As someone who’s been navigating the cryptocurrency market for quite some time now, I must say that the current state of affairs is quite intriguing. The trend seems to be shifting towards altcoins, with Bitcoin dominance on the rise and institutional investors showing little interest in rotating their capital into these alternative coins.

On December 5th, Bitcoin surpassed the $100,000 threshold for the first time ever, reaching a record high of $104,088. Crypto traders’ excitement led to substantial investments into Spot Bitcoin ETFs and an uptick in BTC options trading activity.

After Bitcoin’s surge to $100,000 (BTC), traders are seeking the next promising cryptocurrency to invest in, anticipating even greater returns as the cycle continues. As capital rotation occurs during altcoin season, potential options include Ethereum (ETH), Render (RNDR), Sui (SUI), Pepe (PEPE), Hyperliquid (HYPE) and Ondo (ONDO).

Table of Contents

Bitcoin cycle top and where BTC is headed after $104,000

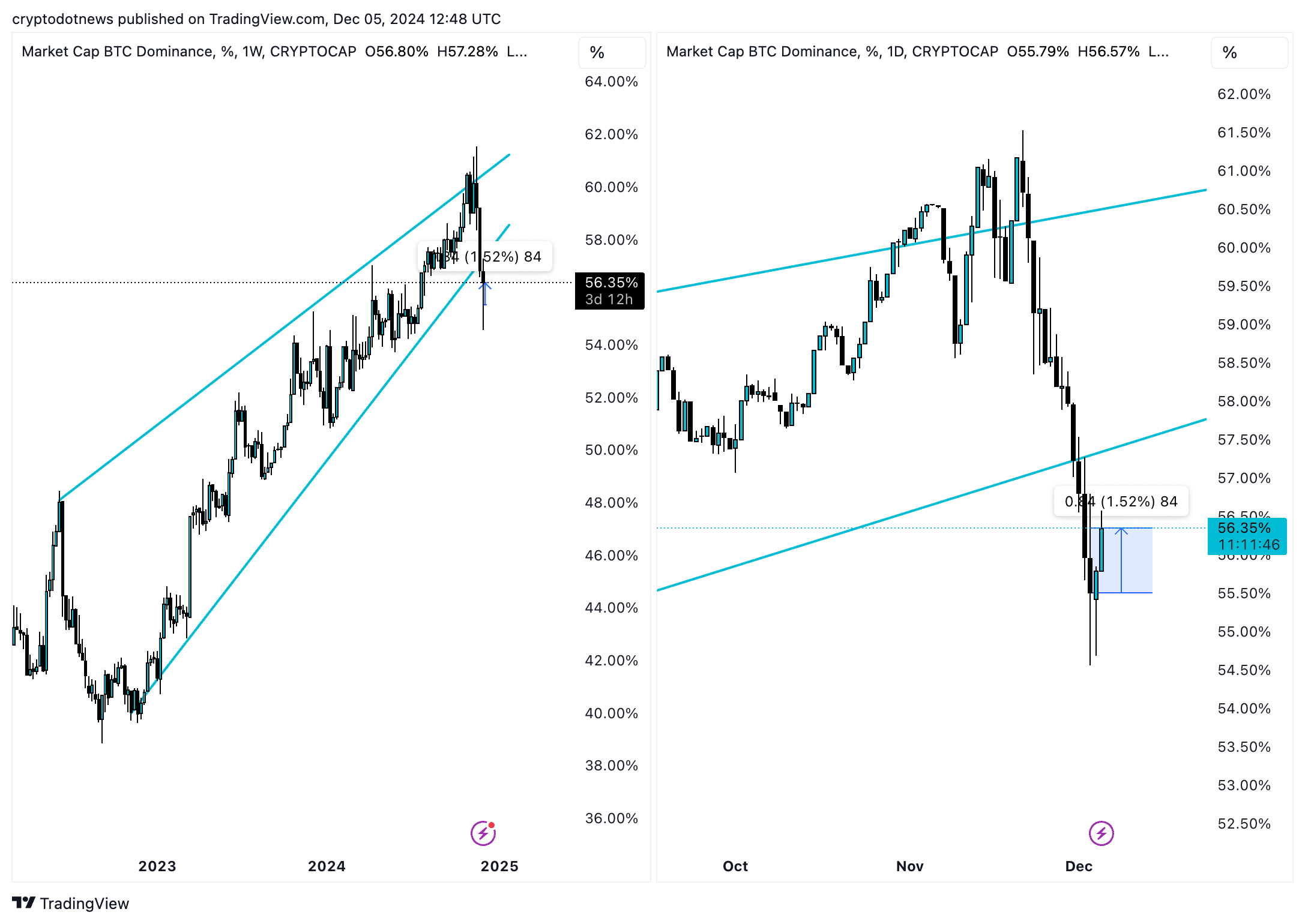

The Bitcoin Pi cycle top predictor suggests that the price could surpass $125,494 before reaching its peak in this market cycle, as it currently stands 22% below the projected target. Additionally, Bitcoin’s dominance has increased by almost 2% over the past two days.

The increasing influence of Bitcoin suggests that there’s still room for growth and it might continue to climb higher. It’s worth noting that the ‘altcoin season’ is underway, as 75% of the top 100 alternative coins have surpassed Bitcoin in a 90-day span.

The price of Bitcoin appears to be trending toward a multiple of its 350-day moving average according to the Pi cycle top indicator, while its growing dominance suggests a positive outlook for the leading digital currency. (Paraphrased with a more conversational tone and simplified technical terms)

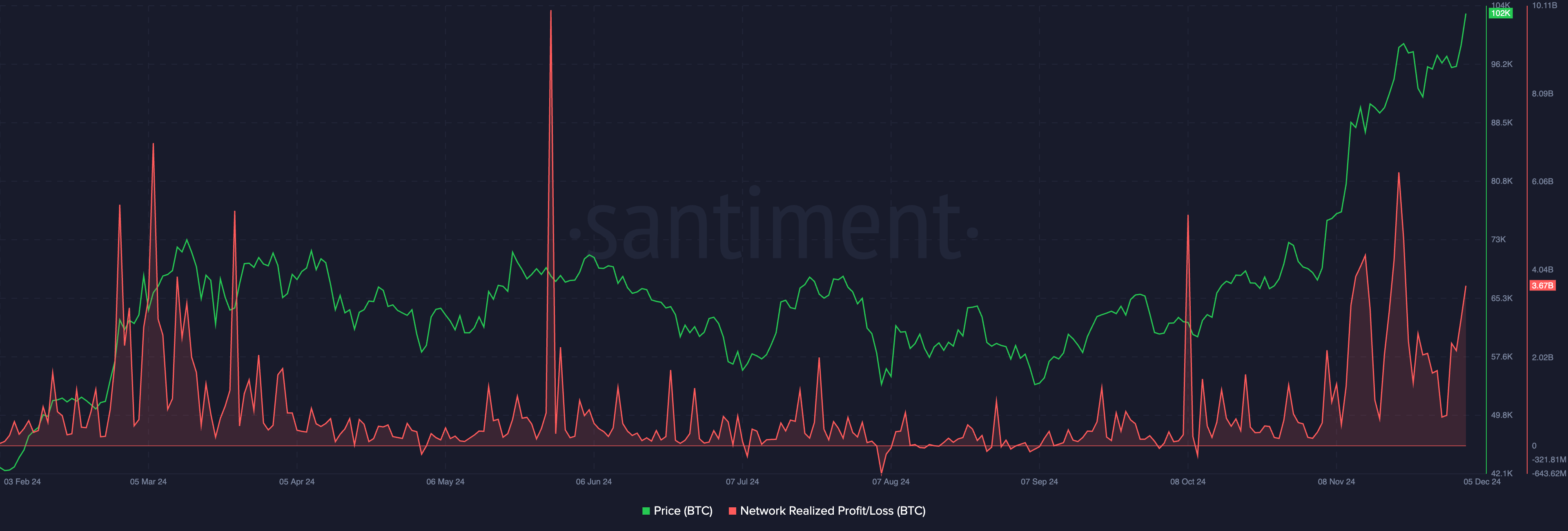

According to data from Santiment, there’s a trend among traders of cashing out their Bitcoin earnings consistently. There were significant surges in profit-taking between October 8 and December 5, although these spikes were relatively minor compared to the massive one recorded in May 2024 when Bitcoin’s price neared $70,000.

A greater and denser peak in the Non-Performing Loans (NPL) metrics might suggest an increased probability of Bitcoin (BTC) experiencing a correction, due to the intensified selling pressure seen on cryptocurrency trading platforms.

Altcoins to watch this week

According to Blockchain.centre’s altcoin season index, it seems that alternative coins (alts) may continue to surpass Bitcoin in performance, as they have over the past 90 days. This index serves to determine whether top 100 cryptocurrencies by market cap are generating returns or falling short when compared to Bitcoin.

This week, many altcoins within the top 50 are surging along with Bitcoin. Here are five promising tokens to keep an eye on: Render, Sui, Pepe, Hyperliquid, and Ondo.

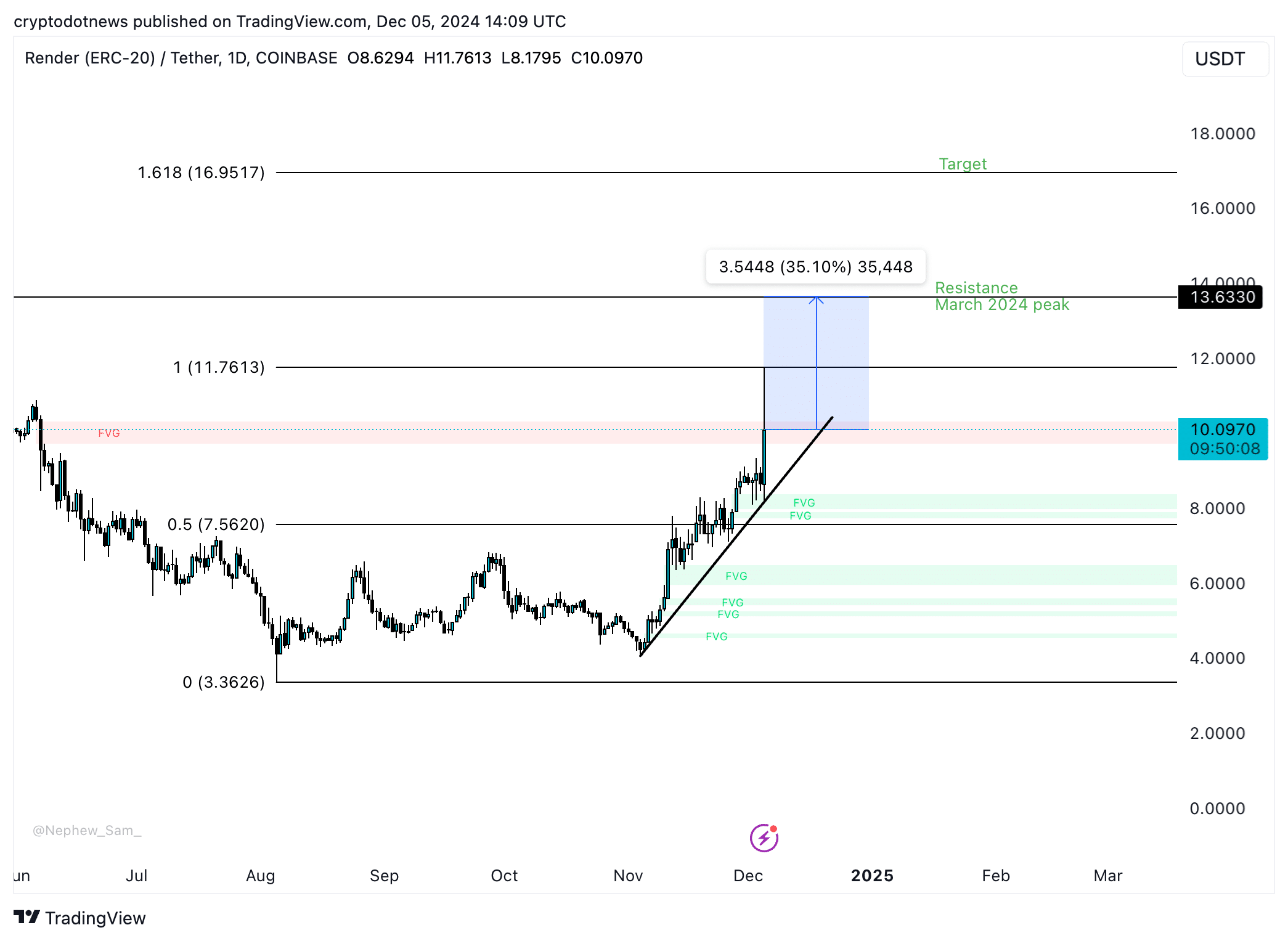

In simpler terms, the value of RNDR is approaching its peak from March 2024, which was around $11.7613. If it continues to increase at a rate of 35%, it could challenge the resistance level at $13.6330. The technical analysis suggests that RNDR’s price may potentially rise, as indicated by the relative strength index and moving average convergence/divergence.

In simpler terms, if we follow the Fibonacci retracement pattern in RNDR’s recent surge, the peak point where it might reverse or reach its maximum value during this particular market cycle is estimated to be around $16.9517.

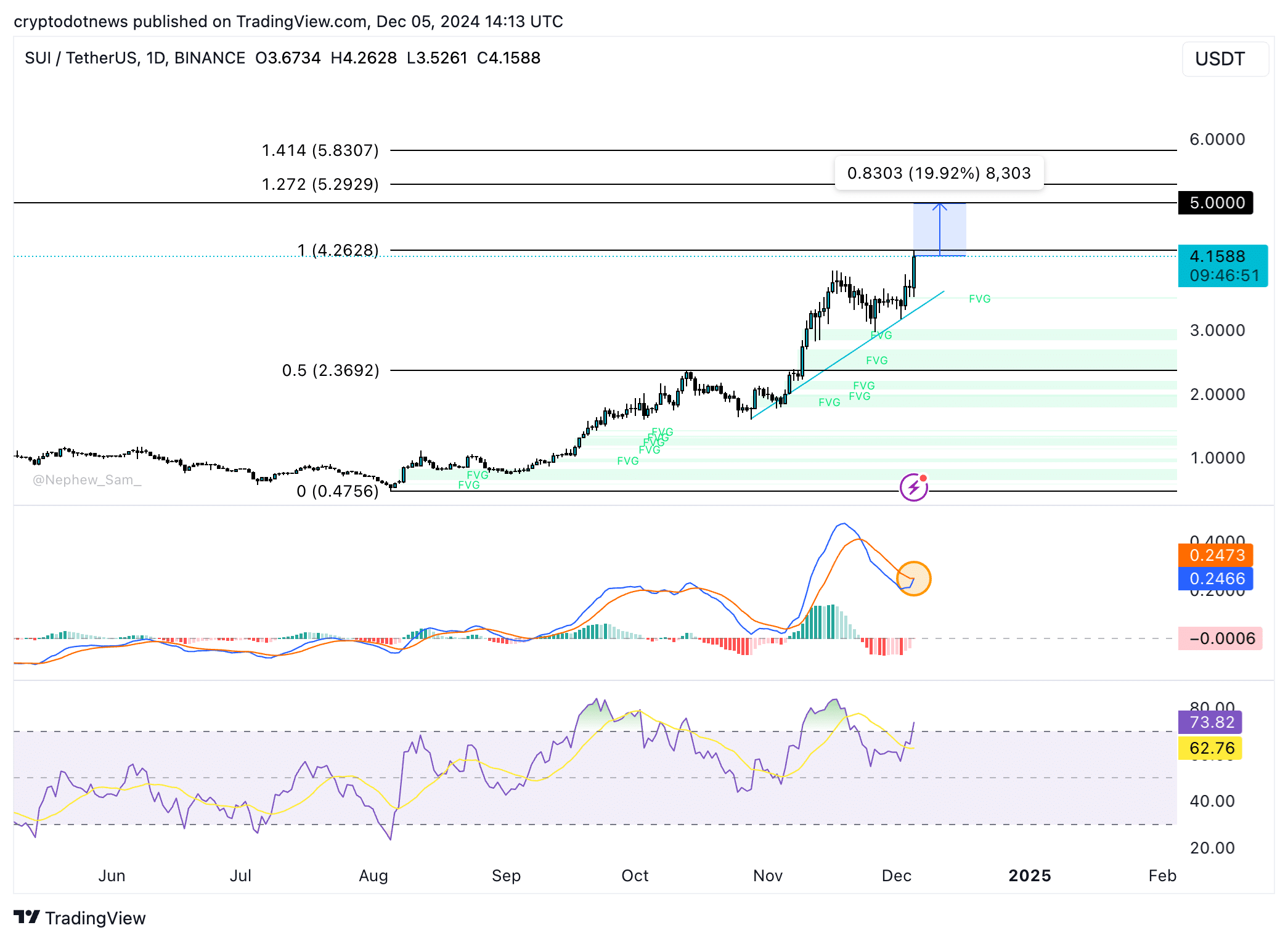

SUI is nearly 20% away from its psychologically important $5 target. Sui token trades at $4.1588 on December 5, rallying alongside Bitcoin.

In simpler terms, when the Relative Strength Index (RSI) goes beyond 70, it usually triggers a sell signal among traders. But if we look at the Moving Average Convergence Divergence (MACD), there could be a situation where the MACD line moves above its signaling line, which is considered bullish for Swiss Franc (SUI).

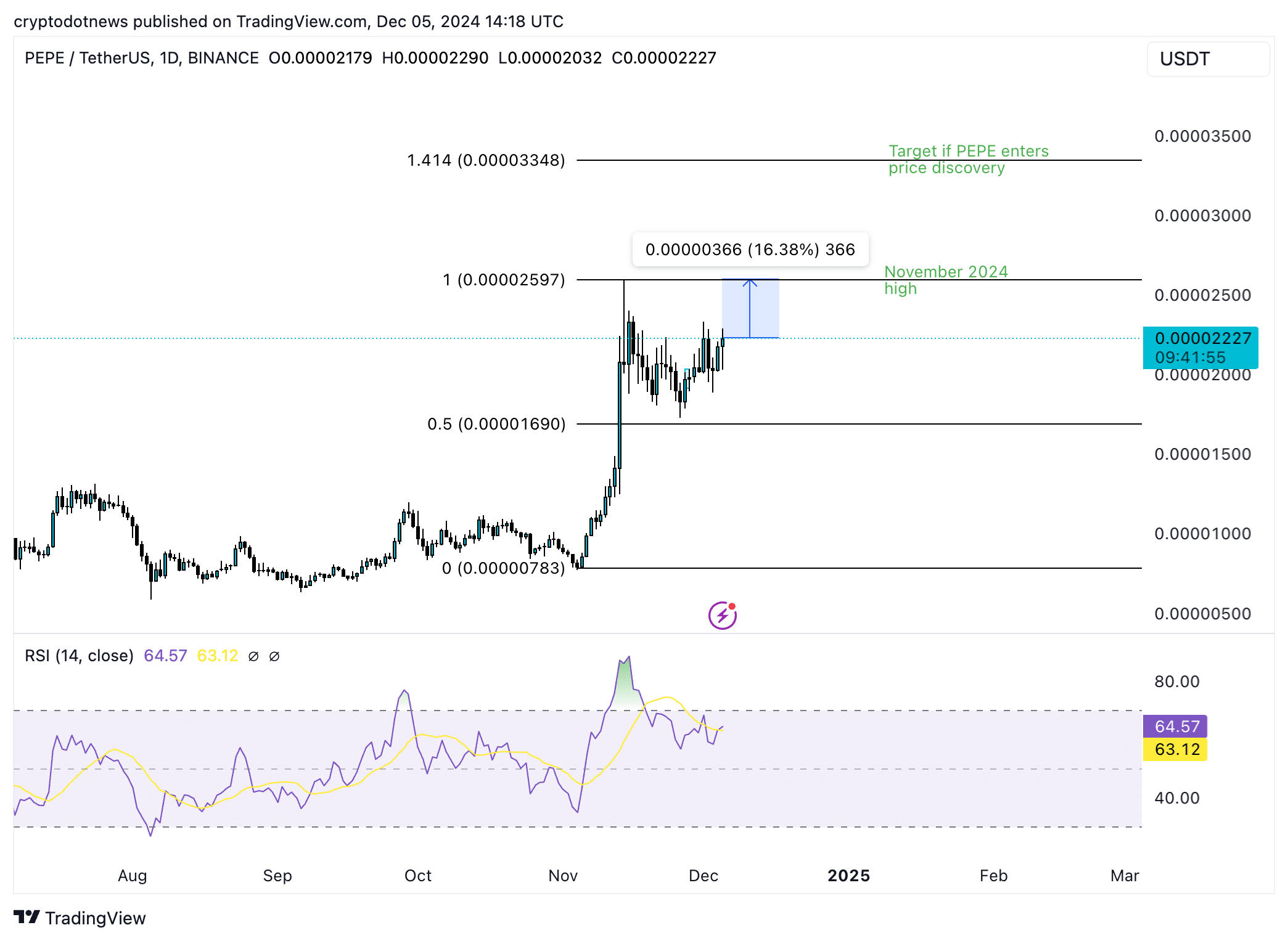

PEPE is preparing to evaluate if it can reach its November 2024 high of approximately 0.00002597 USD, which represents an increase of about 17% from its current price point.

Right now, RSI (Relative Strength Index) is pointing upwards and it’s below 70, which suggests that PEPE isn’t overvalued at the moment. If PEPE manages to surpass its November high, then we might see it exploring new price territories, with a potential target of $0.00003348 according to price discovery predictions for PEPE.

The target coincides with the 141.40% Fibonacci retracement of the November price rally.

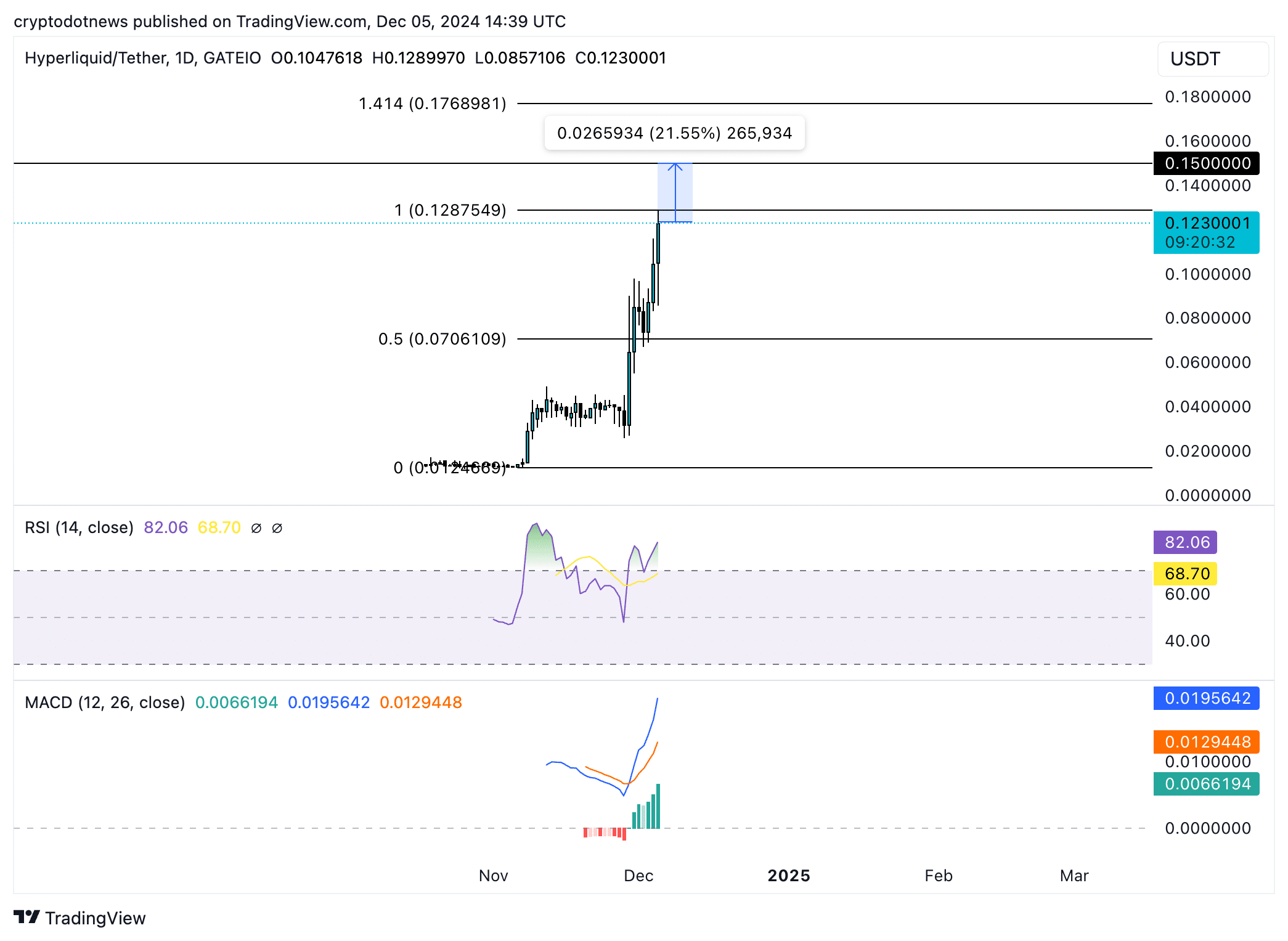

On Thursday, HYPE reached an unprecedented peak of $0.12875. There’s potential for this token to surge towards the significant mark of $0.15000, which is approximately 22% higher than its current value.

Reaching this barrier with success might open the path towards a potential goal of $0.17689. This objective corresponds to the 141.40% Fibonacci retracement level during HYPE’s climb to its latest record peak.

Technical indicators support a thesis of gain in HYPE price.

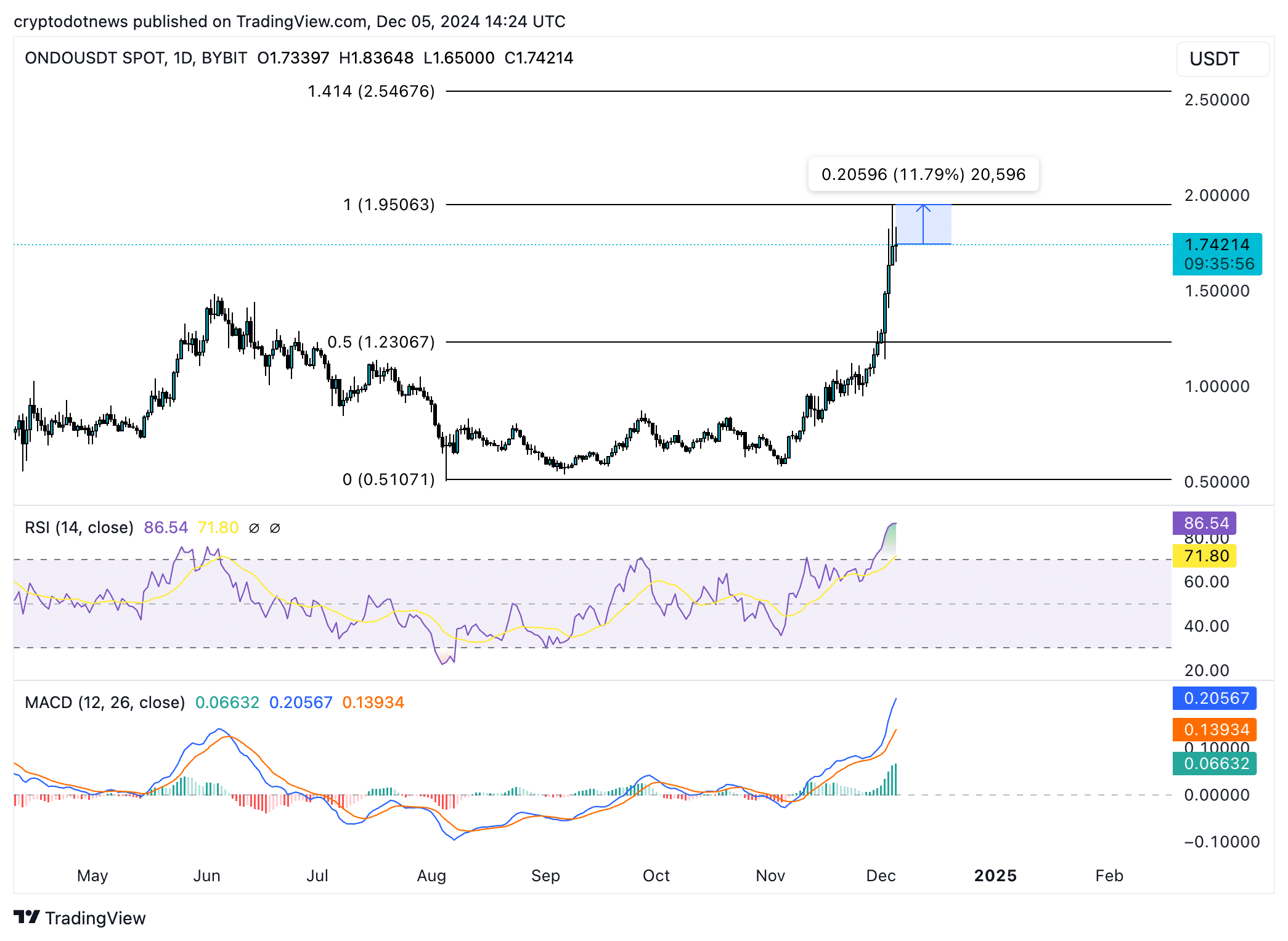

Currently, ONDO is priced at $1.74214. However, it’s worth noting that this price is 12% below its all-time high of $1.95063.

The Relative Strength Index (RSI) for ONDO is rising and indicates that the token is currently overpriced at 86. Although this usually triggers a sell signal, the Moving Average Convergence Divergence (MACD) displays green histogram bars above the neutral line, suggesting there’s strong underlying growth in the price of ONDO.

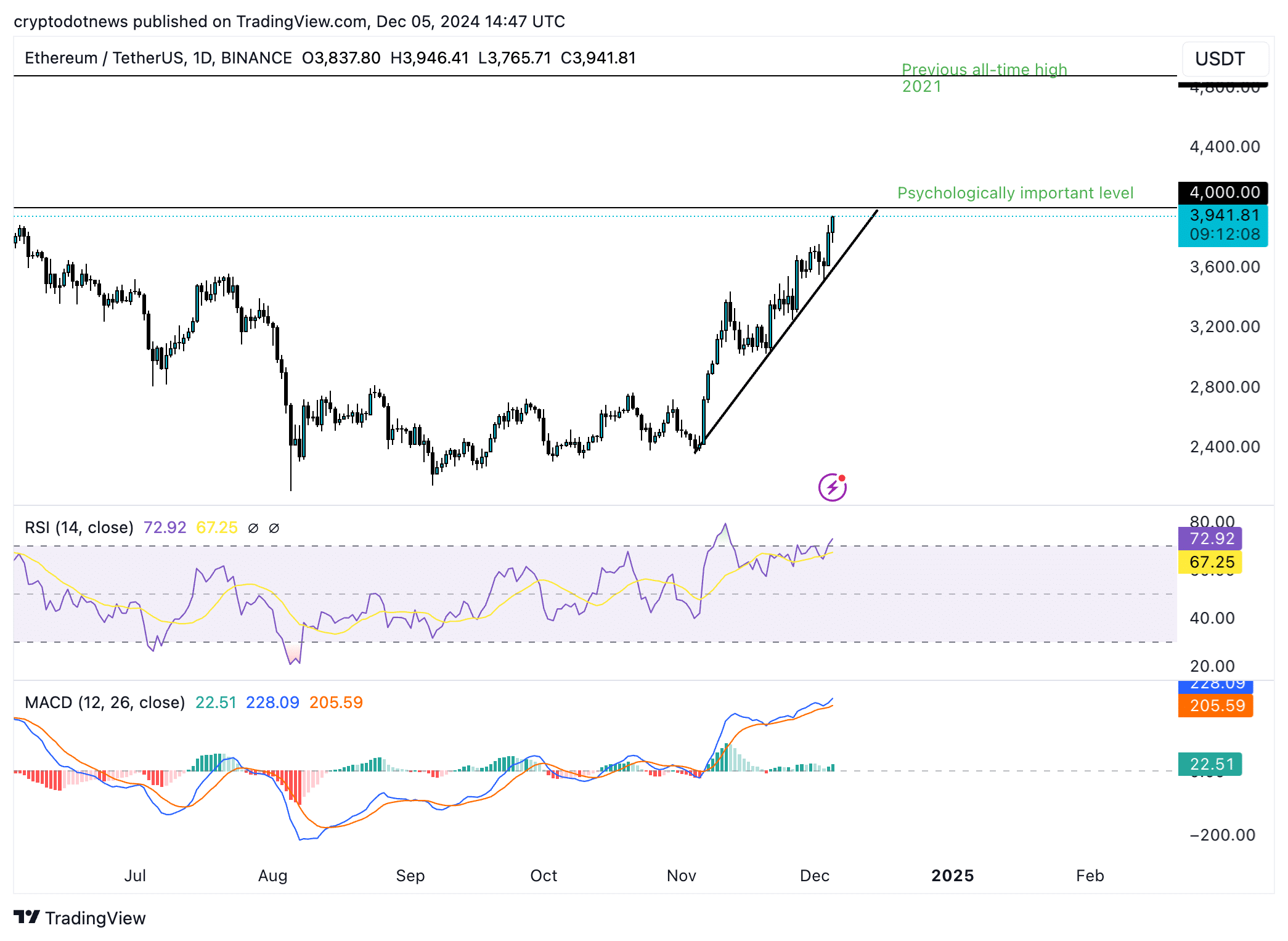

Ethereum gears for gains

Ethereum appears to be gaining ground. If it continues this positive trajectory, it might aim for its past record high of $4,878.

To surpass the significant $4,000 barrier would allow ETH’s price to aim for its previous record high and initiate a new phase of price exploration within this cycle. With the forthcoming advancements in the ecosystem, increased functionality, and growing adoption through layer 2 and layer 3 chains, Ethereum is poised for more substantial growth.

On a daily basis, the Relative Strength Index (RSI) is climbing upward and surpassing 70, suggesting strong bullish sentiment for Ethereum’s price trend. The Moving Average Convergence Divergence (MACD) also indicates a robust underlying positive momentum in the Ethereum market.

Strategic considerations

With Bitcoin’s dominance once again on an upward trajectory and XRP challenging USD Tether (USDT) for the title of third-largest cryptocurrency, investors are shifting their funds towards alternative digital currencies such as XRP, Solana (SOL), popular meme coins, and artificial intelligence tokens.

Approximately $135 million worth of short positions were closed over the last 24 hours, according to Coinglass data. The surge in Bitcoin’s price to around $104,000 has boosted open interest by about 12%, and options trading volume by a staggering 125%.

Traders are consistently taking profits in Bitcoin, and this supports the capital rotation thesis.

According to Ki Young Ju of CryptoQuant, this current cycle varies from past ones because institutional investors purchasing Bitcoin show no intention of shifting towards alternative coins. This suggests that the surge in prices for alternative coins depends mainly on a surge of funds coming from individual traders in cryptocurrency trading platforms, who are the primary sources of capital influx.

To figure out the best period for altcoins this season, traders should keep an eye on exchange user activity and the graph showing the total market capitalization of altcoins.

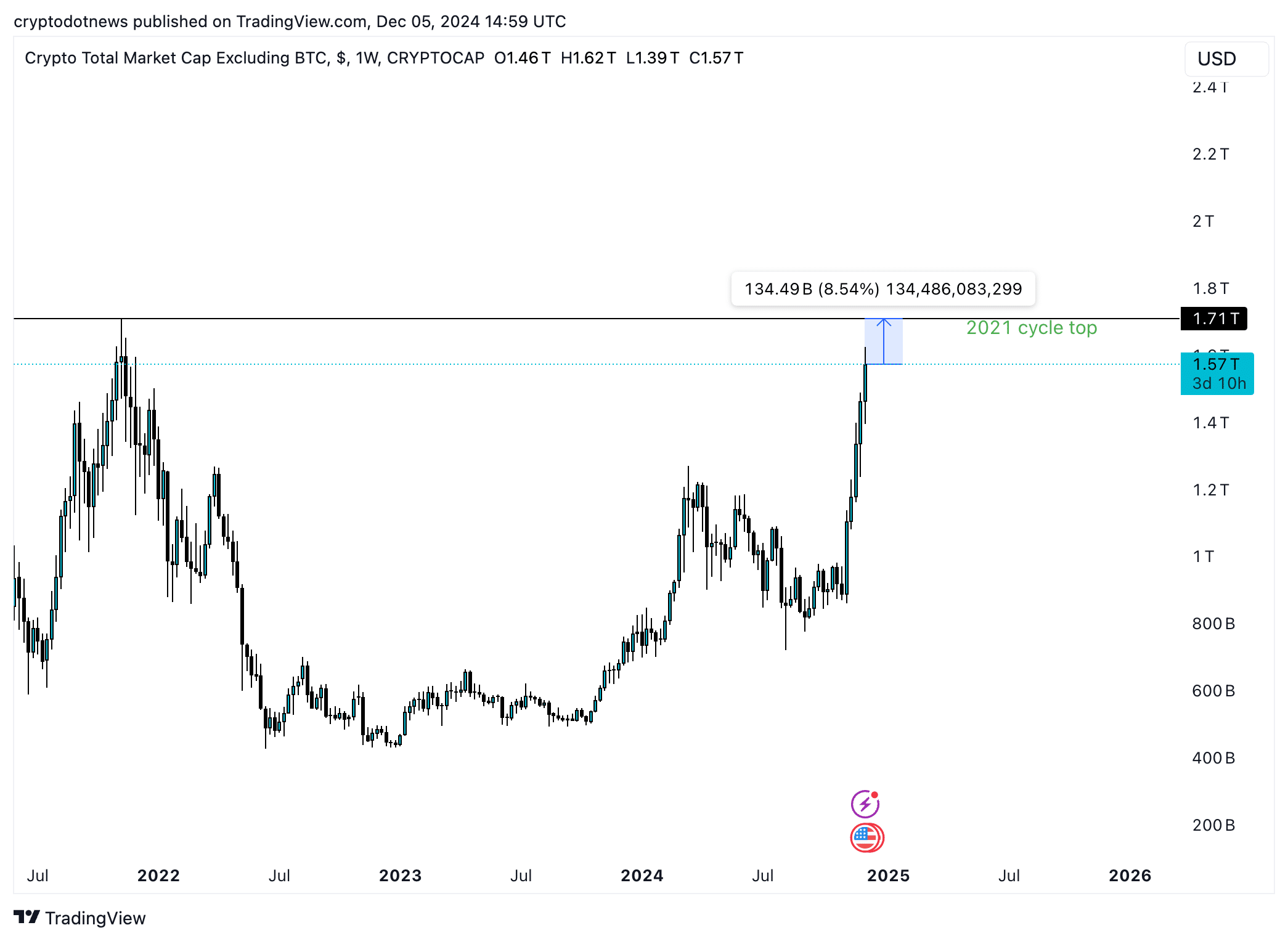

The combined value of all cryptocurrencies other than Bitcoin is currently about 8.5% lower than its peak in 2021, which was $1.71 trillion. However, as ordinary traders continue to invest in crypto platforms, experts predict that this total value will surpass the current level of $1.57 trillion.

For traders considering a shift towards altcoins, the chart serves as a crucial guide, especially when Bitcoin remains stable at prices over $100,000.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-05 22:54