As a researcher with a background in finance and experience in following the cryptocurrency market closely, I find Michael Saylor’s response to Bitcoin’s price drop an intriguing display of confidence. The co-founder of MicroStrategy and Bitcoin advocate is known for his bullish stance on the digital currency. His comparison of Bitcoin to a swarm of cyber hornets in his tweet post is an interesting metaphor that highlights the resilience and adaptability of the decentralized network, even amidst market volatility.

Bitcoin underwent a substantial decrease in value, dipping below the $68,000 threshold during the night. In response to this price decline, Michael Saylor – MicroStrategy’s co-founder and a well-known Bitcoin advocate – took to Twitter and shared an AI-generated image. The image depicted a real Bitcoin and bees, with the caption: “Bitcoin is a Hive of Digital Wasps.” Despite this price drop, Saylor reaffirmed his faith in Bitcoin through his tweet.

#Bitcoin is a Swarm of Cyber Hornets.

— Michael Saylor⚡️ (@saylor) June 1, 2024

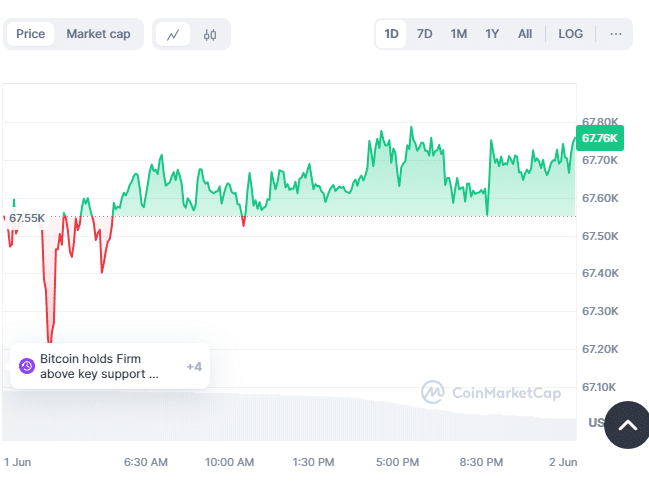

As a researcher studying the Bitcoin market, I’ve observed that its price took a hit due to macroeconomic influences. Specifically, the Personal Consumption Expenditures (PCE) price index rose by 0.25% in April, marking a three-year low with an annual change of 2.75%. Although this figure matched analysts’ predictions, it still triggered a 2.14% decrease in Bitcoin’s price from $68,608 to $67,712, as indicated by three successive red candles on the chart. However, there was a slight recovery, with Bitcoin trading at $67,727.68 at the time of writing – a 0.43% increase within the last 24 hours.

As a researcher studying the dynamic world of cryptocurrency exchanges, I’ve come across an unfortunate incident involving DMM Bitcoin, a Japanese platform. This exchange recently experienced a major hack resulting in the theft of approximately $300 million in crypto assets. Among the stolen goods were 4,502 Bitcoins.

Michael Saylor, in a recent interview on the “What Bitcoin Did” podcast, expressed optimism regarding the newly authorized Ethereum exchange-traded funds (ETFs). He anticipates that these ETFs will catalyze wider institutional acceptance of cryptocurrencies. Additionally, he proposed that the percentage of investment allocated to digital currencies could potentially increase from the current 1% to a range of 5-10%.

Saylor remarked that Ethereum’s path to widespread public approval and political backing is similarly smooth as Bitcoin’s. He underscoreed the potential benefits of this heightened recognition, as Bitcoin currently dominates the digital currency landscape, accounting for approximately 70% of the total funding. Saylor’s recent stance in favor of investing in Ethereum represents a significant shift from his previous viewpoint.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-06-02 01:56