As a seasoned crypto investor with several years of experience, I’ve learned to expect the unexpected in this volatile market. However, the recent drop in Bitcoin’s price to $53,717 following Mt. Gox’s cold wallet transfer was a jolt that even I couldn’t have predicted. I’ve seen my fair share of market downturns and recoveries, but this one felt different.

In simple terms, the cost of the initial decentralized digital currency, Bitcoin, dipped to $53,717 – its minimum since February of this year – after reports surfaced about Mt. Gox moving its cryptocurrency reserves from cold storage.

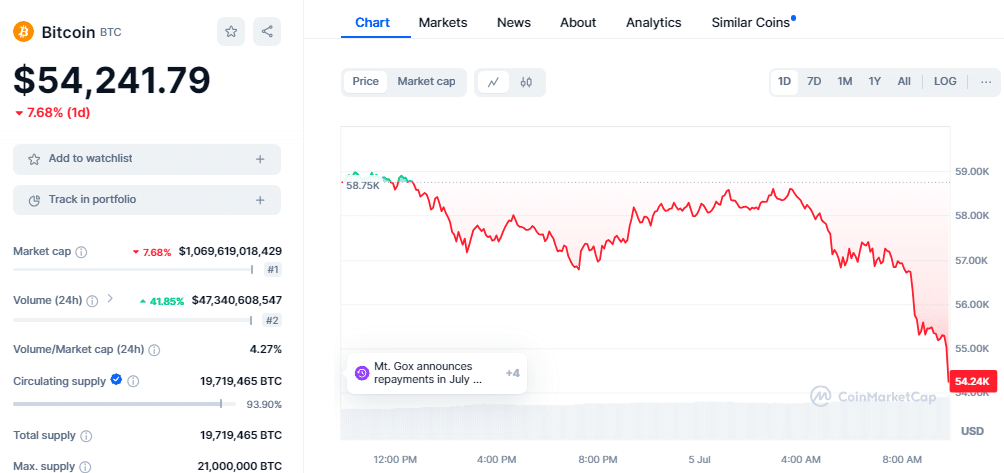

As a researcher studying the Bitcoin market, I’ve noticed a significant drop in its value, which reached a low of $53,717 around 4:20 am UTC on July 5, based on CoinMarketCap data. It’s important to mention that the cryptocurrency has since bounced back slightly and is now trading above $54,241. However, it’s still experiencing a setback of approximately 7.68% over the past 24 hours.

In the past 24 hours, a significant drop of almost 10% was observed not just in Bitcoin, but also in other prominent cryptocurrencies like Ether and Solana. This price instability resulted in an enormous surge in crypto liquidations, totaling $585 million – marking the highest amount in the previous 2.5 months, according to CoinGlass.

In the grand scheme of things, the long positions in liquidations amounted to approximately $510 million, while short positions stood at around $79 million. It’s worth noting that long Bitcoin positions accounted for about $193.19 million of the total liquidation value, which should allow for the execution of most intended actions.

The cryptocurrency market’s attitude has significantly shifted to pessimism, as evidenced by the Crypto Fear & Greed Index reaching a record low of 29 on July 5. This figure signifies extensive “fear” among investors, representing the most unfavorable sentiment experienced since early January 2023.

As a crypto investor, I’ve noticed some significant Bitcoin transfers from Mt. Gox and other market shifts that have left me feeling uneasy about the digital currency markets. These events underscore the ongoing volatility and uncertainty in this space.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-05 08:52