As a seasoned market analyst with over two decades of experience under my belt, I’ve witnessed more than a few rollercoaster rides in the crypto world. The recent dip in Bitcoin’s price, while causing some short-term panic among investors, doesn’t faze me much. It’s important to remember that these fluctuations are par for the course when dealing with such volatile assets.

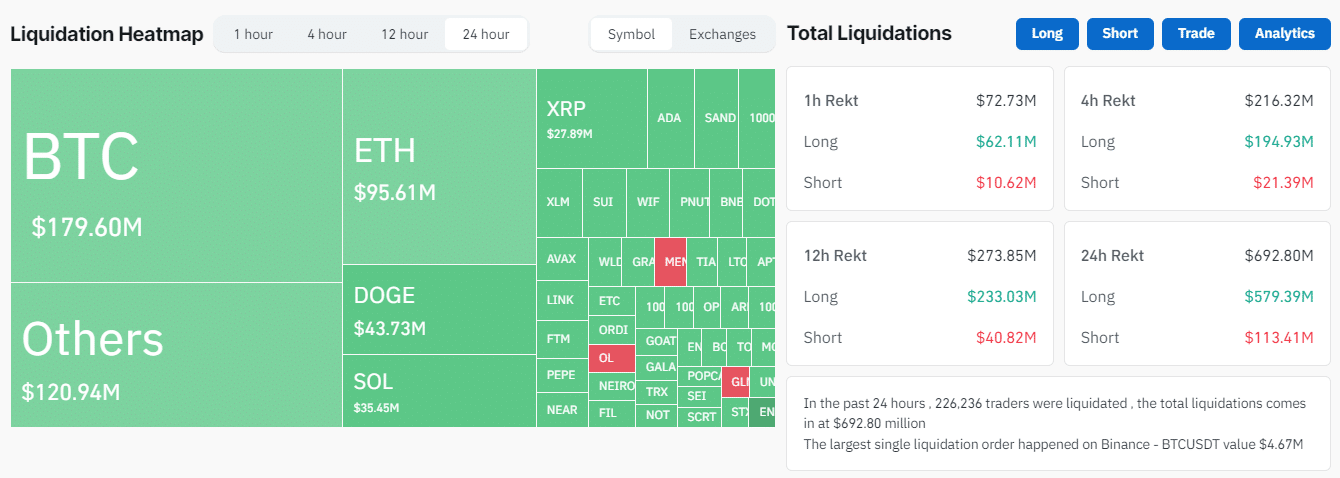

The cost of Bitcoin has dropped under $92,000, reducing some of its recent advancements that took it close to $99,000 last week. This adjustment has sparked a chain reaction leading to the liquidation of approximately $693 million in the past 24 hours, with around $577 million in long investments and $133.87 million in short bets being terminated.

Around 226 thousand traders had their positions closed (liquidated), with the biggest single liquidation order worth about 4.67 million dollars taking place on Binance for the BTC-tether pair.

Similarly significant sell-offs occurred in other popular cryptocurrencies: Ethereum suffered a loss of approximately $95.61 million, Dogecoin experienced a loss of around $43.73 million, XRP saw a loss of about $27.89 million, and Solana posted a loss of roughly $35.45 million.

At the moment, a single Bitcoin is being exchanged for approximately $91,895. Over the past day, its value has decreased by 6%. This dip has brought its total market capitalization to an impressive $1.82 trillion. Despite this recent decline, Bitcoin has shown a robust growth of 31% since November began. This resilience suggests that the market is experiencing strong momentum, fueled by the upward trends of alternative cryptocurrencies and meme coins. These digital currencies have experienced surges of up to 20% in recent times.

Market experts observe that the temporary drop might be due to a pause or slowdown, but Bitcoin’s recent trend suggests it is robust against increased speculation.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-26 16:20