As an experienced financial analyst, I find Peter Brandt’s analysis intriguing based on historical patterns in Bitcoin’s bull markets. The symmetry between the number of weeks from the start of each cycle to the halving dates and the subsequent highs is a compelling observation. If this pattern continues, we could indeed see Bitcoin reaching new heights in 2025.

Based on historical trends of past bull markets, it’s possible that Bitcoin may reach its peak price during the current cycle around 2025.

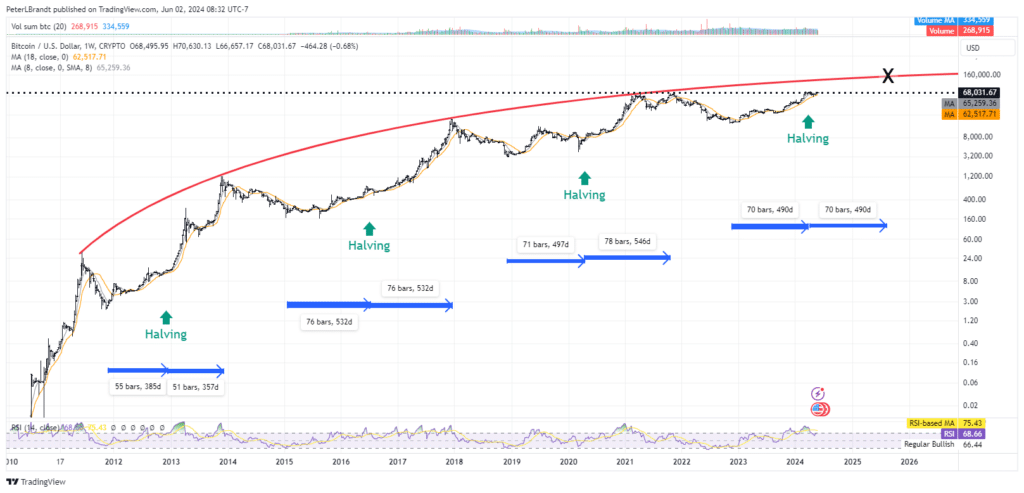

According to renowned market analyst Peter Brandt, who specializes in deciphering chart patterns, the peak price for Bitcoin’s current bull run might occur in the year 2025 instead of 2024, based on historical trends from past bull markets.

Brandt’s analysis relies on the concept of halvings, which occur every four years and see mining rewards being cut in half programmatically. In his blog post, the chart expert points out that historically, these halvings have shown “remarkable consistency” within past bull market cycles.

In simpler terms, the time span between the beginning of each bull market and the halving events has nearly matched the duration from the halving dates to the subsequent bull market peaks.

Peter Brandt

If the current trend continues, Brandt predicts that Bitcoin’s next peak may occur around late August or early September in the year 2025.

As a crypto investor, I’ve come across the analysis that previous bull market peaks have shown a pattern of an “inverted parabolic curve.” If this trend persists, it could mean that Bitcoin (BTC) might hit its peak price between $130,000 and $150,000 during the next bull run.

Brandt exercises caution despite his optimistic outlook, acknowledging that “as a trader, I’m wary of being overly certain about any notion.” Although he favors this perspective, he attaches a 25% likelihood that Bitcoin might have already reached its peak for the current cycle. In March, it set a new record high at over $70,000.

An analyst cautions that if Bitcoin fails to set a new significant peak above $55,000 and instead falls below this level, the likelihood of what he refers to as an “Exponential Decay” event will increase. Currently, Bitcoin is priced at $69,290 according to CoinGecko’s latest figures.

I, as an analyst, have observed that Bitcoin’s price has been remarkably stable in the last several weeks, with values fluctuating between $65,000 and $70,000. According to recent reports from crypto.news, the chief executive of blockchain analytics firm CryptoQuant, Ki Young Ju, draws parallels between the present market conditions and the mid-2020 period when Bitcoin traded at approximately $10,000.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-03 12:32