As a seasoned crypto investor with a keen interest in Bitcoin ETFs, I’ve witnessed my fair share of market fluctuations. The latest trend of sustained negative net flows for spot Bitcoin ETFs in the U.S., coupled with the recent drop below $60,000, is a cause for concern.

In the United States, Bitcoin (BTC) exchange-traded funds (ETFs) have experienced three consecutive weeks of decreased inflows, coinciding with a drop in Bitcoin’s price beneath the $60,000 mark.

Based on information from Farside investors, there were outflows of $174.5 million from spot Bitcoin ETFs on June 24. The significant negative net flows can primarily be attributed to the Grayscale Bitcoin Trust (GBTC), a pattern seen in the initial trading sessions and more recently.

Significantly, GBTC experienced outflows amounting to $90.4 million, the largest since June 11. Simultaneously, other Bitcoin spot ETFs added to the overall negative net inflow figure, with no product reporting any inflows on that day. The last occurrence of this trend was on June 11; however, most ETFs at that time remained unchanged.

As an analyst, I’ve noticed that during this specific period, a total of up to seven investment products experienced outflows. Among them, the Fidelity Wise Origin Bitcoin Fund (FBTC) recorded the second-largest outflow, with approximately $35.2 million being withdrawn. The Franklin Bitcoin ETF (EZBC) followed closely behind, registering $20.9 million in net redemptions.

As an analyst, I find it intriguing that BlackRock’s iShares Bitcoin Trust (IBIT) defied the general trend and didn’t experience any inflows or outflows on June 24. Strikingly, IBIT has effectively shielded itself against any adverse flows during this market downturn. The last occasion when this product witnessed a negative net flow was on May 1, with a net outflow of $36.9 million.

After the latest Bitcoin ETF performance, the total inflow into spot Bitcoin ETFs has decreased to $14.38 billion. This amount fell below $15 billion on June 17, following a net outflow of $145.9 million. For seven consecutive days, investors have withdrawn their funds from these products.

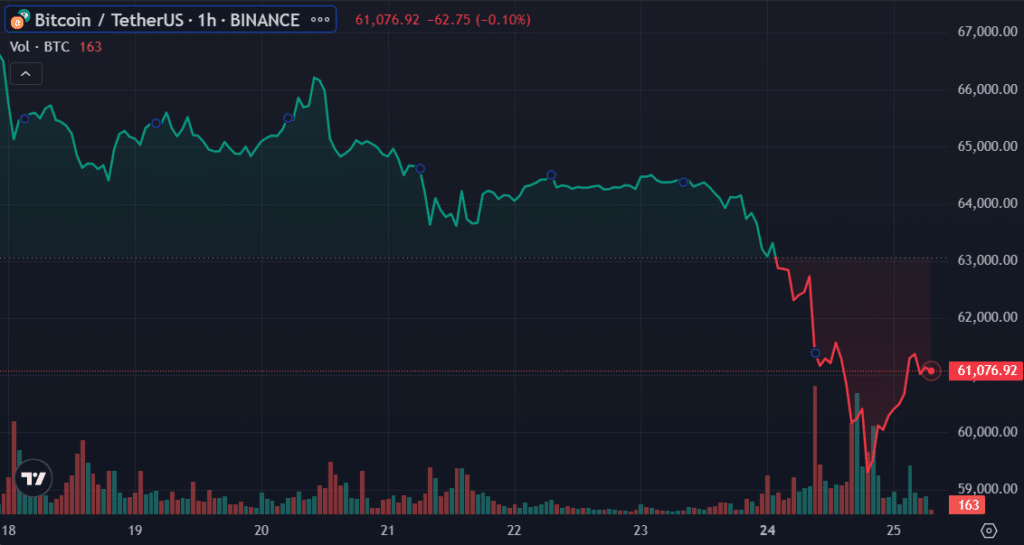

In contrast to the recent downtrend, Bitcoin has managed to gain a minimal increase of 0.8%, currently valued at $60,772. This minor uptick emerges after a significant decline of 4.61% the day prior.

I observed yesterdays price action of Bitcoin (BTC), where it dipped beneath the $60,000 mark to reach a one-month low of $58,402 before bouncing back.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-25 12:20