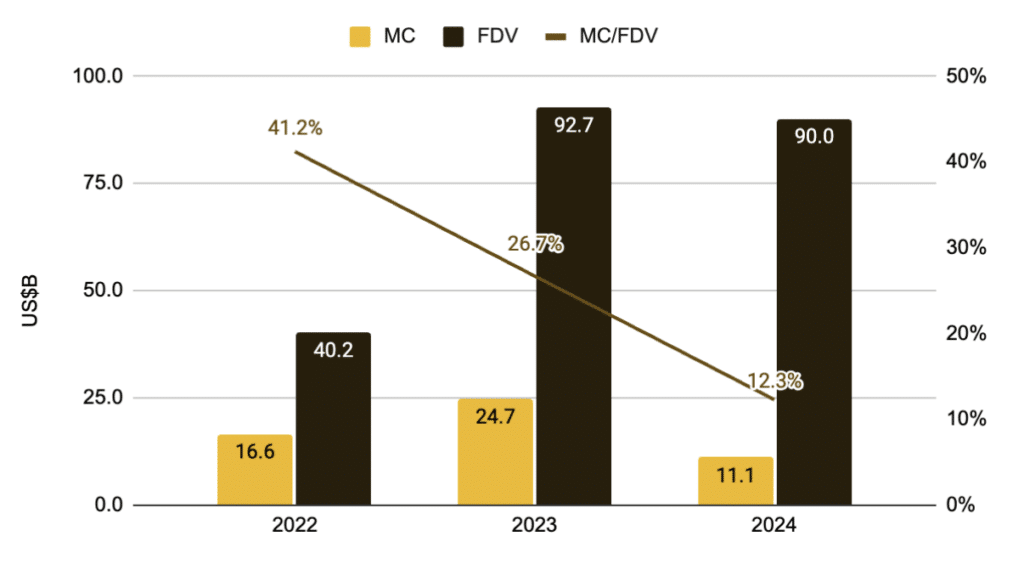

Experts at Binance have recently released a report detailing their analysis of tokens debuted in the year 2024. The findings reveal that the initial circulating supply to fully diluted value (FDV) ratio was remarkably low compared to previous years. This observation suggests that there could be significant selling pressure, which might lead to unfavorable consequences for the crypto market.

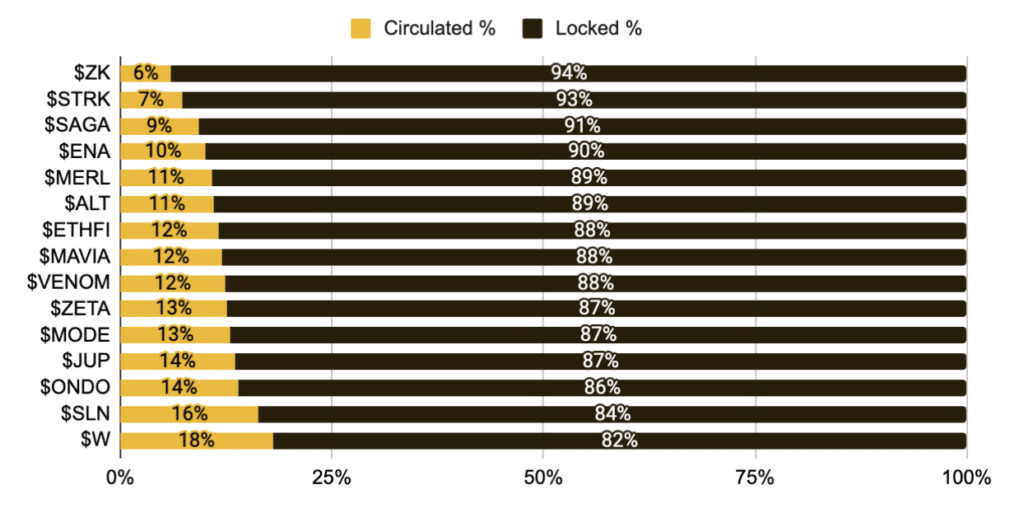

As of now, the amount of tokens issued in total since the start of 2024 is nearly at par with the previous year’s figure. Experts at Binance have pointed out that there’s a consistent increase in the number of projects featuring high Funded Development Values (FDV), primarily due to their limited initial circulating supplies.

A 12.3% capitalized FDV ratio implies around $80 billion is needed to maintain current token prices, according to experts. This injection of funds is expected to bolster demand and counteract selling pressure.

Low circulating supply driving initial price increases

When tokens are first introduced into the market, there’s a relatively small amount available for circulation. With the same level of demand, this scarcity leads to price hikes during the initial launch phase.

As a researcher studying the cryptocurrency market, I cannot stress enough the significance of keeping a close eye on the release schedules for new volumes of tokens. With the launch of numerous projects, the market dynamics have shifted dramatically, creating increased selling pressure. The report projects that an astounding $155 billion worth of tokens will be unlocked by 2030. Consequently, understanding the timing and implications of these releases is crucial for making informed investment decisions.

The role of meme coins in the market

As an expert analyst, I’ve observed and studied the recent surge in popularity for meme coins. My findings indicate that the unique structure of these assets plays a significant role in driving demand. Furthermore, some investors view meme coins as an alternative investment opportunity, providing a counterbalance to large-scale projects backed by institutional investments.

In the realm of cryptocurrencies, meme coins have emerged as a significant player. According to analysts at Franklin Templeton, these assets have garnered widespread appeal among traders, particularly those seeking lucrative returns with minimal transaction costs.

The Value Between Meme Coins and Their Native Networks

— Franklin Templeton Digital Assets (@FTI_DA) March 13, 2024

As a crypto investor, I’m thrilled to see that the buzz surrounding meme coins continues unabated. It’s remarkable how these tokens have managed to thrive amidst the volatile shifts in the broader crypto market. The staggering market capitalization of meme coins now exceeds an astounding $58 billion.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-17 17:34