As an analyst, I’m expressing a potential scenario where Bitcoin might experience a drop to around $88,000 if it struggles to maintain its crucial support level at approximately $95,000.

Over the last 24 hours, Bitcoin (BTC) experienced a decline of approximately 6%, dropping below $96K. This downward trend was triggered by a sudden sell-off on the spot market, which stemmed from broader economic worries. As a result, the price movement of BTC reached a “crucial” point, contributing to an overall decrease of 8.4% in the global cryptocurrency market.

Based on Skew’s analysis, if Bitcoin continues its recent downtrend, it could potentially fall to approximately $95,000 (currently only $300 above this level). Such a drop might cause Bitcoin to reevaluate prices as low as $88,000.

The analyst observed that during the range of approximately $92,000 to $88,000, there was a substantial boost in demand for bids, which has helped cushion this market sector. Furthermore, they suggested that the movement in the spot market will significantly influence events for the remainder of this week.

A connected diagram indicated that areas of low liquidity were situated lower on the Binance trading platform’s order book, implying significant buyer demand around the $88,000 price point.

It’s possible that Skew’s prediction may come true due to increased selling activity on Binance, a major cryptocurrency exchange in terms of trading volume. Based on CryptoQuant’s analysis, the Net Taker Volume on an hourly basis at Binance took a sharp downturn on January 8, reaching a low for the year of approximately -$325 million during the release of ISM PMI and JOLTs Job Openings data. This market data suggested less favorable conditions for risk-associated assets such as Bitcoin.

Alongside other knowledgeable traders, Johnny too foresaw a possible drop approaching within the upcoming weeks in that region.

As an analyst, I am inclined to believe that a shift similar to this could occur within the subsequent 2-3 weeks leading up to the inauguration, given current market trends and geopolitical factors.

— Johnny (@CryptoGodJohn) January 8, 2025

As per anonymous analyst Rekt Capital, Bitcoin is now trading between $91,000 and $101,165 because it couldn’t sustain its crucial daily support at $101,165. In the near future, we might see Bitcoin fluctuating within this range, with $91,000 serving as the next significant level of support.

Predictions about Bitcoin becoming bearish were seen as institutional interest seemed to decrease, with this trend evident from a substantial decline in incoming funds on January 7th, which amounted to approximately $52.9 million – a figure that represents around 94% less than the nearly $1 billion accumulated the day before.

Despite the bearish speculations, on-chain data tells a different story.

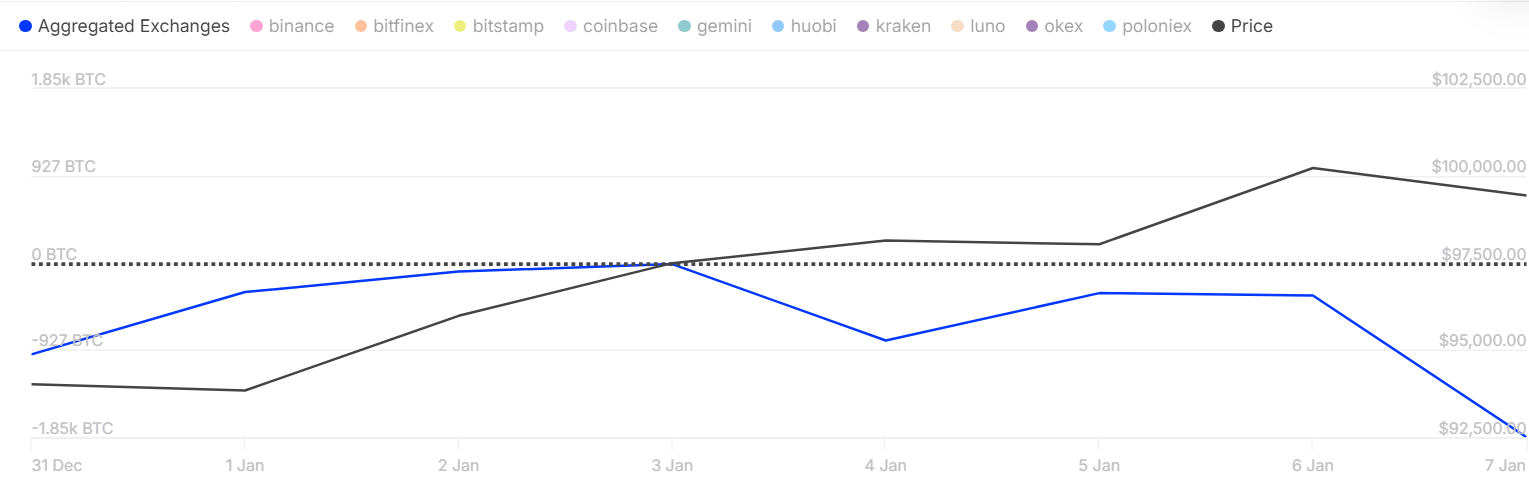

Based on figures from IntoTheBlock, the amount of Bitcoin being withdrawn from exchanges significantly rose, from a withdrawal of 346.47 BTC on January 6th to approximately 1,850 BTC on Tuesday, January 7th. This substantial increase in withdrawals indicates that investors might be transferring their Bitcoin holdings into personal wallets for longer-term storage, which could potentially decrease the pressure to sell off.

In the one-day Bitcoin (BTC) to Tether (USDT) chart, the Chaikin Money Flow index stands firm at 0.09, suggesting continuous buying pressure and an ongoing flow of funds into Bitcoin. This strong investment trend might encourage a possible price rise.

Another strong argument for Bitcoin emerged recently when CryptoQuant CEO Ki Young Ju highlighted that the current demand for Bitcoin appears to be quite significant.

As a researcher, I examine Bitcoin’s demand through an indicator called the Apparent Demand. This tool compares the quantity of freshly mined Bitcoins with the number of coins that have been in long-term possession (over a year). When the indicator shows high values, it suggests that investors are optimistic about the asset’s future prospects, as they seem to be holding onto their Bitcoin for the long haul.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-08 15:24