As a seasoned crypto investor with a decade-long journey in this rollercoaster of a market, I find myself both intrigued and cautiously optimistic about the recent trends in Bitcoin inflows. The surge in centralized exchange net flows, coupled with the increased activity of large holders, paints a complex picture that could go either way.

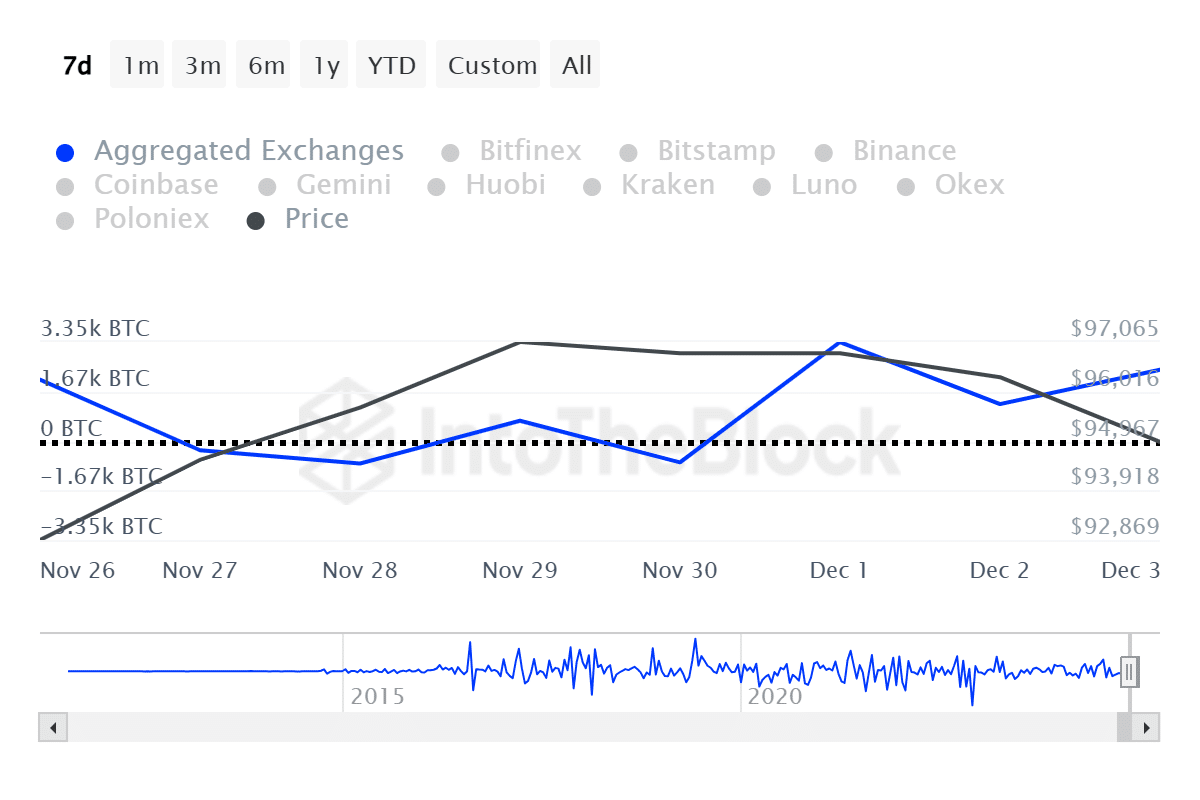

From December 1 onwards, there has been an uptick in Bitcoin being transferred to centralized exchanges, which might indicate an upcoming sell-off.

As a researcher examining the latest trends, I’ve noticed an intriguing shift in Bitcoin (BTC) exchange net flows as per data from IntoTheBlock. In just one instance, we saw a significant change from a $69 million outflow to a $326 million inflow. Notably, on Dec. 3 alone, the flagship cryptocurrency registered an impressive net inflow of approximately $230 million. This surge in net inflows suggests a growing interest among investors towards Bitcoin.

In total, over $562 million in Bitcoin entered CEX platforms, ITB data shows.

On Tuesday, according to ITB data, the proportion of large Bitcoin holders sending their assets to exchanges compared to total exchange inflow increased to 0.86%. This indicates a higher level of activity among larger Bitcoin holders (often referred to as “whales”) than retail investors.

The number of significant Bitcoin transactions (those valued at over $100,000) has grown from 17,960 to 25,830, coinciding with an increase in exchange net flows, according to data from our analytics platform.

On December 2nd, the massive amount of Bitcoin transactions spiked from approximately $38.7 billion to $87.3 billion. Over the past week, a grand total of $169.6 billion worth of Bitcoin transactions involving large entities (known as “whales”) were reported by ITB.

It appears that an account which has held approximately 2,700 Bitcoins, worth more than $257 million, and hasn’t moved these coins since December 2013, has recently transferred them to another wallet. This action could suggest a possible selling event, given the massive increase in value (157 times) since the initial purchase.

The whale accumulated the Bitcoins when the price was hovering around $625 for a total of $1.68 million.

As a researcher, I find myself reporting that I’ve noticed Bitcoin standing firm at approximately $96,500. Over the last 24 hours, it has experienced a modest increase of 1%. Remarkably, its market capitalization has once more exceeded the $1.9 trillion mark, indicating a significant surge in value.

An uptick in investment inflows might cause apprehension and confusion among individual investors due to fear, uncertainty, and doubt. On the other hand, a surge in large-scale investors hoarding assets could alter the overall market perception, leading to increased demand.

For Bitcoin and other cryptocurrencies, a significant positive factor that could drive prices up might be the anticipated interest rate reduction by the U.S. Federal Reserve. The Federal Open Market Committee (FOMC) is set to meet on December 17th and 18th.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-04 11:13