As a seasoned researcher with over two decades of experience tracking financial markets, I have seen my fair share of economic cycles and their impact on various assets, including cryptocurrencies. The latest NFP data is indicative of an economy that’s not performing as well as expected, which could lead the Federal Reserve to cut interest rates.

Cryptocurrency prices rose slightly after the U.S. published another weak nonfarm payroll report.

Bitcoin (BTC) rose to $56,500 while Ethereum (ETH) jumped to $2,400 on Friday, Sept. 6.

In my recent analysis, it appears that the Bureau of Labor Statistics’ latest report indicates a lower-than-anticipated job growth of 142,000 positions in August, with the median prediction being 164,000. Interestingly, the bureau also revised the July figure downward from an initially reported 114,000 to 86,000 jobs. Furthermore, a report by ADP on September 5 suggests that the private sector only added 99,000 jobs in August. These figures might signal a shift in the employment landscape that I will continue to monitor closely.

The unemployment rate slipped to 4.2% from the previous 4.3%, while average hourly earnings rose by 3.8%.

As a crypto investor, I’ve noticed some concerning trends in the labor market. Companies seem apprehensive about the economy, which could be affecting their hiring decisions. The manufacturing sector, specifically, appears to be struggling, as data from the Institute of Supply Management and S&P Global suggest it continued to contract in August. Unfortunately, the Bureau of Labor Statistics reports that we lost 24,000 jobs last month, adding another layer of uncertainty to the economic landscape.

Data on unemployment has been confirmed!

— Michaël van de Poppe (@CryptoMichNL) September 6, 2024

Based on my analysis of the National Federation of Credit Unions (NFP) data, it seems plausible that the Federal Reserve will lower interest rates during its meeting on September 18th. There’s a strong possibility they might implement a significant cut of 0.50%, which could be the reason behind the recent decrease in government bond yields. For instance, the 10-year yield has dropped to 3.75%, and the 30-year yield has fallen to 3.9%.

Implication for cryptocurrencies

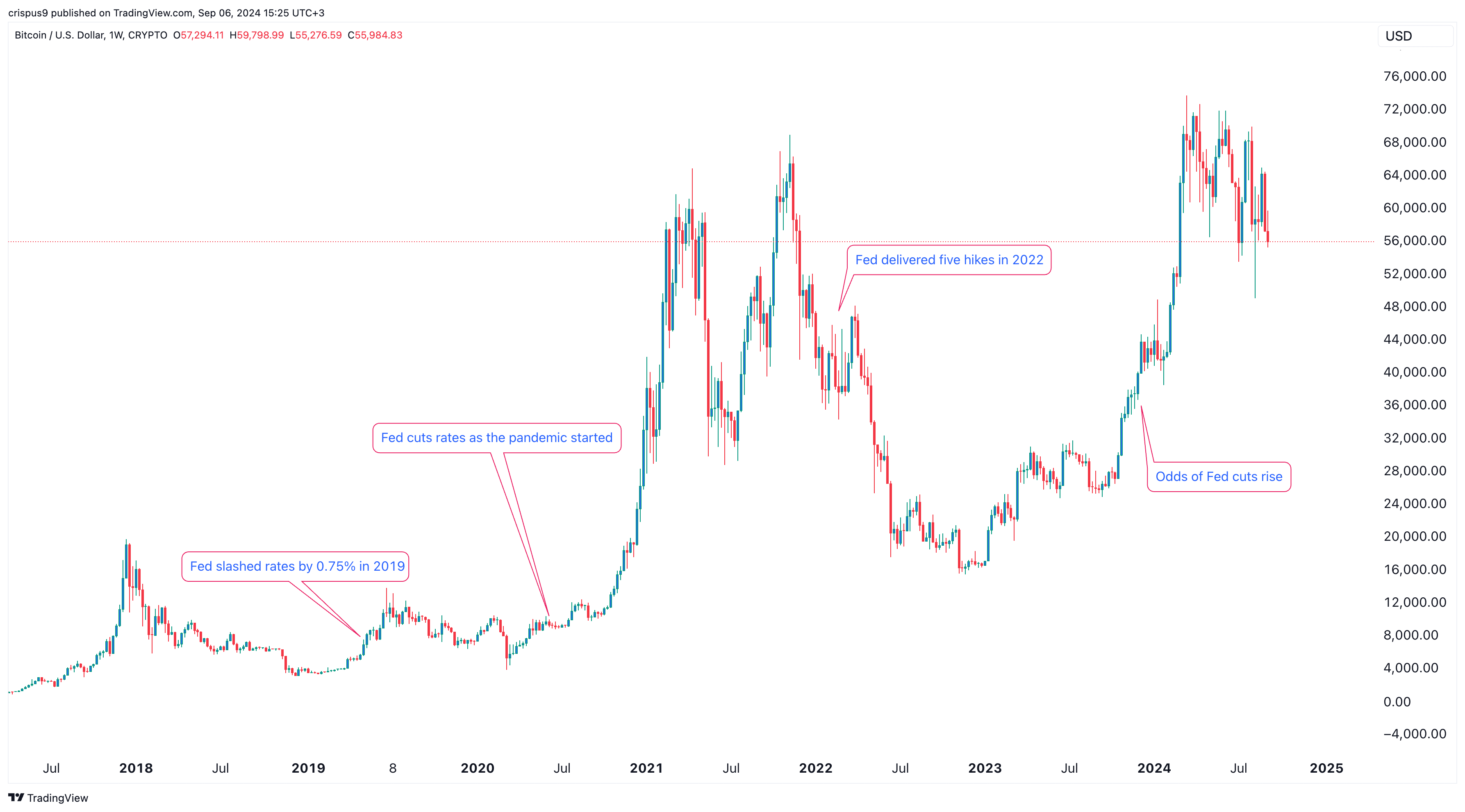

In essence, digital currencies like cryptocurrencies often thrive when the Federal Reserve reduces interest rates. An illustrative instance transpired in 2018: the Fed increased rates from 1.25% in March to 2.50% by December, leading Bitcoin’s value to plummet more than 84% between its peak and trough.

In 2019, Bitcoin surged more than 350% following a 0.75% reduction in interest rates by the Federal Reserve. A comparable pattern emerged in 2020 during the pandemic’s start as the Fed lowered rates down to zero.

In that period, Bitcoin reached an all-time peak of $69,000, but later experienced a significant drop in 2022 when the bank increased interest rates.

One possible explanation for this pattern is that investors usually prefer to take on more risk when interest rates are low. Consequently, if the Federal Reserve reduces interest rates, it’s plausible that some of the massive sums of money in money market funds could shift towards riskier investments such as stocks and cryptocurrencies.

On the other hand, it’s possible that Bitcoin and other digital currencies might decrease in value as the effect of the interest rate reduction may have already been factored into their current prices by investors.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-09-06 15:56