Bitcoin ETFs Rake in $260M, Blackrock’s IBIT Dominates with 632K BTC! 🎉💰

Hold onto your digital wallets, folks! The crypto craze is hotter than a barbecue at a vegan convention! On Friday, May 16, spot bitcoin exchange-traded funds (ETFs) strutted in like celebrity chefs, pulling in a whopping $260.27 million—yeah, you heard that right! Meanwhile, ethereum ETFs looked like the shy kid at prom, modestly scooping up a tiny $22.12 million. Ouch! 🤭

Bitcoin ETFs Are the Party of the Century While Ethereum Plays Hard to Get

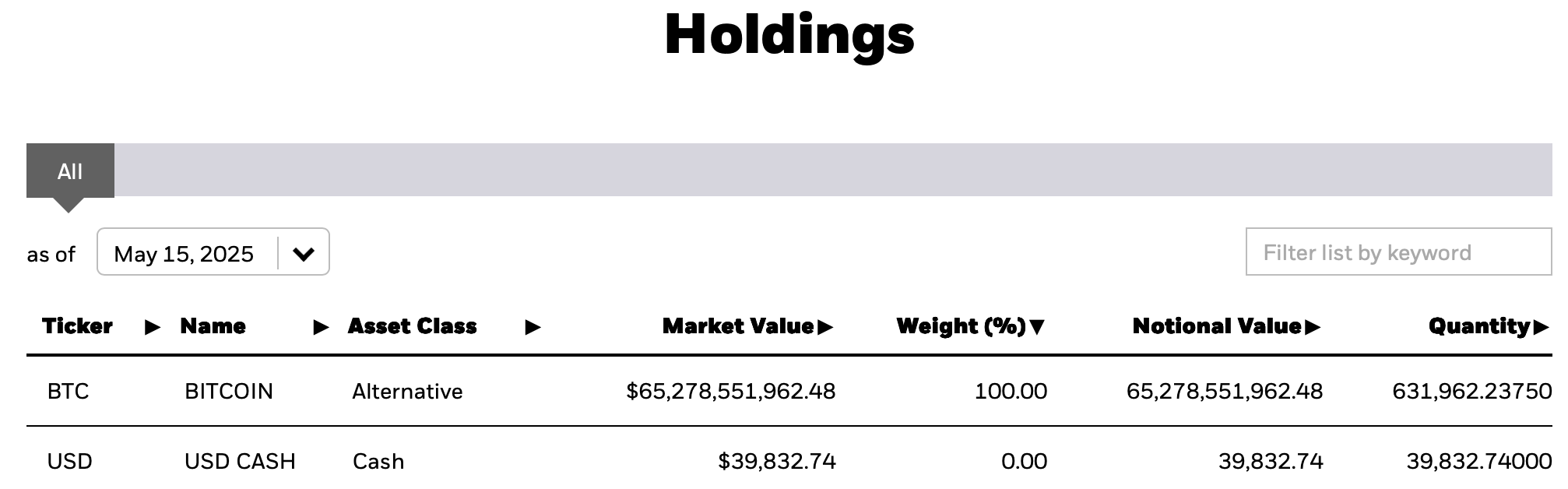

Leading this wild crypto parade was Blackrock’s Ishares Bitcoin Trust (IBIT), which swaggered in with a colossal $129.73 million. According to sosovalue.com stats, they’re sitting pretty—and I mean, *really* pretty—with 631,962 BTC — that’s enough to buy a small country or at least a really fancy cup of coffee! ☕💸

Fidelity’s Wise Origin Bitcoin Fund (FBTC) wasn’t shy either, grabbing a tidy $67.95 million, followed by Ark Invest’s ARKB with $57.98 million. And get this—Grayscale’s Bitcoin Mini ETF threw in a modest $4.61 million as if to say, “Hey, what about us?”

But don’t worry, many of the big shots like GBTC, BITB, and HODL sat this one out—probably napping or binge-watching crypto documentaries. As of May 15, 2025, IBIT’s got more than just bragging rights—it’s hoarding a staggering 631,962.23 BTC! That’s like the entire population of a small planet, folks!

Meanwhile, on the Ethereum side of things, sosovalue.com metrics show Fidelity’s Ethereum Fund (FETH) snatching $13.57 million—probably because folks think Ethereum will someday flip Bitcoin like a pancake. Grayscale’s Ethereum Mini Fund added $8.55 million, which is adorable but a little shy compared to Bitcoin’s fireworks. Other Ethereum ETFs? Well, they looked around, yawned, and didn’t bother to show up—probably busy binge-watching “Crypto: The Series.”

All these ETFs traded at slight premiums to their net asset values—because why not? IBIT, FBTC, and FETH were each trading between +0.29% and +0.39%. Only Hashdex’s DEFI ETF was feeling blue at a -0.40% discount. Poor DEFI! 😢

The takeaway? Big institutions still love their bitcoin like grandma’s apple pie, while Ethereum is the wallflower at the dance, waiting for its turn. The crypto world’s a wild circus, and Bitcoin is still the main attraction—grab your popcorn! 🍿🎪

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-17 22:29