As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market trends and cycles. The current trend of Bitcoin reserves dwindling on centralized exchanges like Binance and Coinbase is a sight that brings back memories of the 2017 bull run.

The amount of Bitcoin stored on popular centralized cryptocurrency platforms such as Binance and Coinbase has hit a multi-year low, fueling optimism among crypto enthusiasts.

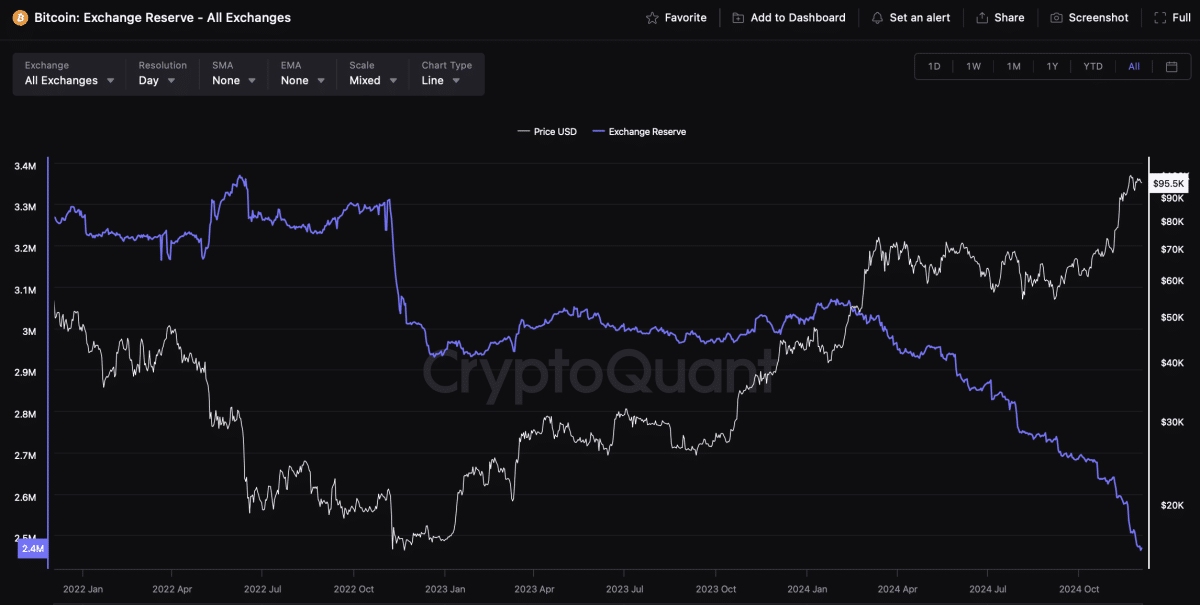

According to CryptoQuant’s data analysis, investors have taken out more than 171,000 Bitcoins (BTC) from major cryptocurrency exchanges following Donald Trump’s victory in the U.S. presidential election. This large-scale withdrawal reduces the amount of Bitcoin available for quick selling, which is typically an indication that investors are implementing a long-term investment strategy.

During the time following President Trump’s election win, there was a significant decrease in Bitcoin being held on exchanges, a trend that actually began in the year 2021. The reserves of Bitcoin on these exchanges have been gradually decreasing since crypto reached its peak, suggesting a strong faith in BTC even amid market declines in both 2022 and 2023.

By October 2021, it was observed that exchange holdings amounted to approximately 3.2 million Bitcoins. As of the current news update, these holdings have decreased to around 2.46 million tokens, according to CryptoQuant. This trend is also supported by Glassnode’s data, indicating a rise in short-term BTC that are not actively traded. Furthermore, the illiquid supply metric on this platform, which monitors long-term investor holdings, has increased by about 185,000 Bitcoins within the last month.

Approximately three quarters (75%) of existing Bitcoin (BTC) – about 14.8 million units – have not been active since the beginning of November, potentially continuing through 2025 due to a surge in cryptocurrency-friendly policies under President Trump and increased BTC adoption.

In simpler terms, Bitcoin, the leading cryptocurrency, reached an all-time high of $99,600 shortly after President Trump’s re-election. However, Bitcoin and other digital currencies experienced a price drop on December 3 due to political instability in South Korea and investors shifting their profits towards alternative coins such as Ripple (XRP).

On the other hand, analysts such as Thomas Lee from Fundstrat Capital are anticipating a potential surge in supply and a possible jump over $100,000 by the close of 2024.

“It’s just a matter of time.” – @fundstrat on #Bitcoin 🚀

— Michael Saylor⚡️ (@saylor) December 2, 2024

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-03 21:26