As a seasoned cryptocurrency investor who has weathered numerous market cycles, I find myself intrigued by the recent downturn in Bitcoin and Ethereum prices. While it’s never a pleasant sight to see our investments dip, I’ve learned over the years that these periods can present unique opportunities.

Major investors in Bitcoin and Ethereum are considering taking advantage of the broader market’s dip, as these key assets are currently being offered at reduced prices.

As a researcher, I’m reporting that Bitcoin (BTC) has experienced a 1.4% decrease in the last 24 hours, currently trading at approximately $97,300 at this moment. Notably, it reached an unprecedented peak of $103,700 just last week, setting a new all-time high.

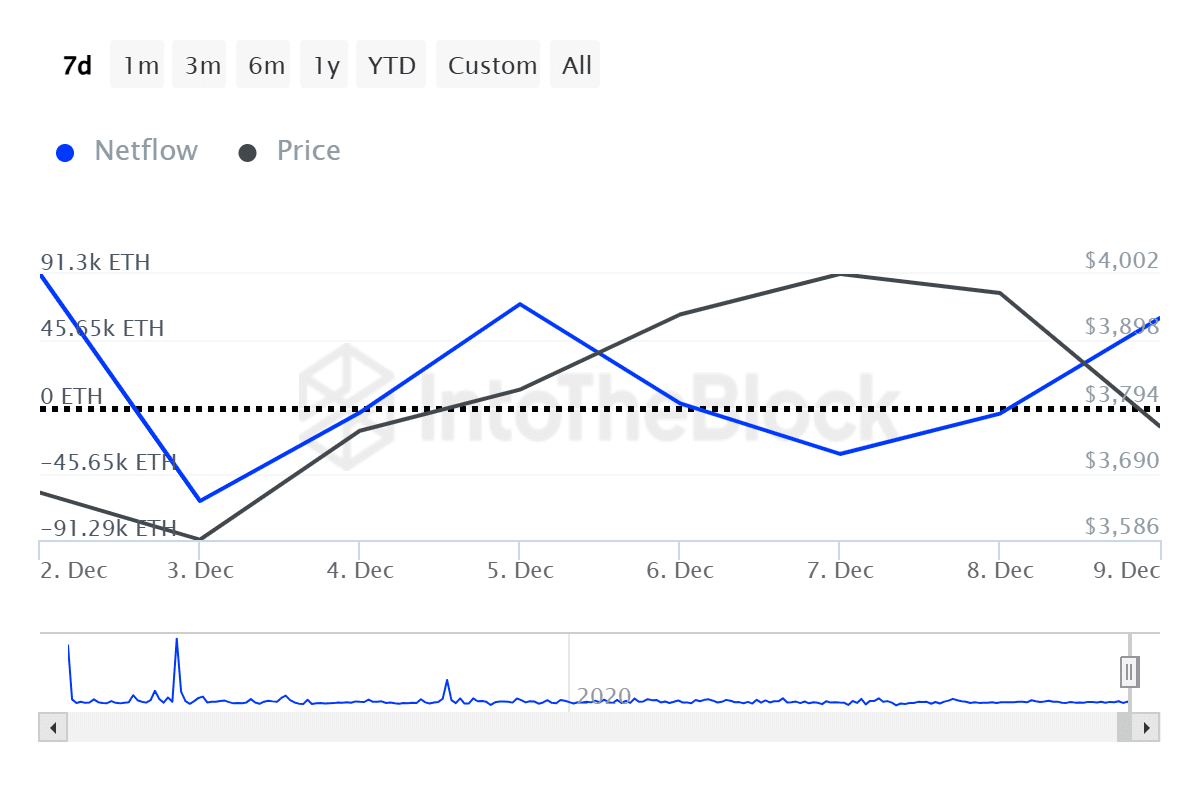

Ethereum (ETH) dropped 3.3% and is currently changing hands at $3,750 — the leading altcoin broke the $4,000 mark on Dec. 6 for the first time in nine months.

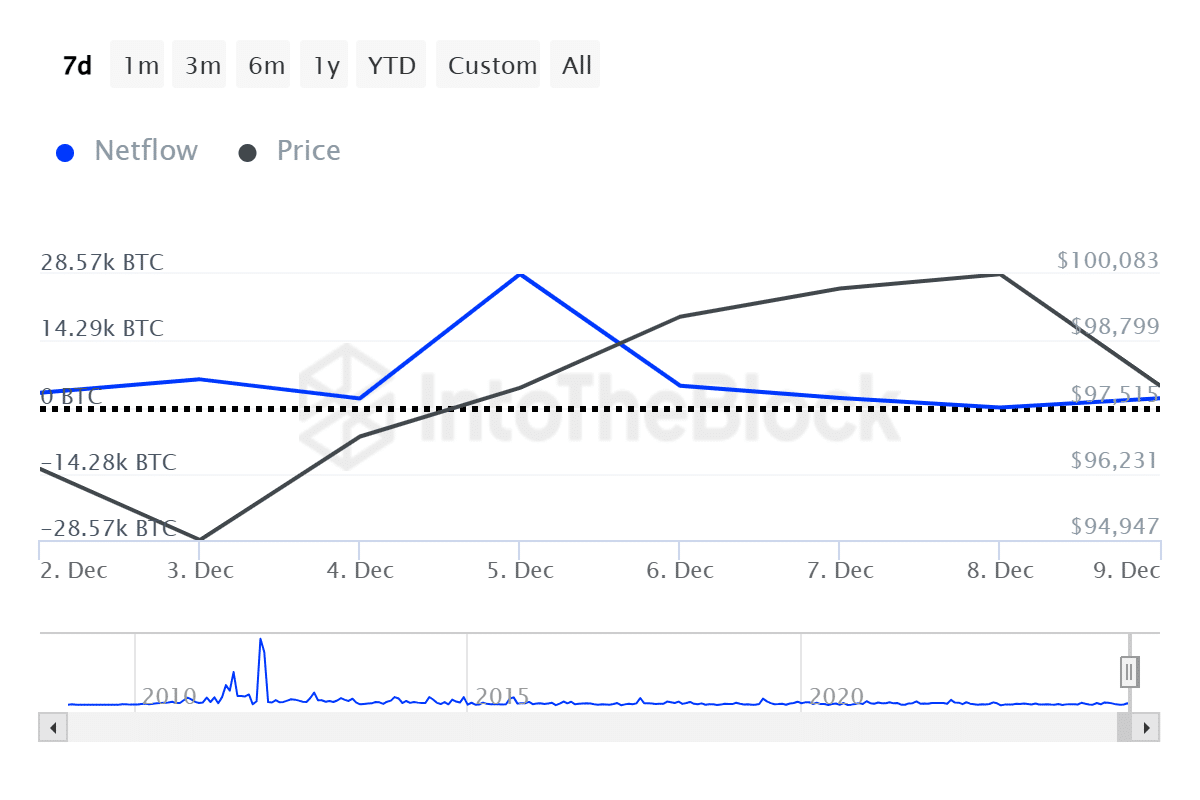

Large Bitcoin holders, often referred to as “whales,” began purchasing more Bitcoin when its price was decreasing. According to data from the market analytics platform IntoTheBlock, these whales accumulated approximately 1,900 BTC on Monday, following a series of declines since December 5.

Yesterday, the number of significant Bitcoin transactions (those valued over $100,000) jumped by 116%, reaching approximately $93 billion.

On December 9th, according to ITB data, Ethereum’s ‘big fish’ (whales) exhibited a comparable pattern with an inflow of approximately 61,000 Ether. These surges in the net flows of large Bitcoin and Ethereum holders occurred almost immediately after the prices began to drop.

The amount of large Ethereum transactions also surged 127% to $10.9 billion on Monday.

Unexpected improvements in whale behavior might spark a sense of “oh-no-I-missed-it” anxiety among individual investors, leading them to jump into transactions and drive prices up once more.

On December 9th, figures from ITB indicate that approximately $200 million worth of USDT was transferred into centralized cryptocurrency exchanges. Typically, when this happens, there’s a surge in buying activity for Bitcoin and other altcoins as investors tend to use USDT, the largest stablecoin, for these transactions, suggesting a potentially bullish trend in the crypto market.

At present, the total value of the worldwide cryptocurrency market has dropped by 6% in the last 24 hours and is now standing at approximately $3.65 trillion, as per data provided by CoinGecko. Interestingly, despite this decline, the daily trading volume has significantly increased from $247 billion to a staggering $475 billion over the past day.

As a researcher, one key factor contributing to the recent market downturn appears to be the upcoming release of the U.S. Consumer Price Index (CPI) on an unspecified date and the anticipated Federal Open Market Committee (FOMC) meeting scheduled for December 17-18. These events are likely influencing investor expectations and, as a result, affecting market behavior.

Should these significant trends indicate a bullish outlook, it’s possible that the cryptocurrency market could experience another surge in growth.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-10 14:42