In a rather dashing display of resilience, Bitcoin ETFs kept their winning streak alive, attracting a cool $117 million on Thursday—thanks to the heavyweights Blackrock, Fidelity, and Ark 21shares. Meanwhile, poor old Ether ETFs continued to wallow in red, bleeding $16.11 million for the third day in a row. Oh, the drama.

Bitcoin ETFs Soar While Ether ETFs Keep Their Date with Despair

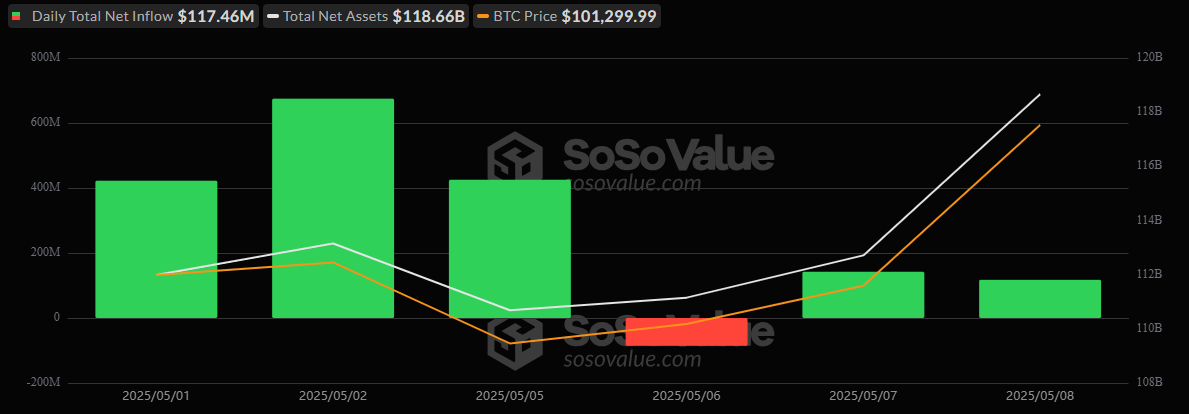

On Thursday, Bitcoin ETFs made a marvelous show of force, garnering a sweet $117.46 million in net inflows, marking not just a green day but a second in a row! Of course, it wasn’t exactly a tsunami of capital, but the little push was potent enough to make some heads turn.

Leading the charge was Blackrock’s IBIT, once again flexing its muscles with a whopping $69 million, more than half of the day’s total. Fidelity’s FBTC wasn’t far behind, with a respectable $35.34 million. And who could forget ARK 21shares’ ARKB, gently placing a modest $13.12 million into the kitty. The remarkable thing? Not a single outflow was recorded from any of the 12 spot bitcoin ETFs. Impressive, huh?

Total value traded surged to a staggering $3.87 billion, and the net assets of Bitcoin ETFs swelled to $118.66 billion, inching ever closer to the glorious day when this unstoppable force might actually become… well, unstoppable.

Meanwhile, Ether ETFs… oh, Ether ETFs. They just can’t seem to catch a break. Outflows hit $16.11 million, with Fidelity’s FETH leading the charge in the “Great Exodus” with a $19.30 million withdrawal. Oh dear. There was a small glimmer of hope, though: Grayscale’s Ether Mini Trust managed to scrape together a paltry $3.19 million in inflows. Tiny, but sweet.

Despite the increase in total ether ETF trading volume to $591.53 million, net assets took a slight dip, closing at $7.22 billion. That’s right—three days in the red for Ether, while Bitcoin, with all its consistency, continues to bask in institutional glory. It’s like a soap opera, really.

In the world of digital assets, Bitcoin’s bullish vibes are a testament to the power of steadiness, while Ether ETFs remain stuck in a tragic, ongoing tug-of-war with recovery. Don’t worry, Ether fans, recovery might be just around the corner—or is it?

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2025-05-09 18:46