As a seasoned crypto investor with a knack for spotting market trends and a flair for navigating through volatility, I find myself in familiar territory amidst the recent dips in Bitcoin, Ethereum, and Dogecoin. The dance between bulls and bears is an intricate one, and I’ve learned to anticipate these ebbs and flows with a mix of excitement and patience.

On Monday, the top digital currencies such as Bitcoin, Ethereum, and Dogecoin saw a decline in their prices due to anticipation among investors regarding potential changes in interest rates, which were set to be discussed by Federal Reserve Chair Jerome Powell in forthcoming speeches.

In simpler terms, Bitcoin, the most valuable digital currency, is currently experiencing a steady rise in value. On the other hand, Ethereum has seen ups and downs in its worth. Interestingly, Dogecoin – known for its devoted fanbase – has found it challenging to keep its value stable.

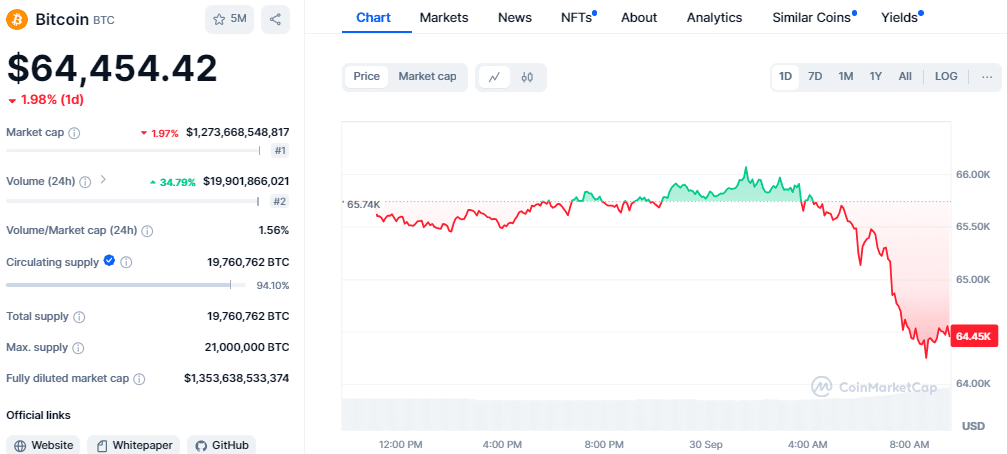

In a brief moment, Bitcoin climbed over $66,000 only to fall back to $64,247 during the night. However, this drop didn’t halt its significant advance of 8.90% for the month of September, which is considerably more than its usual decline of 3.47%. This upward trend can be attributed to the Federal Reserve’s decision to lower interest rates by 0.5% earlier in the month.

Currently trading near $2,620, Ethereum has experienced some fluctuations, with a recent shift of approximately $45 million in ETH causing some unease among traders. Over the past 24 hours, Ethereum’s price has dipped by 1.88%.

As reported by CoinMarketCap, Dogecoin experienced a significant decrease, dropping approximately 6.37% over the past day to reach $0.1211. Negative market sentiment and an increase in short positions seem to have impacted its price negatively. However, the coin continues to garner popularity due to its dedicated fanbase.

Currently, the combined value of all cryptocurrencies amounts to approximately 2.29 trillion US dollars, showing a decrease of 0.77% over the last day. Investors are keeping a close eye on Powell’s speech for indications about potential interest rate reductions. Such cuts could significantly influence the market trend.

The recent fall in the prices of Bitcoin, Ethereum, and Dogecoin appears to be a result of investors being more cautious as they await important economic reports. These market players are keen to understand how potential interest rate reductions might influence the value of these cryptocurrencies in the future.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-09-30 09:40