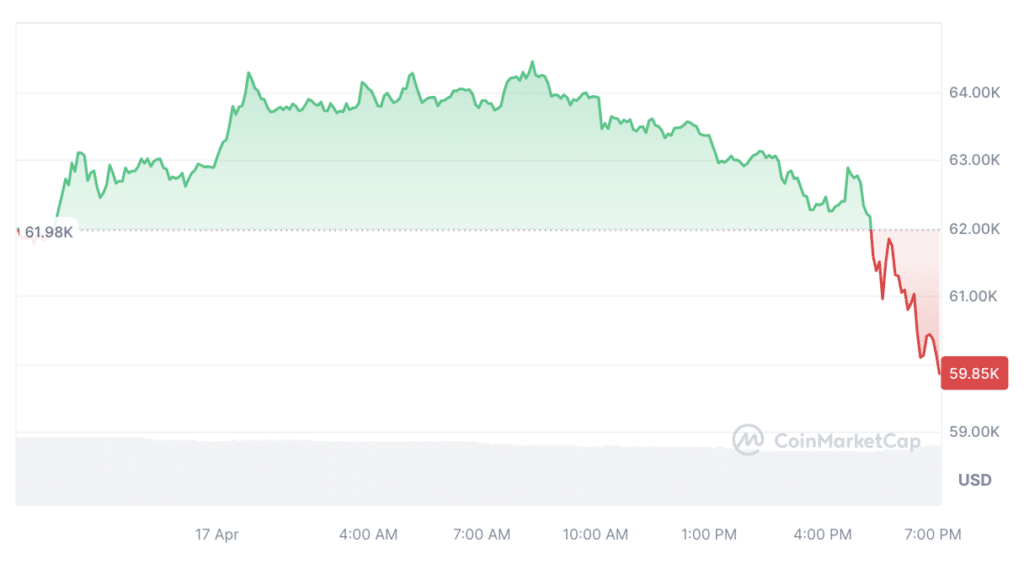

The price of Bitcoin immediately dropped below the $60,000 level as the halving approaches.

Based on information from CoinMarketCap, Bitcoin’s (BTC) price has dropped by over 3% within the last 24 hours and is currently valued at around $59,800. The trading volume for cryptocurrencies has also decreased by approximately 12%, reaching roughly $40 billion.

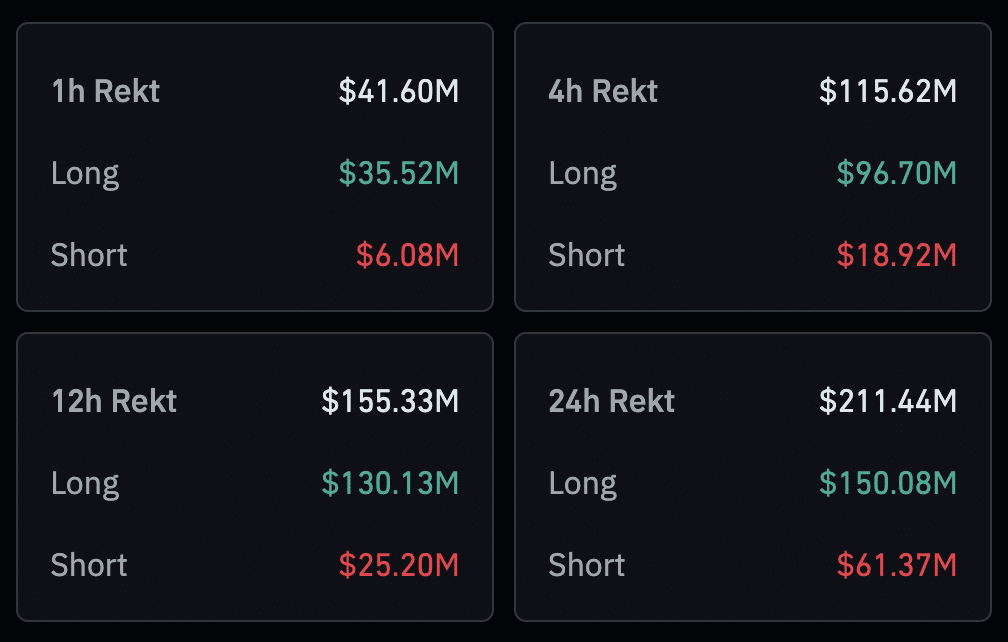

Traders have been actively selling off their positions as shown by data from CoinGlass. In the past 4 hours, they have disposed of approximately $115 million in assets. Out of this amount, about $96.70 million was from long positions, while the remaining was from short positions. The largest portion of these liquidations took place on OKX crypto exchange, amounting to $43.81 million.

In the coming days, the Bitcoin halving will take place, which could lead some traders to sell off their positions due to its significant impact. During this event, miners will receive 50% less reward for adding new coins to the market. Some Bitcoin enthusiasts view this reduction as a positive sign.

Before the Bitcoin halving, the cryptocurrency underwent heightened price fluctuations for reasons beyond just the event. Additionally, there has been a wave of selling as investors pull out of Bitcoin ETFs following remarks from Federal Reserve Chair Jerome Powell indicating that the central bank may not reduce interest rates until significant inflation reduction is achieved.

Markus Thielen, the research chief at 10x Research, points out that crypto miners started hoarding Bitcoins in January 2024 to widen the gap between availability and market desire. Consequently, Bitcoin’s price experienced a significant surge and peaked at its all-time high in March.

In contrast, digital mining firms will progressively get rid of their stored coins following a halving event, which could potentially decrease the value of cryptocurrencies by increasing the coin supply in the market.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-17 19:50