As a seasoned crypto investor with a knack for navigating the volatile landscape of digital assets, I must admit that the recent surge in Bitcoin ETF inflows has piqued my interest. With a career spanning over a decade in the tech industry and witnessing the birth and evolution of Bitcoin, it’s fascinating to see institutional investors pouring billions into these funds.

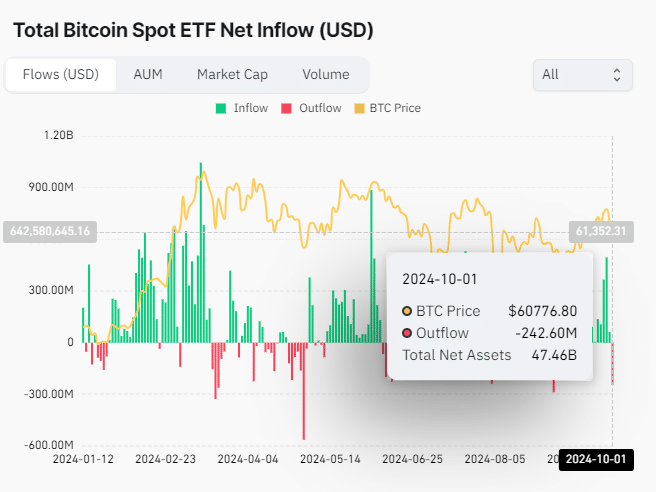

On October 2nd, the combined investments in Bitcoin Exchange-Traded Funds (ETFs) exceeded $47 billion, with significant contributions coming from iShares Bitcoin Trust (IBIT), Grayscale Bitcoin Trust (GBTC), Fidelity Wise Origin Bitcoin Fund (FBTC), and ARK 21Shares Bitcoin ETF (ARKB). In simpler terms, a lot of money has been invested in these specific Bitcoin ETFs, pushing the total investment over $47 billion.

Currently, the combined value of all Bitcoin Exchange-Traded Funds is roughly $59.03 billion, and the total assets they manage amounts to around $50.39 billion, as reported by Coinglass.

The price of IBIT is roughly $35.13, boasting a massive market capitalization of around $22.55 billion. It trades at a turnover rate of 6.89% and carries an expense ratio of 0.25%. This makes it the leading Bitcoin Exchange Traded Fund (ETF) in terms of size.

Alternatively, the Grayscale Bitcoin Trust (GBTC) is currently valued at approximately $49.12, boasting a market cap of around $13.65 billion, a trading volume of 1.5%, and an expense fee of 1.5%.

Due to escalating tensions between Israel and Iran following Iran’s ballistic missile strike on Israel, there are concerns that Bitcoin’s price could dip below $60,000 after experiencing a 6.05% decrease in value. Currently, the value of Bitcoin hovers around $61,205.43, representing approximately a 4% drop over the past day, with an overall market capitalization of about $1.2 trillion.

Read Also: Spot Bitcoin ETFs Buy Double Mined BTC, Price Gain by 9%

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-02 15:32