As an experienced ETF analyst, I believe that the recent inflows into Bitcoin ETFs are a positive sign for the digital asset class. The $1.3 billion inflows in May have effectively offset the losses in April, bringing the total net inflows since launch to $12.3 billion. This is an important metric because it nets out the natural ebb and flow of capital that comes with ETFs.

Spot Bitcoin ETFs offset April losses in the first two weeks of May.

As a researcher, I’ve observed that Bitcoin Exchange-Traded Funds (ETFs) have attracted a significant amount of investment this May. Specifically, these funds have experienced inflows worth approximately $1.3 billion during this month. Remarkably, this influx has more than made up for the outflows recorded in April. In total, Bitcoin ETFs have witnessed inflows amounting to an impressive $12.3 billion since their launch.

Over the past two weeks, Bitcoin ETFs have experienced significant investment, totaling approximately $1.3 billion. This influx of funds has effectively countered the losses seen in April, allowing their net assets to return to a high point of around $12.3 billion since their launch. I believe this figure is crucial because it represents the total sum of money flowing into and out of these ETFs.

— Eric Balchunas (@EricBalchunas) May 17, 2024

The analyst advised investors not to be concerned about fluctuations in money moving into and out of ETFs, as this is a normal occurrence. Balchunas is confident that Bitcoin ETFs will continue to yield favorable results over the long term.

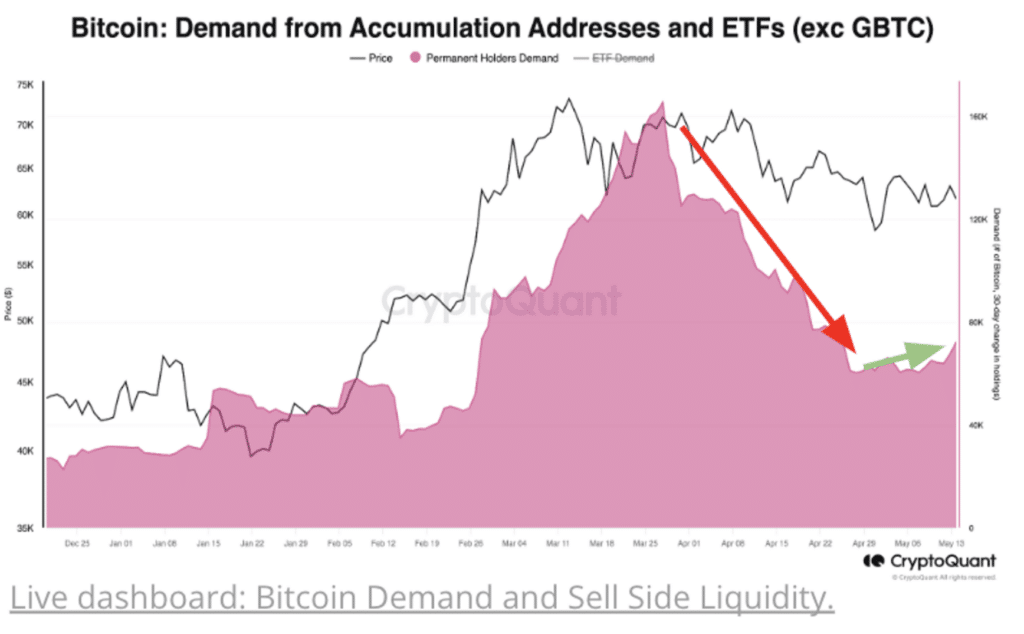

According to CryptoQuant’s analysis, the revival of Bitcoin’s market trends is accompanied by a renewed interest in Bitcoin among typical investors and larger investors. The quickening increase in Bitcoin’s stored supply with these market players indicates a strengthening demand for Bitcoin from their ranks.

In the last week, there has been a rebound in investments into Bitcoin spot ETFs, as indicated by SoSo Value’s data. Specifically, these ETFs attracted approximately $257.34 million in new investments on May 16th.

As an analyst, I’d rephrase it this way: IBit from BlackRock, specifically the iShares Bitcoin Trust, saw a significant inflow of funds amounting to $94 million. With this addition, the total capital under management for IBit reached an impressive $18 billion. However, it’s important to note that this figure falls slightly short of the Grayscale Bitcoin Trust ETF (GBTC), which currently manages a larger capital sum.

On May 16, GBTC experienced a net purchase of approximately $5 million, marking it as the third consecutive green closing day for the product since its transformation from a trust into a spot Exchange-Traded Fund (ETF).

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-17 19:27