As a seasoned researcher with a decade of experience in the cryptocurrency market, I have witnessed firsthand the rollercoaster ride that this industry can be. The recent report by Binance highlighting regulatory uncertainty surrounding new crypto ETFs is yet another reminder of the complexities and challenges that this space presents.

Experts from Binance observe that ambiguity surrounding regulations might be casting a shadow over the destiny of upcoming cryptocurrency ETFs, leading to worries about whether they will be accepted and how they could affect the market.

With unclear regulations hanging over crypto exchange-traded funds tied to assets such as Solana (SOL) and XRP (XRP), analysts from Binance underline the importance of fostering substantial expansion within the overall ecosystem to entice institutional investment and secure “enduring development.

According to a research report published on Friday (as seen by crypto.news), the analysts expressed apprehensions about the recently proposed ETFs. They highlighted three main issues: the small market size for these derivative tokens, insufficient institutional involvement, and ongoing regulatory examination. In essence, they predicted that the approval procedure for these new asset-based ETFs could prove to be both time-consuming and intricate.

People might hold off on approving more digital asset ETFs until they see how well Ethereum ETFs perform and gain widespread approval, as this could set a significant precedent.

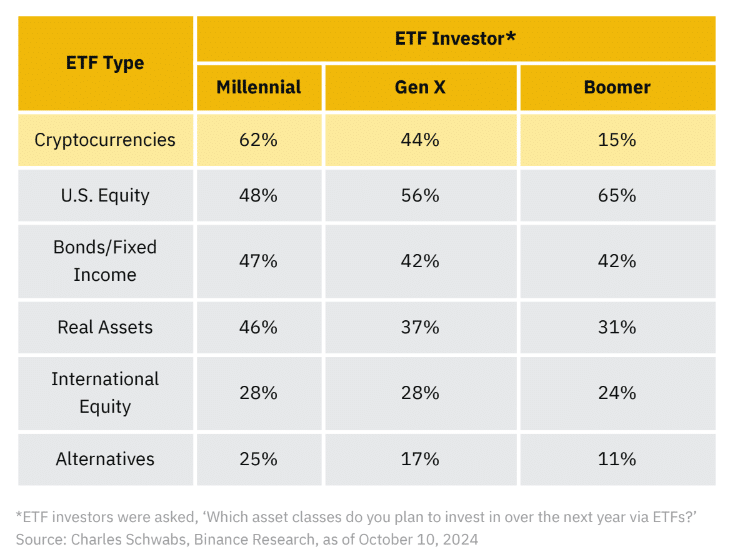

Binance

Nevertheless, the analysts pointed out that the upcoming election period may impact regulatory viewpoints, possibly changing the course for these products. Typically, cryptocurrency markets have shown a significant response to fresh updates and stories. However, the long-term expansion will hinge on sectors such as decentralized finance, tokenization, and stablecoins successfully aligning with market demands, as suggested in the report.

Institutions should look beyond Bitcoin

According to Binance, while leveraged ETFs on specific cryptocurrencies have made investing more accessible for many, it’s important to remember they only cover a small part of the overall market. For long-term success in the crypto industry, analysts suggest that investments should be spread across various sectors, not just Bitcoin. To attract significant institutional investment, they believe the market must transition towards growth driven by fundamental analysis rather than just price fluctuations.

Experts at Binance predict that the growth of blockchain-centric products could boost the use of on-chain technology, as well as draw more financial backing towards Bitcoin (BTC), Ethereum (ETH), and the overall digital currency marketplace.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-25 17:48