As an experienced financial analyst, I find the recent trend in derivatives and spot trading volumes on various cryptocurrency exchanges intriguing. Based on the data provided, it appears that while overall trading volume decreased significantly in April compared to March, there were notable exceptions.

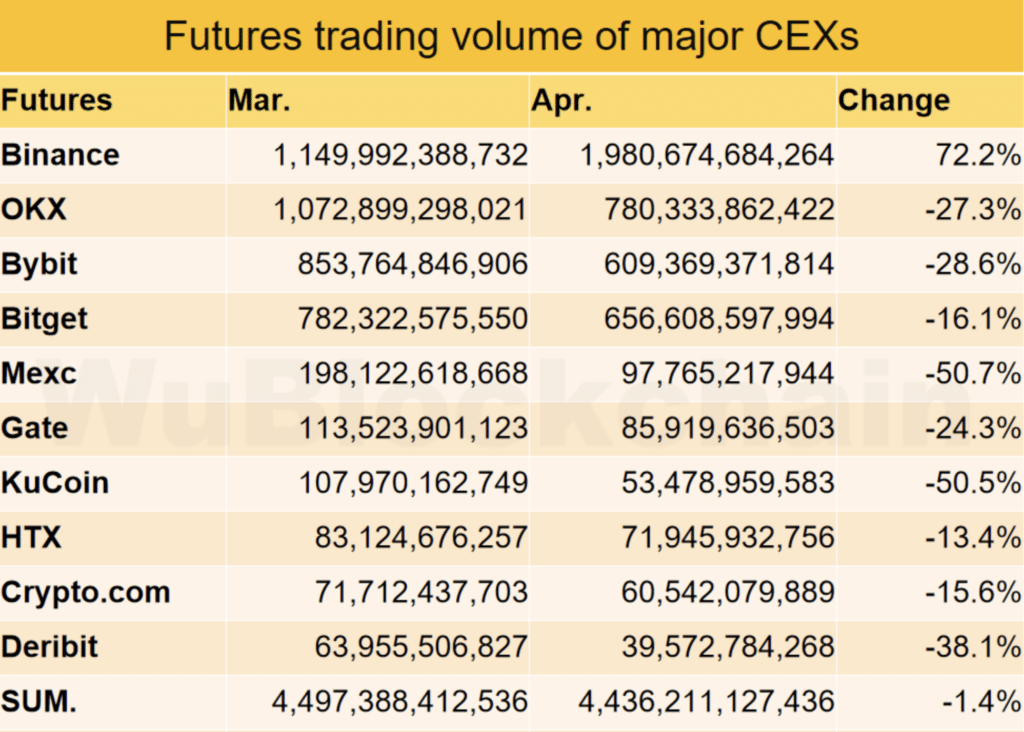

In April, derivatives trading volume on the largest exchanges decreased by 1.4% month-on-month.

As a market analyst, I’ve observed a significant increase in futures trading volumes on Binance, the leading centralized exchange, with a rise of over 72% from March to April.

The Wu Blockchain team explains that the significant surge in trading activity can be attributed to Binance’s temporary reduction of fees for USDC perpetual contracts. Consequently, there has been an uptick in trading for these contracts.

Although there was a significant decrease, the trading volume in April, excluding this factor, fell by 26.6% compared to the preceding month. The most substantial declines in futures trading volumes were observed at Bitget with a 16.1% drop, Crypto.com with a 15.6% decrease, and HTX experiencing a 13.4% reduction.

The trading volume for spot markets decreased by approximately 38% compared to the previous month. Among all the exchanges, Gate experienced an increase in activity of around 13.7%. On the other hand, Kucoin suffered the most significant decline with a 70.8% decrease, followed closely by Upbit (57.5%) and Bitfinex (47.7%).

Starting from early April, Binance Futures implemented a discount on trading fees for all perpetual contracts funded with US Dollar Coin (USDC). Throughout this promotional period, Binance users benefited from these fee reductions while executing transactions in any USDC-margined perpetual contract.

As a crypto investor, I’ve noticed an intriguing turn of events following Binance founder Changpeng Zhao’s sentencing to a four-month prison term due to Bank Secrecy Act violations. Consequentially, the exchange was hit with a hefty fine totaling $4.4 billion.

Zhao admitted guilt and reached an agreement with investigators, resulting in his stepping down as Binance’s CEO and committing to pay a $50 million penalty.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-05-13 17:11