As a seasoned researcher with years of experience following the cryptocurrency market, I must admit that the recent price fluctuations of Bitcoin are a familiar sight. The struggle to recover above $60,000 and the temporary crash below $50,000 have been a rollercoaster ride for investors, and miners are feeling the brunt of it.

With Bitcoin finding it challenging to surge past the $60,000 mark, mining operations are encountering profitability troubles throughout the sector.

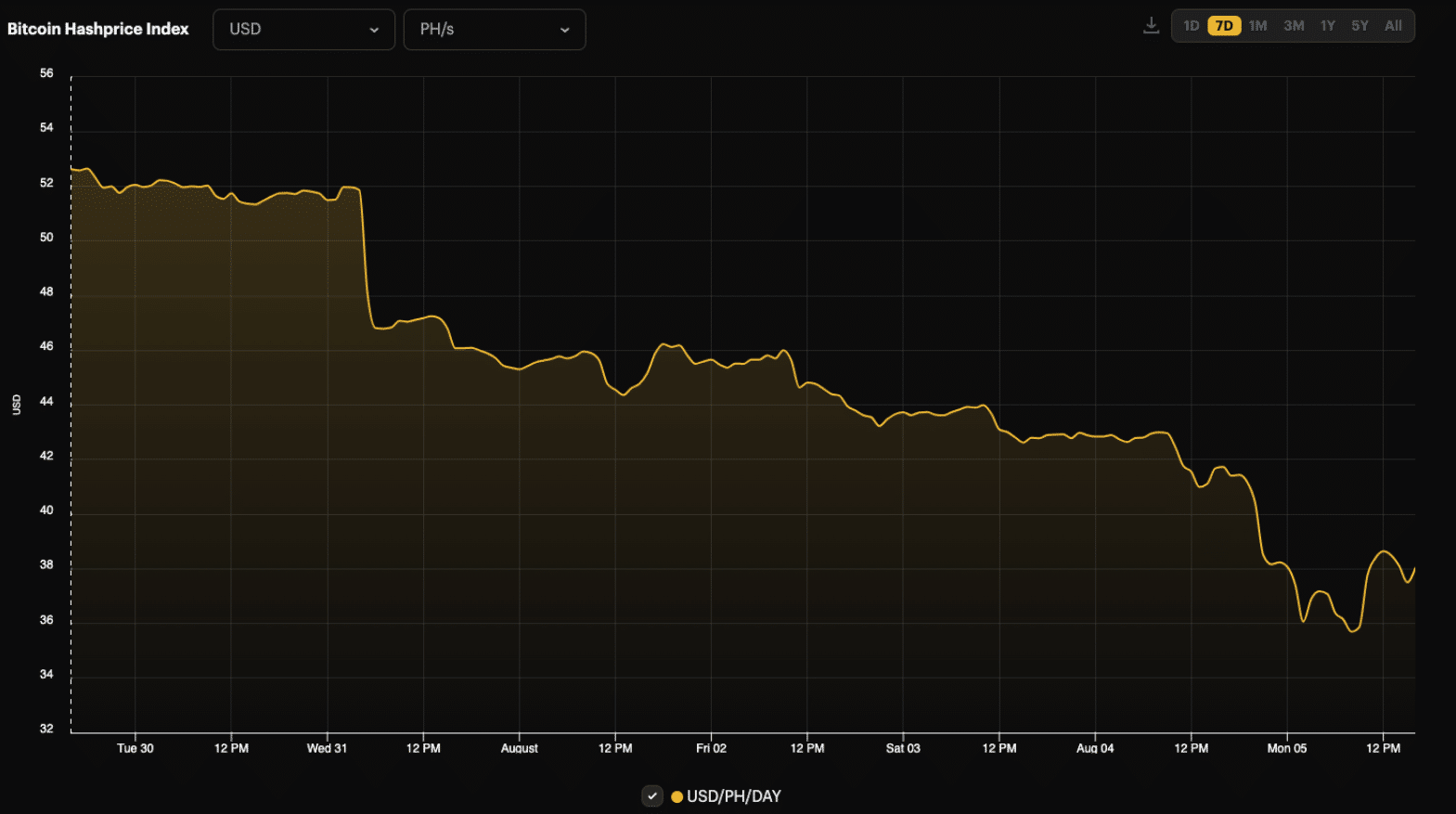

On August 5th, Bitcoin (BTC) momentarily dipping below $50,000 has created difficulties for numerous cryptocurrency miners, as experts at Hashrate Index point out that this situation is causing profitability concerns throughout the entire industry.

In a recent blog article, analyst Kaan Farahani from Hashrate Index pointed out that when Bitcoin dipped to $55,000, it led to a substantial decrease in the hashprice indicator by around 28% within a week. This downward trend has added pressure on miner profitability.

Despite the bearish price movements, Farahani noted that Bitcoin’s global network hashrate remained “relatively steady throughout the week,” with the 7-day simple moving average network hashrate decreasing only by approximately 1%, from 644 EH/s to 638 EH/s.

“A more subdued response could indicate less variability in the seasonal hash rate over the next few weeks to months, since energy restriction programs during warm summer periods are anticipated to become less intense.”

Kaan Farahani

A drop in hashrate resulted in an average block time of approximately 10 minutes and 12 seconds over the course of the week, according to analysts at Hashrate Index. They anticipate a “slight reduction” of about 2% in mining complexity during the next adjustment on Aug. 14.

Bitcoin can still go lower

Even though Bitcoin has tried but failed to surpass $56,000, certain financial experts haven’t ruled out potential further drops. A recovery from $49,000 offers some hope, but CryptoQuant analysts caution that falling below the $57,000 support point might trigger a “potential decrease towards $40,000,” causing investors to be wary about Bitcoin’s future direction.

In the past 24 hours, Bitcoin has fallen by more than 16%, dipping below the $57K support threshold. This significant drop could potentially lead to a further decrease in value, possibly down to around $40K. At present, traders are grappling with their largest negative unrealized profits since November 2022.

— CryptoQuant.com (@cryptoquant_com) August 5, 2024

A continued fall in Bitcoin’s value may intensify the struggles for crypto mining company shares, which have already taken substantial hits due to turmoil in Asian markets. According to Hashrate Index, an average decrease of 21% has been seen among these companies over the last week. Bitdeer suffered the most with a drop of 28.59%, while Iris Energy saw a more moderate decline of only 12.31%.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-08-06 12:48