As a researcher with extensive experience in the cryptocurrency market, I find these recent developments in the U.S. Bitcoin ETF landscape particularly intriguing. The consistent inflows over the past five days, totaling $72.1 million on July 11 alone, are a clear indication of increasing institutional interest in Bitcoin.

On July 11, US-listed Bitcoin (BTC) ETFs experienced their fifth straight day of investments totaling $72.1 million. This surge came as Bitcoin breached the $59,000 threshold.

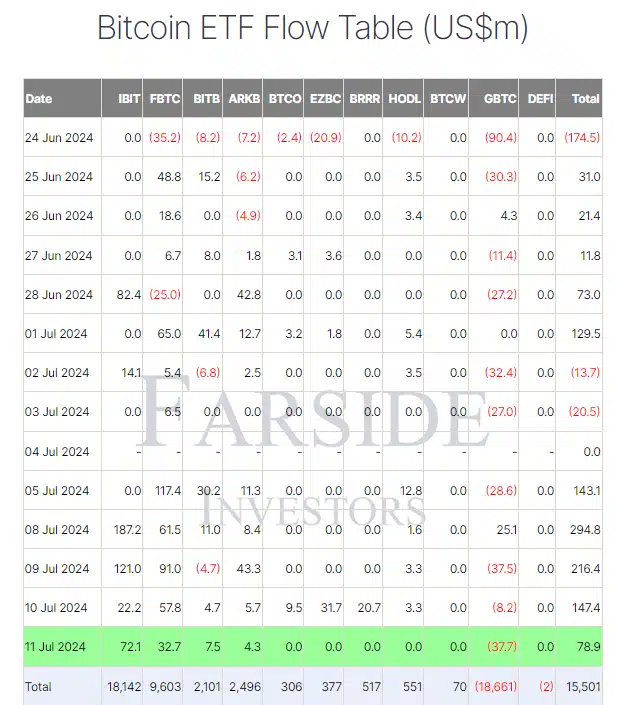

Based on Farside Investors’ data, these investment offerings brought in $72.1 million in new investments on July 11. This addition comes after a successful week that started with a $143.1 million influx of capital on July 5.

As a crypto investor, I’d say: Among all the crypto investment products, BlackRock’s IBIT took the lead last week with an impressive $72.1 million in new investments, bringing its total assets under management to a staggering $18.1 billion. Right behind it was Fidelity’s FBTC, which attracted $32.7 million and raised its total inflows to a significant $9.6 billion.

As an analyst, I’d rephrase it as: Both Bitwise’s BITB and ARK’s ARKB reported substantial inflows of $7.5 million and $4.3 million respectively, adding to their existing totals, which now stand at a impressive $2.1 billion and $2.5 billion.

As a researcher studying the trends in Grayscale’s GBTC, I noticed an unexpected development: Despite a temporary influx of $37.7 million on July 8, the fund experienced a net withdrawal of $37.7 million, bringing its total outflows to a substantial $18.7 billion.

Some well-known Bitcoin ETFs, including Invesco Galaxy’s BTCO, Franklin Templeton’s EZBC, Valkyrie Bitcoin’s BRRR, VanEck’s HODL, and WisdomTree’s BTCW, experienced no notable adjustments in their investment activity. However, the market for Bitcoin ETFs continues to thrive, with a total inflow of $15.5 billion as of now, based on Farside Investors’ figures.

As a crypto investor, I’ve noticed an increasing flow of funds into Bitcoin ETFs. Interestingly enough, this trend aligns with positive economic signs. Specifically, U.S. inflation rates have dropped for the fourth month in a row. This deceleration is encouraging news that could potentially boost the value of my Bitcoin investments.

In June, inflation decreased by 0.1 percentage point for the first time since May 2020, marking a significant step forward in the Federal Reserve’s mission to control rising prices.

As an analyst, I’ve observed an uptick in Bitcoin prices recently. After hitting a four-month low, the cryptocurrency surged above $59,000 on July 11 – marking a 3.4% growth within the last week.

In the face of possible price increases due to the redistribution of Bitcoins from Mt. Gox creditors and the sale of confiscated Bitcoins by the German authorities, the investment of large sums of money into Bitcoin ETFs has played a significant role in maintaining the cryptocurrency’s value during this volatile time.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-07-12 15:00