Bitcoin Automated Teller Machines (ATMs) are increasing in number globally, as seen by a 6% rise in 2024, indicating that cryptocurrency is gaining broader acceptance and moving towards mainstream usage.

The count of Bitcoin Automated Teller Machines (ATMs) is steadily increasing, providing a convenient avenue for individuals to purchase and trade cryptocurrencies. Latest findings demonstrate that this growth pattern persists. Similar to traditional ATMs, Bitcoin ATMs allow you to deposit cash into your digital wallet, thereby streamlining the process.

Essentially, Bitcoin ATMs serve as automated kiosks designed specifically to handle transactions involving cryptocurrencies, much like traditional ATMs facilitate banking transactions. These specialized machines enable users to purchase Bitcoin (BTC) and sometimes other digital tokens using cash or debit cards. Furthermore, some of these machines offer the option to sell cryptocurrency for cash, although it’s worth noting that fees tend to be higher when selling compared to buying.

As a researcher delving into the world of cryptocurrencies, I can’t help but marvel at the milestones we’ve witnessed. The first Bitcoin Automated Teller Machine (ATM) emerged in Vancouver, Canada, back in 2013. This was a significant step towards making digital currencies more accessible to the masses. Since then, these Bitcoin ATMs have proliferated rapidly, with over 37,500 machines now operating in more than 70 countries.

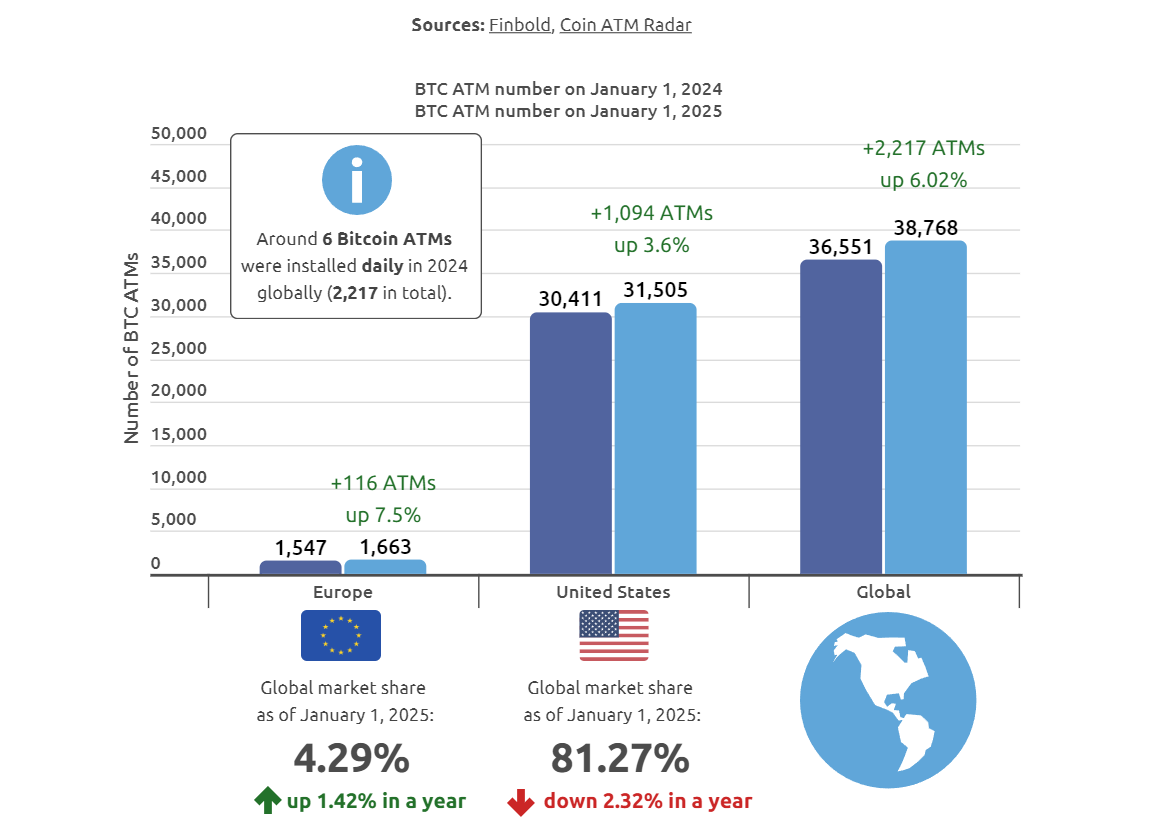

Recent research by Finbold, drawing on data from Coin ATM Radar, has highlighted 2024 as a particularly noteworthy year. In that year, we saw a 6% increase in the number of Bitcoin ATMs, underscoring the growing acceptance and adoption of cryptocurrencies worldwide.

Bitcoin ATMs mainly landed in US

Globally, the United States dominates the Bitcoin ATM market, accounting for approximately 81% of all such machines worldwide. As of January 13, there were more than 31,500 Bitcoin ATMs operational within the U.S., marking an increase of over a thousand devices since the beginning of 2024. This total number of global Bitcoin ATMs reached 38,768, recovering from a decrease in mid-2023 when it dipped to roughly 33,000 units.

The Bitcoin ATM market in Europe is gradually expanding, albeit starting from a smaller base compared to the U.S. Despite fluctuations in the cryptocurrency market, the number of Bitcoin ATMs in Europe has consistently increased, with 2024 seeing an addition of 116 new machines, marking a 7.5% rise from the previous year. This continuous growth sets Europe apart, as most other regions experienced decreases during the ‘crypto winter,’ as the report highlights.

In 2024, a majority of ATM expansion occurred during the first six months. By April’s end, approximately 1,942 new machines were set up worldwide, which equates to around 485 machines installed each month from January to April. However, the pace of growth decreased significantly in the latter half of the year, with an average of just 34 machines added monthly between May and December. Interestingly, this slowdown took place despite Bitcoin reaching unprecedented highs in November, when its value came close to $100,000.

Diverse regulatory approaches

In many locations around the world, Bitcoin Automated Teller Machines (ATMs) are generally allowed, but the specific rules can differ. For instance, in the United States, these machines fall under the jurisdiction of the Financial Crimes Enforcement Network (FinCEN). This means operators must register as Money Service Businesses and adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations for larger transactions. On a state level, operators may require a Money Transmitter License and need to comply with consumer protection laws such as clear fee disclosure and data security measures. Additionally, local zoning ordinances can influence how cryptocurrency ATMs operate in specific areas.

Worldwide, the rules governing cryptocurrency Automated Teller Machines (ATMs) differ from one nation to another. In the United Kingdom, the Financial Conduct Authority has increased its supervision over these machines. Notably, in September 2024, Olumide Osunkoya, a resident of London, admitted guilt for five offenses related to operating an unlawful network of cryptocurrency ATMs throughout the U.K. This was the country’s first conviction of this nature.

In August of that year, German officials took control of 13 cryptocurrency Automated Teller Machines (ATMs) and amassed approximately $28 million in cash from 35 different locations throughout the country. This action, spearheaded by BaFin, focused on ATMs functioning without the necessary permits, sparking worries about money laundering activities.

Bitcoin ATM scams surge, with older adults most affected

Although many Bitcoin Automated Teller Machines (ATMs) are operated by law-abiding businesses, there’s a growing concern that they might be exploited for illegal activities like fraud or money laundering. Recent statistics from the Federal Trade Commission indicate a significant surge in consumer complaints about scams linked to Bitcoin ATMs. The reported losses due to these scams have multiplied almost ten times since 2020, amounting to more than $110 million in 2023.

In the first half of 2024, fraud losses linked to Bitcoin ATMs surpassed $65 million, according to the Federal Trade Commission. Interestingly, adults aged 60 and above were more than thrice as likely to fall victim to Bitcoin ATM scams compared to their younger counterparts. Regardless of age, the typical loss was a substantial $10,000. The FTC reported that most of these scams were associated with government impersonation, business impersonation, and tech support frauds.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-13 15:34